Looking Into Albemarle's Recent Short Interest

Looking Into Albemarle's Recent Short Interest

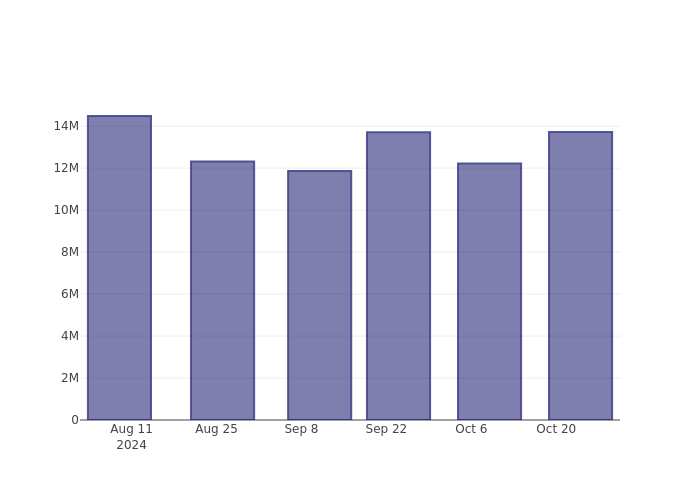

Albemarle's (NYSE:ALB) short percent of float has risen 12.22% since its last report. The company recently reported that it has 13.72 million shares sold short, which is 13.32% of all regular shares that are available for trading. Based on its trading volume, it would take traders 4.87 days to cover their short positions on average.

美国雅保(NYSE:ALB)的流通股空头比例自上次报告以来上升了12.22%。该公司最近报告称,共有1372万股被做空,占所有可供交易的普通股的13.32%。根据其交易量,交易者平均需要4.87天来平仓。

Why Short Interest Matters

为什么空头持仓很重要

Short interest is the number of shares that have been sold short but have not yet been covered or closed out. Short selling is when a trader sells shares of a company they do not own, with the hope that the price will fall. Traders make money from short selling if the price of the stock falls and they lose if it rises.

空头持仓是指已卖空但尚未平仓的股票数量。卖空是指交易员卖出自己不拥有的公司股票,希望股价下跌。如果股价下跌,交易员会从卖空中赚钱,而如果股价上涨,他们就会亏损。

Short interest is important to track because it can act as an indicator of market sentiment towards a particular stock. An increase in short interest can signal that investors have become more bearish, while a decrease in short interest can signal they have become more bullish.

空头持仓之所以重要是因为它可以作为对特定股票的市场情绪的指标。空头持仓增加可能表明投资者变得更看淡,而空头持仓减少可能表明他们更看好。

List of the most shorted stocks

做空集合股列表

Albemarle Short Interest Graph (3 Months)

美国雅保空头持仓图表(3个月)

As you can see from the chart above the percentage of shares that are sold short for Albemarle has grown since its last report. This does not mean that the stock is going to fall in the near-term but traders should be aware that more shares are being shorted.

从上图中可以看出,美国雅保的做空股份比例自上次报告以来增加。这并不意味着股票会在短期内下跌,但交易者应该注意到更多的股票正在被做空。

Comparing Albemarle's Short Interest Against Its Peers

比较美国雅保的空头持仓与其同行业对手

Peer comparison is a popular technique amongst analysts and investors for gauging how well a company is performing. A company's peer is another company that has similar characteristics to it, such as industry, size, age, and financial structure. You can find a company's peer group by reading its 10-K, proxy filing, or by doing your own similarity analysis.

同行比较是分析师和投资者之间常用的技术,用于衡量一家公司的表现。一家公司的同行是另一家具有类似特征的公司,例如行业、规模、年龄和财务结构。通过阅读其10-k、代理文件,或者进行自己的相似性分析,您可以找到公司的同行群体。

According to Benzinga Pro, Albemarle's peer group average for short interest as a percentage of float is 2.74%, which means the company has more short interest than most of its peers.

根据Benzinga Pro的数据,美国雅保同行业板块中空头持仓占流通股比例的平均值为2.74%,这意味着该公司的空头持仓高于大部分同行。

Did you know that increasing short interest can actually be bullish for a stock? This post by Benzinga Money explains how you can profit from it.

你知道增加空头持仓实际上可能对一只股票有利吗?Benzinga Money的这篇帖子解释了如何从中获利。

This article was generated by Benzinga's automated content engine and was reviewed by an editor.

本文是由Benzinga的自动内容引擎生成的,并经编辑审查。