On Nov 06, major Wall Street analysts update their ratings for $Arcellx (ACLX.US)$, with price targets ranging from $91 to $106.

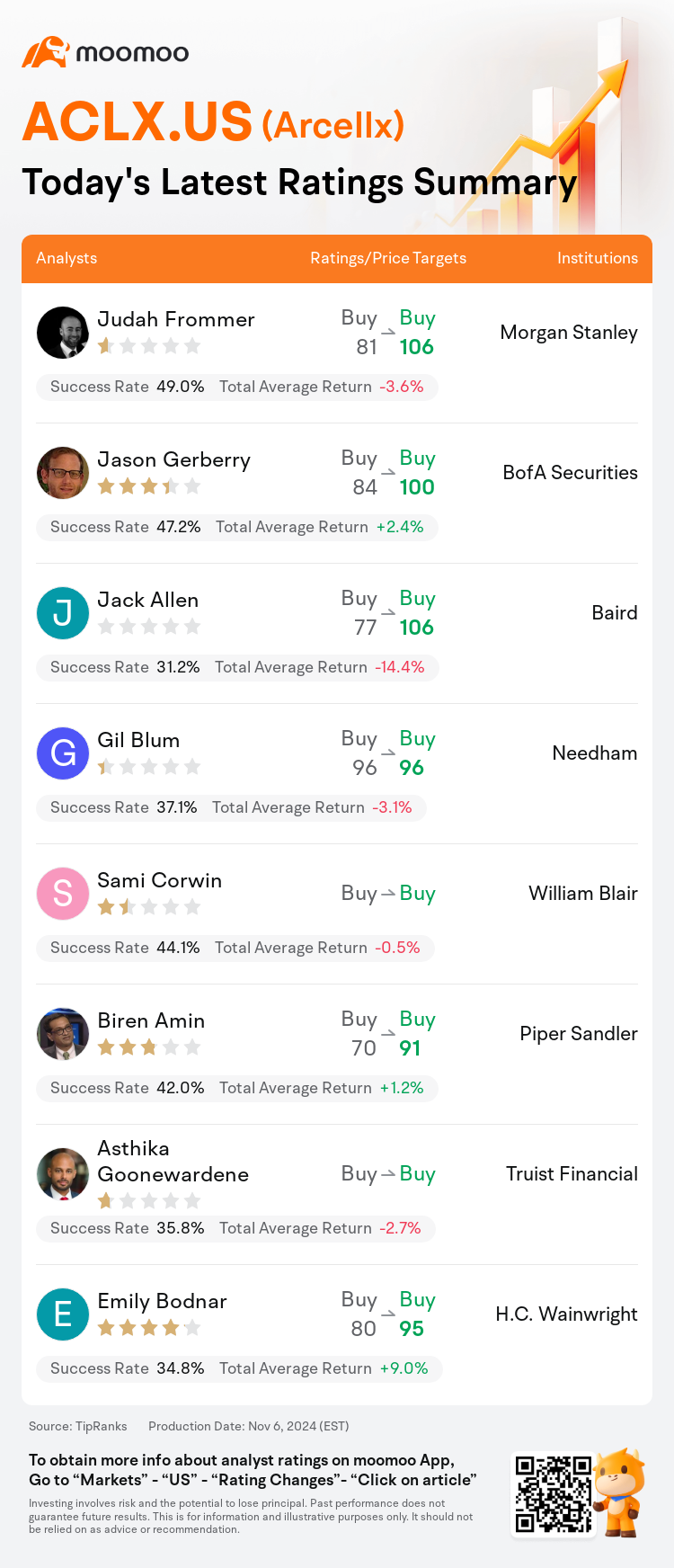

Morgan Stanley analyst Judah Frommer maintains with a buy rating, and adjusts the target price from $81 to $106.

BofA Securities analyst Jason Gerberry maintains with a buy rating, and adjusts the target price from $84 to $100.

Baird analyst Jack Allen maintains with a buy rating, and adjusts the target price from $77 to $106.

Baird analyst Jack Allen maintains with a buy rating, and adjusts the target price from $77 to $106.

Needham analyst Gil Blum maintains with a buy rating, and maintains the target price at $96.

William Blair analyst Sami Corwin maintains with a buy rating.

Furthermore, according to the comprehensive report, the opinions of $Arcellx (ACLX.US)$'s main analysts recently are as follows:

The expectations for Arcellx's anito-cel have been enhanced due to the promising initial results from the iMMagine-1 Phase 2 trial involving relapsed/refractory multiple myeloma patients. There is a considerable opportunity for market share capture, starting with treatment in later-stage patients and potentially extending to earlier stages if the current clinical outcomes are maintained.

Recent abstracts presenting initial Phase 2 data and extended Phase 1 data reinforce the pivotal-stage anito-cel's solid profile and its regulatory standing in the treatment of multiple myeloma. Despite a dip in share value, this could be interpreted as a 'sell the news' reaction following a substantial pre-abstract appreciation. It is now anticipated that anito-cel will secure a more significant share of the peak market and has increased chances of success.

The firm expressed incremental optimism following the release of updated clinical data. The publication of ASH abstracts, which included initial data from the registrational IMMagine-1 study, contributed to this positive outlook.

