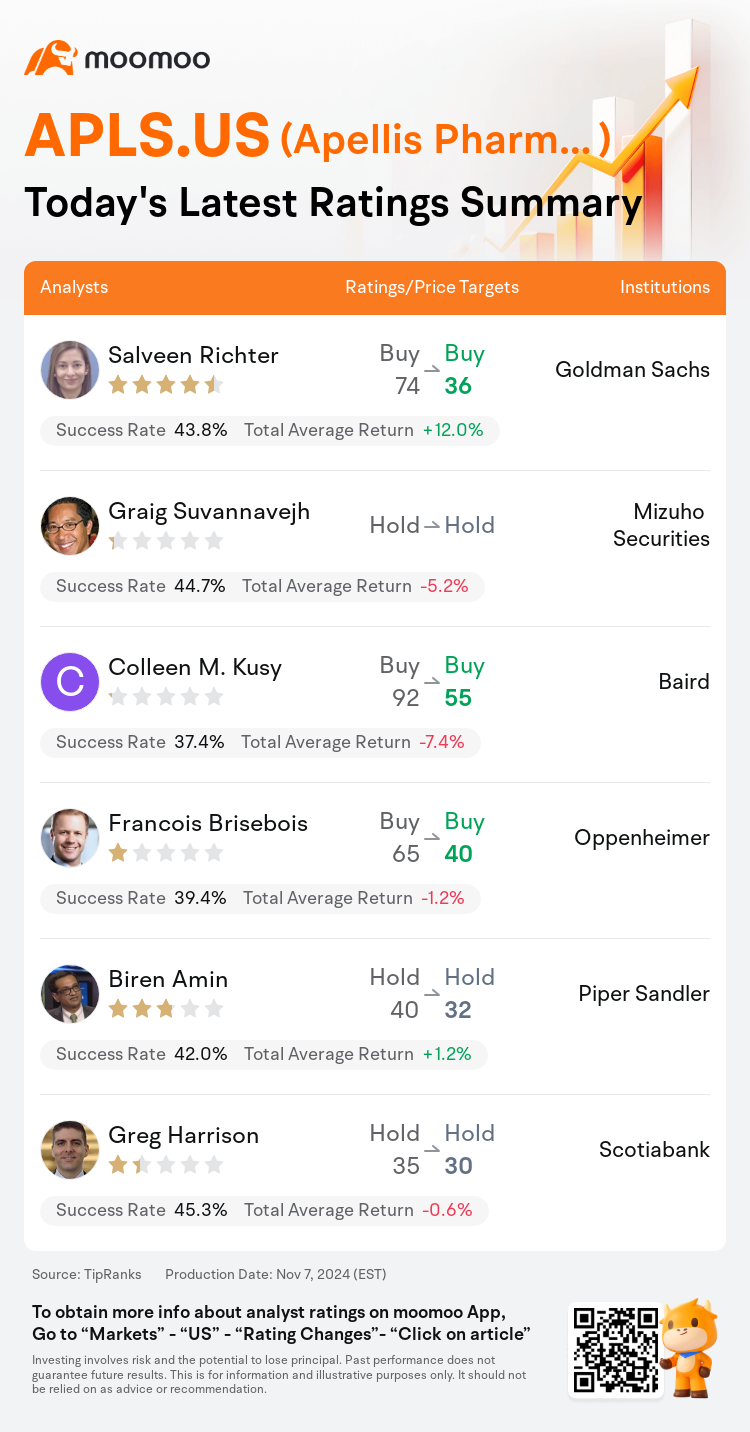

On Nov 07, major Wall Street analysts update their ratings for $Apellis Pharmaceuticals (APLS.US)$, with price targets ranging from $30 to $55.

Goldman Sachs analyst Salveen Richter maintains with a buy rating, and adjusts the target price from $74 to $36.

Mizuho Securities analyst Graig Suvannavejh maintains with a hold rating.

Baird analyst Colleen M. Kusy maintains with a buy rating, and adjusts the target price from $92 to $55.

Baird analyst Colleen M. Kusy maintains with a buy rating, and adjusts the target price from $92 to $55.

Oppenheimer analyst Francois Brisebois maintains with a buy rating, and adjusts the target price from $65 to $40.

