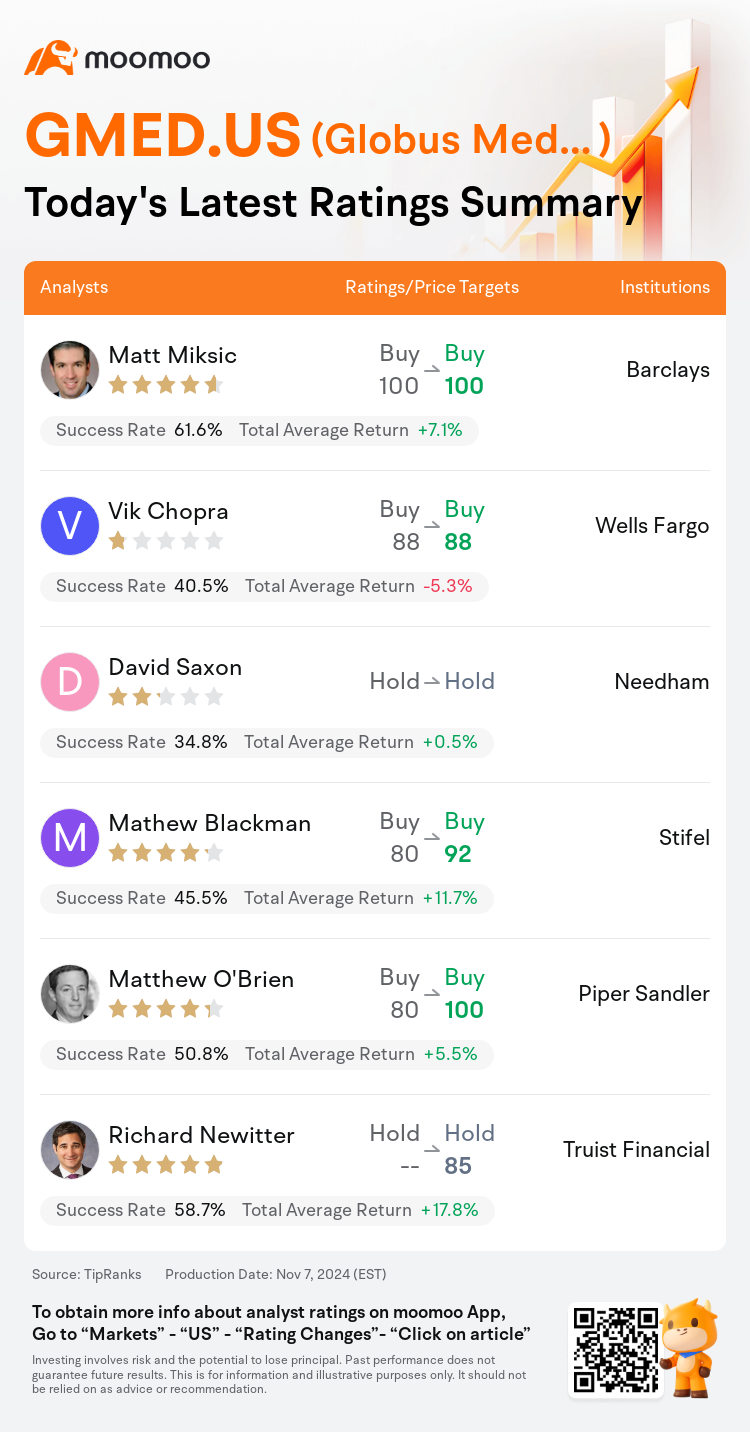

On Nov 07, major Wall Street analysts update their ratings for $Globus Medical (GMED.US)$, with price targets ranging from $85 to $100.

Barclays analyst Matt Miksic maintains with a buy rating, and maintains the target price at $100.

Wells Fargo analyst Vik Chopra maintains with a buy rating, and maintains the target price at $88.

Needham analyst David Saxon maintains with a hold rating.

Needham analyst David Saxon maintains with a hold rating.

Stifel analyst Mathew Blackman maintains with a buy rating, and adjusts the target price from $80 to $92.

Piper Sandler analyst Matthew O'Brien maintains with a buy rating, and adjusts the target price from $80 to $100.

Furthermore, according to the comprehensive report, the opinions of $Globus Medical (GMED.US)$'s main analysts recently are as follows:

Globus Medical is poised to resume mid-to-high single-digit sales growth and achieve mid-30's EBITDA margins. The company's earnings outperformance is seen as 'impressive,' driven by robust sales and increasing cost synergies.

Globus Medical has exceeded expectations by continuing to deliver improved financial results, surpassing earlier projections. This success is partly due to the more efficient than anticipated integration of NuVasive, and as a result, there is a belief that better integration execution and enhanced profitability justify a less discounted multiple. Nonetheless, there is a view that realizing cross-selling synergies may prove challenging, particularly in the face of new competitors in the spine robot market entering this quarter, which could pose a challenge in meeting the market's anticipated 7% growth.

Q3 served as a significant confirmation of the thesis that the business has stronger foundations today than most anticipated. It is believed that current estimates may be too conservative and there is potential for a 1-2 turn increase in the multiple.

The company reported strong Q3 results, with sales and EPS exceeding expectations by 3% and 27%, respectively. This marks the fourth consecutive quarter of positive performance following the acquisition of Nuvasive, and due to management's exceptional execution, the company has achieved what is considered the most successful spine merger in the industry.

Globus Medical is challenging the commonly held beliefs about the inefficacy of spine mergers through its recent performance. The company's strict financial discipline and operational execution are contributing to a momentum that is expected to generate substantial free cash flow conversion, which could potentially lead to significant share repurchase activities.