Here are the latest investment ratings and price targets for $Arcellx (ACLX.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月6日,多家华尔街大行更新了$Arcellx (ACLX.US)$的评级,目标价介于91美元至106美元。

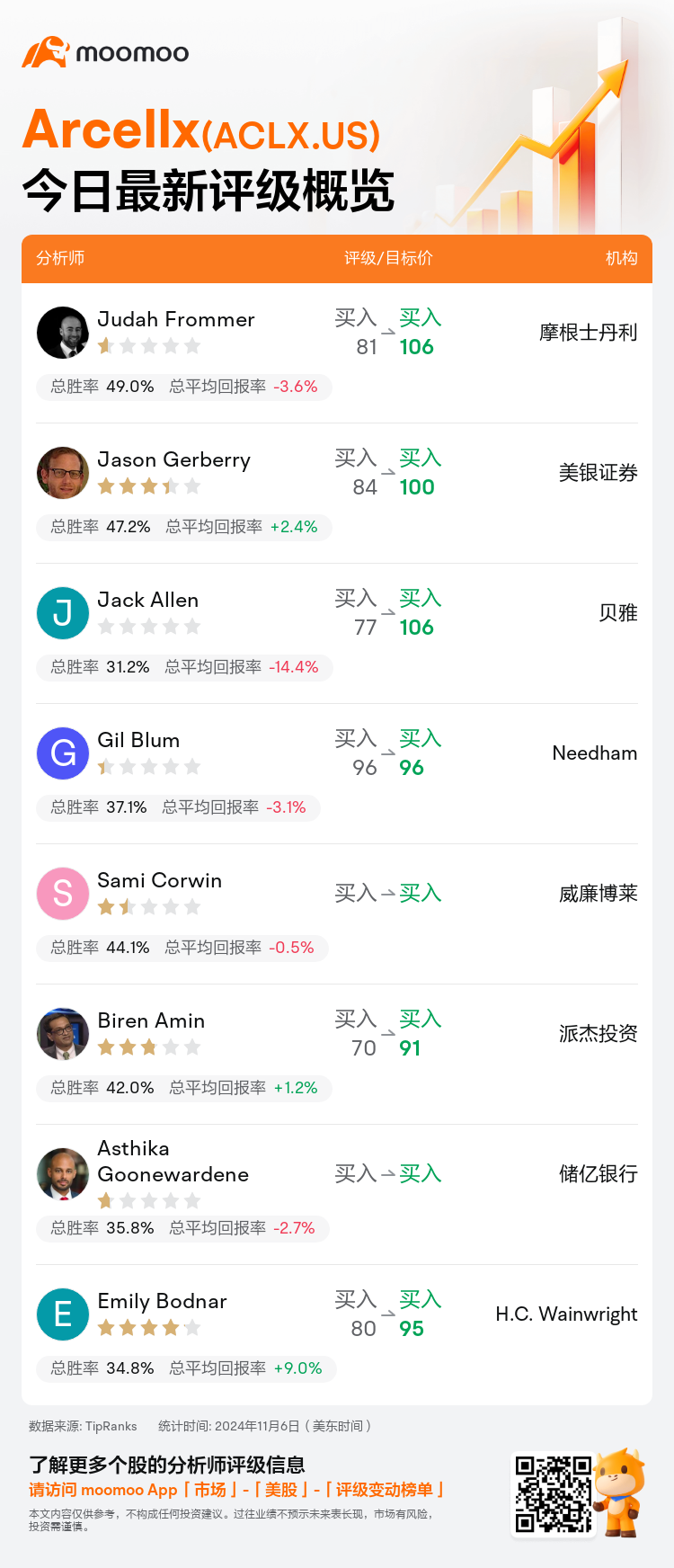

摩根士丹利分析师Judah Frommer维持买入评级,并将目标价从81美元上调至106美元。

美银证券分析师Jason Gerberry维持买入评级,并将目标价从84美元上调至100美元。

贝雅分析师Jack Allen维持买入评级,并将目标价从77美元上调至106美元。

贝雅分析师Jack Allen维持买入评级,并将目标价从77美元上调至106美元。

Needham分析师Gil Blum维持买入评级,维持目标价96美元。

威廉博莱分析师Sami Corwin维持买入评级。

此外,综合报道,$Arcellx (ACLX.US)$近期主要分析师观点如下:

Arcellx的anito-cel期望值已提高,因为iMMagine-1阶段2试验初步结果表明在复发/难治性多发性骨髓瘤患者中具有显著潜力。有相当大的市场份额占领机会,从治疗后期患者开始,如果当前临床结果得以保持,还有可能延伸到早期阶段。

最近的摘要介绍了初步2期数据和扩展的1期数据,进一步加强了关键阶段的anito-cel坚实概况,以及在多发性骨髓瘤治疗中的监管地位。尽管股价有所下跌,这可能被解读为在大幅提前公布摘要后出现的“赚了抛售”的反应。现在预计,anito-cel将在市场巅峰获得更重要的份额,并增加成功机会。

公司在更新的临床数据发布后表达了增量乐观。ASH摘要的公布,包括注册IMMagine-1研究的初步数据,有助于形成这种积极展望。

以下为今日8位分析师对$Arcellx (ACLX.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

贝雅分析师Jack Allen维持买入评级,并将目标价从77美元上调至106美元。

贝雅分析师Jack Allen维持买入评级,并将目标价从77美元上调至106美元。

Baird analyst Jack Allen maintains with a buy rating, and adjusts the target price from $77 to $106.

Baird analyst Jack Allen maintains with a buy rating, and adjusts the target price from $77 to $106.