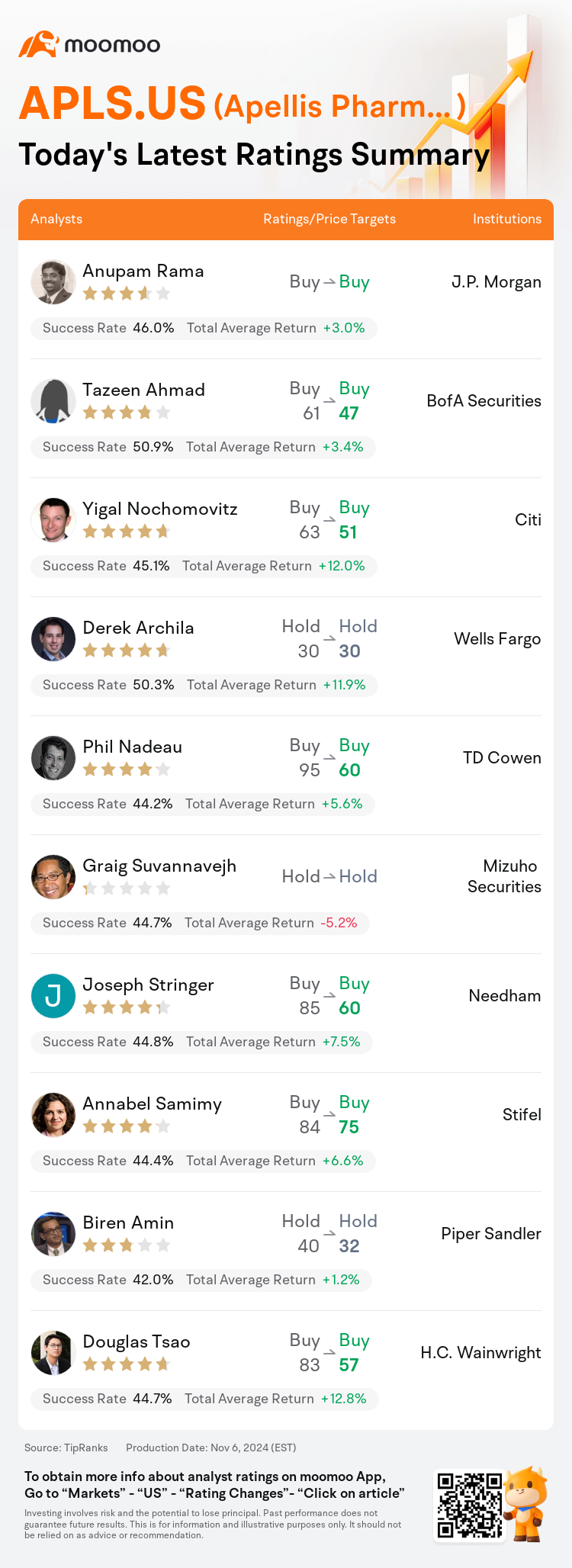

On Nov 06, major Wall Street analysts update their ratings for $Apellis Pharmaceuticals (APLS.US)$, with price targets ranging from $30 to $75.

J.P. Morgan analyst Anupam Rama maintains with a buy rating.

BofA Securities analyst Tazeen Ahmad maintains with a buy rating, and adjusts the target price from $61 to $47.

Citi analyst Yigal Nochomovitz maintains with a buy rating, and adjusts the target price from $63 to $51.

Citi analyst Yigal Nochomovitz maintains with a buy rating, and adjusts the target price from $63 to $51.

Wells Fargo analyst Derek Archila maintains with a hold rating, and maintains the target price at $30.

TD Cowen analyst Phil Nadeau maintains with a buy rating, and adjusts the target price from $95 to $60.

Furthermore, according to the comprehensive report, the opinions of $Apellis Pharmaceuticals (APLS.US)$'s main analysts recently are as follows:

Following the Q3 report, there is acknowledgment of a significant opportunity to develop a robust 'post-GA' investment thesis. This perspective is heavily rooted in the compelling data for C3G and IC-MPGN, which are believed to surpass that of oral competitors in a wider context.