Piper Sandler analyst Biren Amin maintains with a hold rating, and adjusts the target price from $40 to $32.

Furthermore, according to the comprehensive report, the opinions of $Apellis Pharmaceuticals (APLS.US)$'s main analysts recently are as follows:

The assessment post the Q3 report indicates that there's potential for a reevaluation of the stock in 2024, presenting an opportunity to build a new investment thesis following the 'post-GA' period. This is based on the high conviction in the prospects of C3G and IC-MPGN, where the data appear exceptionally robust and seem to surpass that of the oral competitor, even in a wider context.

The company's recent Syfovre revenues were below anticipated levels. Analysts are seeking further understanding regarding the geographic atrophy market but believe that the present valuation might not fully recognize the market's potential. Additionally, the prospective introduction in C3G/IC-MPGN may compensate for the more gradual growth in the GA segment.

The company reported results for Q3 2024, which featured a decline in Syfovre revenue on a sequential basis due to modest growth in vial numbers coupled with a reduced net price and heightened competition.

The company reported a Q3 topline of $196.8M, which fell short of both the anticipated figure of $202.2M and the Street's estimate of $201M. This shortfall was attributed to higher G/N adjustments and a lower number of Syfovre vials compared to expectations.

The firm believes that the third quarter has validated the perspective of a decelerating geographic atrophy market, suggesting a need for adjustments in Syfovre forecasts. The expectation of progressively negative remarks on pricing and a more tempered ascent to peak levels is anticipated to continue impacting the stock's performance. The firm advises investors against initiating a position in the shares at this point.

Here are the latest investment ratings and price targets for $Apellis Pharmaceuticals (APLS.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月7日,多家华尔街大行更新了$Apellis Pharmaceuticals (APLS.US)$的评级,目标价介于30美元至55美元。

高盛集团分析师Salveen Richter维持买入评级,并将目标价从74美元下调至36美元。

瑞穗证券分析师Graig Suvannavejh维持持有评级。

贝雅分析师Colleen M. Kusy维持买入评级,并将目标价从92美元下调至55美元。

贝雅分析师Colleen M. Kusy维持买入评级,并将目标价从92美元下调至55美元。

奥本海默控股分析师Francois Brisebois维持买入评级,并将目标价从65美元下调至40美元。

派杰投资分析师Biren Amin维持持有评级,并将目标价从40美元下调至32美元。

此外,综合报道,$Apellis Pharmaceuticals (APLS.US)$近期主要分析师观点如下:

评估发帖Q3报告表明,2024年重新评估股票的潜力,为'后GA'时期之后建立新的投资主题提供了机会。这基于对C3G和IC-MPGN前景的高度信心,数据显示异常强劲,似乎超过了口服竞争对手,即使在更广泛的背景下也是如此。

公司最近的Syfovre营业收入低于预期水平。分析师正在寻求进一步了解地理萎缩市场,但他们认为目前的估值可能没有充分认识市场的潜力。此外,在C3G/IC-MPGN的潜在推出可能会弥补地理萎缩(GA)部分增长较为缓慢的情况。

公司报告了2024年Q3的业绩,特色板块Syfovre收入按季度来看出现下降,原因是小瓶数量的适度增长,但净价格降低以及竞争加剧。

公司报告了19680万美元的Q3总收入,低于预期的20220万美元和街头估计的20100万美元。这一不足归因于更高的G/N调整以及与预期相比更少的Syfovre小瓶数量。

公司认为第三季度验证了地理萎缩市场逐渐减速的观点,表明需要调整对Syfovre预测。对价格逐步出现负面评价以及向峰值水平更为谨慎的上升的预期预计将继续影响该股票的表现。公司建议投资者在这一时刻不要建立头寸。

以下为今日6位分析师对$Apellis Pharmaceuticals (APLS.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

贝雅分析师Colleen M. Kusy维持买入评级,并将目标价从92美元下调至55美元。

贝雅分析师Colleen M. Kusy维持买入评级,并将目标价从92美元下调至55美元。

Baird analyst Colleen M. Kusy maintains with a buy rating, and adjusts the target price from $92 to $55.

Baird analyst Colleen M. Kusy maintains with a buy rating, and adjusts the target price from $92 to $55.