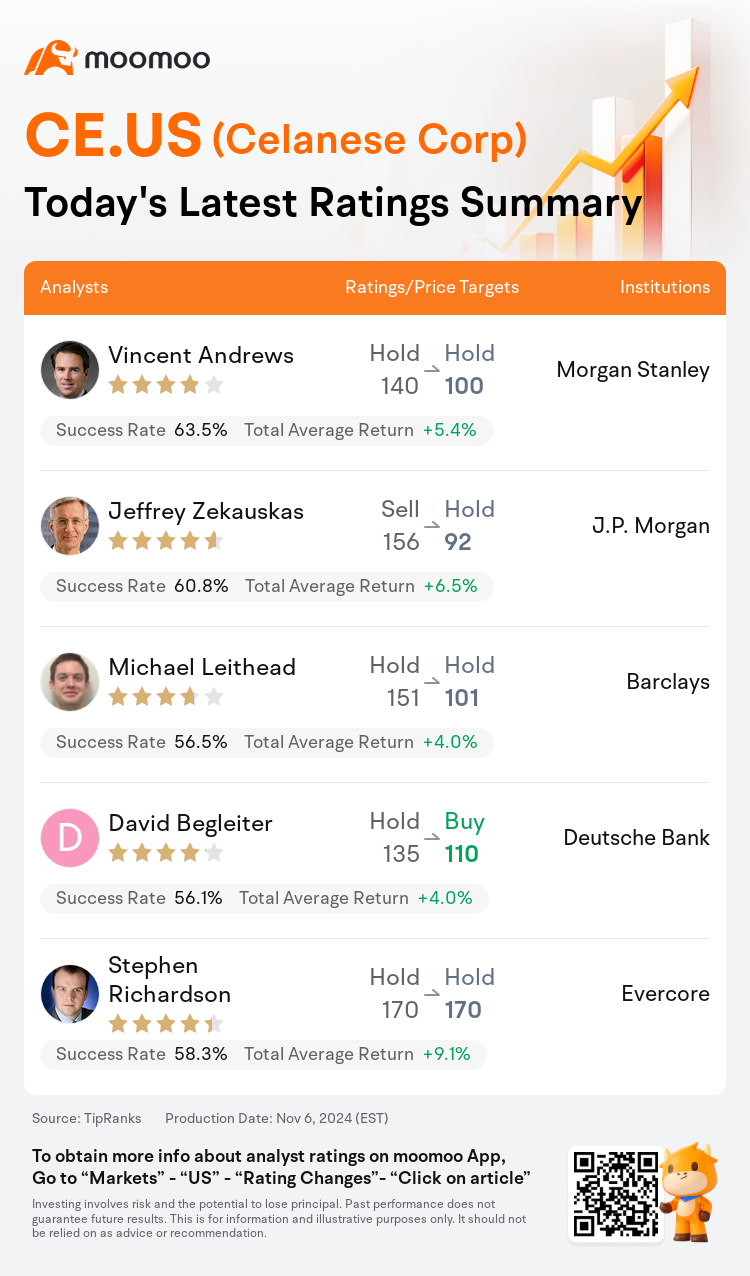

On Nov 06, major Wall Street analysts update their ratings for $Celanese Corp (CE.US)$, with price targets ranging from $92 to $170.

Morgan Stanley analyst Vincent Andrews maintains with a hold rating, and adjusts the target price from $140 to $100.

J.P. Morgan analyst Jeffrey Zekauskas upgrades to a hold rating, and adjusts the target price from $156 to $92.

Barclays analyst Michael Leithead maintains with a hold rating, and adjusts the target price from $151 to $101.

Barclays analyst Michael Leithead maintains with a hold rating, and adjusts the target price from $151 to $101.

Deutsche Bank analyst David Begleiter upgrades to a buy rating, and adjusts the target price from $135 to $110.

Evercore analyst Stephen Richardson maintains with a hold rating, and maintains the target price at $170.

Furthermore, according to the comprehensive report, the opinions of $Celanese Corp (CE.US)$'s main analysts recently are as follows:

The expectation is that Celanese's EPS potential has been recalibrated from the peak influenced by COVID demand and supply disruptions in 2021 to a projected range for 2025. The stock is anticipated to remain mostly stable until there is more clarity regarding the macroeconomic conditions and the funding landscape.

The company's recent earnings report is viewed as not significantly altering the perception of asset quality. However, it necessitates a reevaluation of the capital structure and shareholder confidence in management.

The valuation grounds for an optimistic outlook on Celanese are a consequence of the stock's significant drop subsequent to the Q3 earnings announcement. The Q3 miss and subsequent Q4 guidance falling short of consensus weren't unforeseen, as the contributing factors—marked deceleration in the automotive and industrial sectors of the Western Hemisphere, notably within the European automotive industry, along with subdued demand in the paints, coatings, and construction markets—have been recurrent themes among chemical companies during this earnings period.

The adjusted operating environment prompted a proactive dividend reduction, yet there remains an acknowledgment of Celanese's consistent strong performance internally. In light of potentially favorable growth-oriented events, such as China's economic stimulus and global interest rate reductions, there's an anticipation of a swifter earnings recovery compared to the recalibrated expectations.

Following the company's Q3 report, it's observed that the dividend has been almost entirely removed, accompanied by the implementation of a debt liquidity strategy.