Following Apellis' report of Q3 Syfovre revenues falling short of expectations, clarity is still sought regarding the magnitude of the geographic atrophy (GA) market. Nevertheless, the current valuation appears to undervalue the prospective scale of the opportunity. Moreover, the anticipated introduction in C3G/IC-MPGN may counterbalance the more gradual expansion in the GA segment.

The firm notes that Apellis reported a Q3 topline of $196.8M, which did not meet either the firm's estimation of $202.2M or the consensus estimate of $201M. This shortfall was attributed to higher G/N adjustments and a lower count of Syfovre vials compared to their expectations.

The perception that the GA market is experiencing a slowdown was reinforced by the third quarter performance, which necessitates a recalibration of Syfovre estimates. The anticipation of progressively less favorable commentary on pricing, coupled with a more measured approach to reaching peak levels, is expected to exert ongoing pressure on the stock's performance. It is advised that investors remain cautious about initiating positions in the stock at this time.

The company experienced some challenges from competitive dynamics, as evidenced by its Q3 revenue report of $196.8M, which was slightly below the consensus estimate of $200M. There was a year-over-year growth of 7% for Syfovre, although there was a sequential dip due to increased competition and market share shifts favoring Izervay after the latter received its permanent J-Code in April. Despite these short-term pressures, there is a belief in the significant untapped value over the long term for these products, but this situation has made the company's progress hinge on its ability to deliver results consistently, necessitating a degree of patience from investors.

Here are the latest investment ratings and price targets for $Apellis Pharmaceuticals (APLS.US)$ from 10 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月6日,多家华尔街大行更新了$Apellis Pharmaceuticals (APLS.US)$的评级,目标价介于30美元至75美元。

摩根大通分析师Anupam Rama维持买入评级。

美银证券分析师Tazeen Ahmad维持买入评级,并将目标价从61美元下调至47美元。

花旗分析师Yigal Nochomovitz维持买入评级,并将目标价从63美元下调至51美元。

花旗分析师Yigal Nochomovitz维持买入评级,并将目标价从63美元下调至51美元。

富国集团分析师Derek Archila维持持有评级,维持目标价30美元。

TD Cowen分析师Phil Nadeau维持买入评级,并将目标价从95美元下调至60美元。

此外,综合报道,$Apellis Pharmaceuticals (APLS.US)$近期主要分析师观点如下:

在Q3报告之后,我们意识到存在着一个重要的机会,可以发展一个强大的“后GA”投资主题。这一观点在C3G和IC-MPGN的引人注目数据中得到了充分证实,这些数据被认为在更广泛的背景下超越了口服竞争对手。

在Apellis报告Q3 Syfovre营收不及预期之后,对地理性萎缩(GA)市场规模仍然存在一定的不确定性。然而,目前的估值似乎低估了潜在机会的规模。此外,C3G/IC-MPGN的预期推出可能会抵消地理性萎缩领域逐渐扩大所带来的影响。

公司指出,Apellis报告的Q3总收入为19680万美元,未达到公司预估的20220万美元或共识估值20100万美元。这一不足归因于较高的G/N调整以及与预期相比Syfovre瓶数的减少。

对于地理性萎缩(GA)市场正在经历放缓的观点,第三季度的表现加强了这一观点,这需要重新校准Syfovre的估算。预计随着对定价发表逐渐不利的评论以及更为谨慎地达到峰值水平的预期,将对股票的表现产生持续的压力。建议投资者在此时谨慎考虑是否开多该股票。

由于竞争动态带来的挑战,公司在Q3实现的营收为19680万美元,略低于共识估值20000万美元。Syfovre的年度增长率为7%,尽管由于竞争加剧和市场份额转移偏向Izervay在四月份获得永久J-Code后发生了环比下降。尽管存在这些短期压力,但人们仍相信这些产品在长期内具有相当大的未开发价值,但这种情况使得公司的进展取决于其能否持续交付成果,这需要投资者有一定的耐心。

以下为今日10位分析师对$Apellis Pharmaceuticals (APLS.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

花旗分析师Yigal Nochomovitz维持买入评级,并将目标价从63美元下调至51美元。

花旗分析师Yigal Nochomovitz维持买入评级,并将目标价从63美元下调至51美元。

Citi analyst Yigal Nochomovitz maintains with a buy rating, and adjusts the target price from $63 to $51.

Citi analyst Yigal Nochomovitz maintains with a buy rating, and adjusts the target price from $63 to $51.