Here are the latest investment ratings and price targets for $Celanese Corp (CE.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

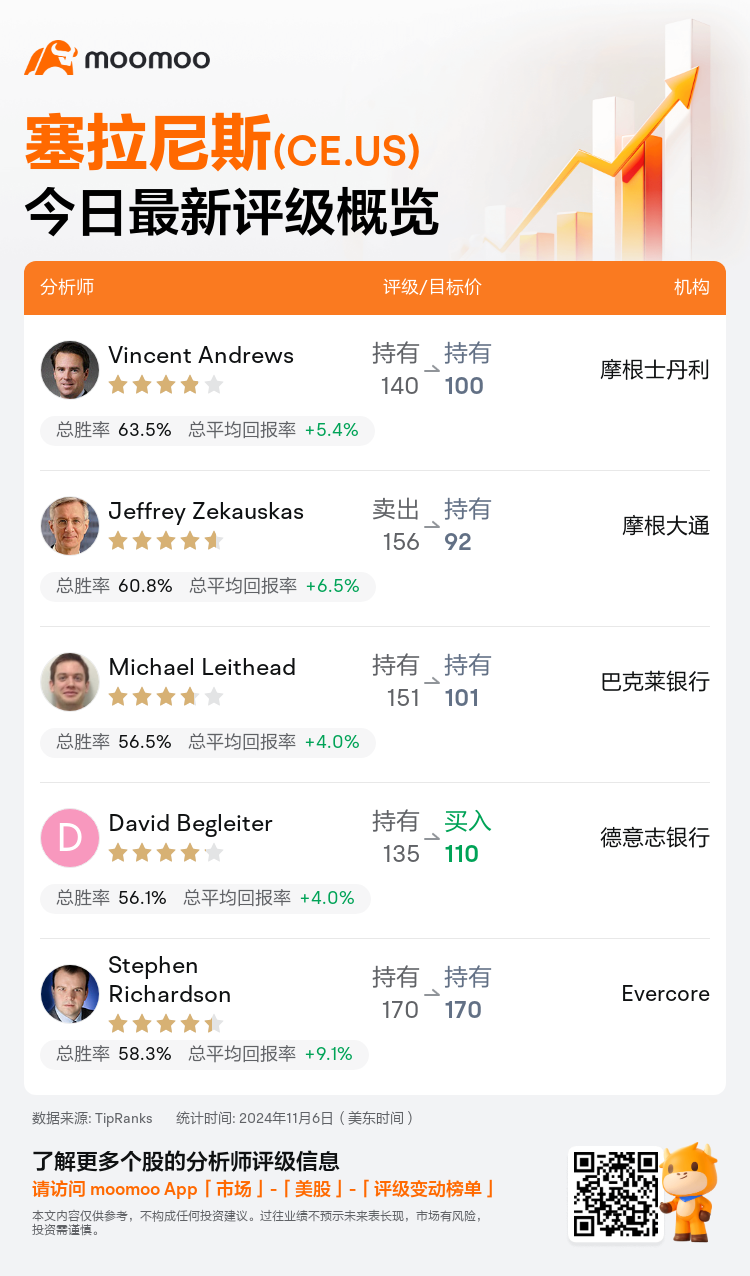

美东时间11月6日,多家华尔街大行更新了$塞拉尼斯 (CE.US)$的评级,目标价介于92美元至170美元。

摩根士丹利分析师Vincent Andrews维持持有评级,并将目标价从140美元下调至100美元。

摩根大通分析师Jeffrey Zekauskas上调至持有评级,并将目标价从156美元下调至92美元。

巴克莱银行分析师Michael Leithead维持持有评级,并将目标价从151美元下调至101美元。

巴克莱银行分析师Michael Leithead维持持有评级,并将目标价从151美元下调至101美元。

德意志银行分析师David Begleiter上调至买入评级,并将目标价从135美元下调至110美元。

Evercore分析师Stephen Richardson维持持有评级,维持目标价170美元。

此外,综合报道,$塞拉尼斯 (CE.US)$近期主要分析师观点如下:

预期是赛百味的每股收益潜力已经从2021年受COVID需求和供应中断影响的峰值重新调整到2025年的预期范围。预计股票在更多宏观经济状况和资金格局方面更加清晰之前将保持基本稳定。

公司最近的盈利报告被认为并没有显著改变资产质量的看法。然而,这需要重新评估资本结构和对管理层的股东信心。

对赛百味乐观展望的估值基础是股票在第三季度盈利公告后显著下跌的结果。第三季度的不及预期和随后第四季度指引未达共识并不令人意外,因为影响因素——西半球汽车和工业行业的明显减速,尤其是欧洲汽车行业,以及涂料、涂层和施工市场需求乏力——在化工企业这一盈利期间已是反复出现的主题。

调整后的营运环境促使积极降低股息,但仍然承认赛百味在内部表现一直强劲。鉴于中国经济刺激和全球利率降低等潜在有利增长事件,人们预期赛百味的盈利恢复速度比重新调整后的预期更快。

根据公司第三季度报告,观察到股息几乎完全取消,伴随着债务流动性策略的实施。

以下为今日5位分析师对$塞拉尼斯 (CE.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

巴克莱银行分析师Michael Leithead维持持有评级,并将目标价从151美元下调至101美元。

巴克莱银行分析师Michael Leithead维持持有评级,并将目标价从151美元下调至101美元。

Barclays analyst Michael Leithead maintains with a hold rating, and adjusts the target price from $151 to $101.

Barclays analyst Michael Leithead maintains with a hold rating, and adjusts the target price from $151 to $101.