Here are the latest investment ratings and price targets for $Globus Medical (GMED.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

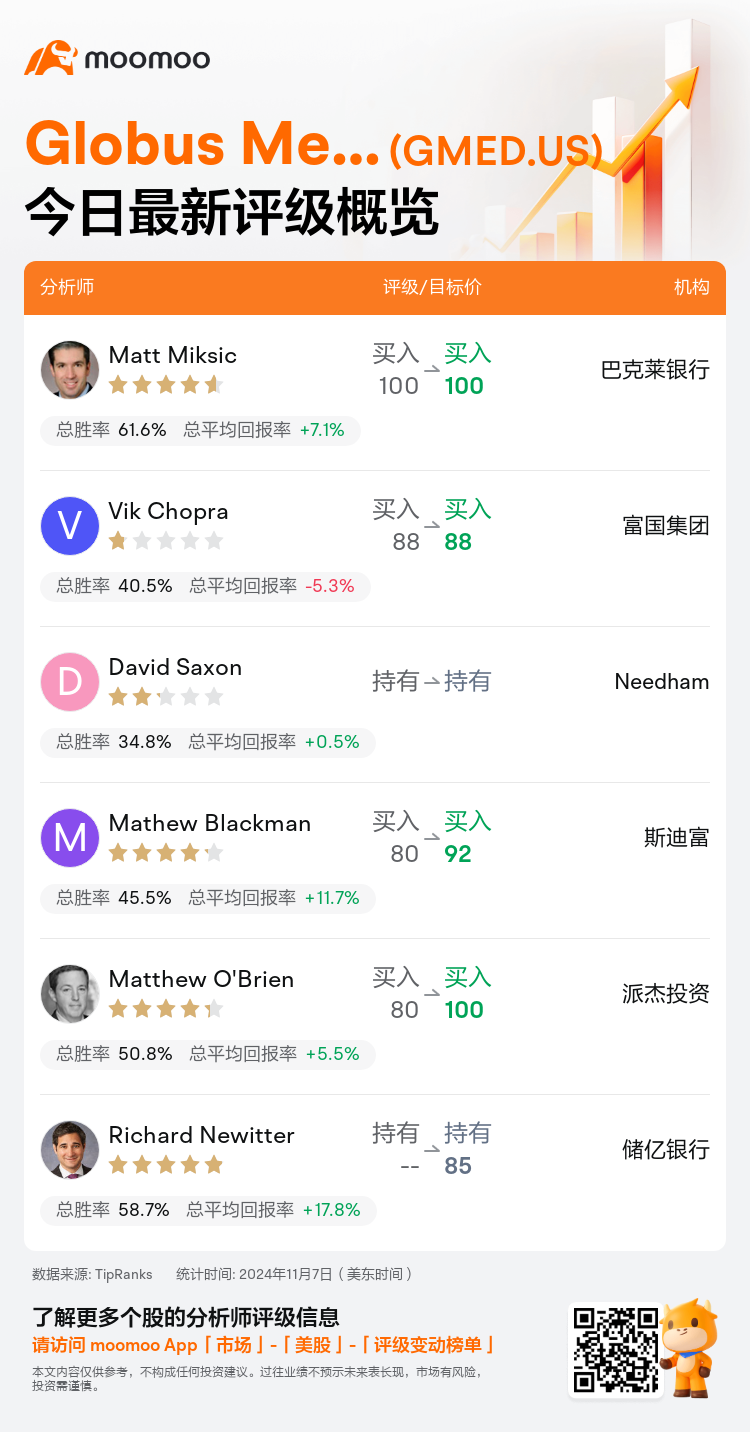

美东时间11月7日,多家华尔街大行更新了$Globus Medical (GMED.US)$的评级,目标价介于85美元至100美元。

巴克莱银行分析师Matt Miksic维持买入评级,维持目标价100美元。

富国集团分析师Vik Chopra维持买入评级,维持目标价88美元。

Needham分析师David Saxon维持持有评级。

Needham分析师David Saxon维持持有评级。

斯迪富分析师Mathew Blackman维持买入评级,并将目标价从80美元上调至92美元。

派杰投资分析师Matthew O'Brien维持买入评级,并将目标价从80美元上调至100美元。

此外,综合报道,$Globus Medical (GMED.US)$近期主要分析师观点如下:

globus medical有望恢复中高个位数的销售增长,并实现中30%的EBITDA边际。公司的收入表现被认为是'令人印象深刻',得益于强劲的销售和不断增加的成本协同效应。

globus medical继续交付改善的财务业绩,超过早期的预期。这种成功部分归功于NuVasive的整合比预期更高效,因此有一种观点认为更好的整合执行和增强盈利能力可以证明较低折价倍数的合理性。尽管如此,有一种观点认为实现跨销售协同效应可能会面临挑战,尤其是在新竞争对手进入本季度的脊柱机器人市场之际,这可能对满足市场预期的7%增长构成挑战。

第三季度证实了一个重要观点,即该企业如今拥有比大多数人预期的更坚实的基础。人们相信目前的估计可能过于保守,存在着倍数增加1-2倍的潜力。

该公司报告了强劲的第三季度业绩,销售额和每股收益分别超出预期3%和27%。这标志着继收购Nuvasive后连续第四个季度取得积极业绩,由于管理层出色的执行,该公司已实现了被认为是行业内最成功的脊柱合并。

globus medical通过最近的表现正在挑战关于脊柱合并有效性的常见观念。公司严格的财务纪律和业务执行正在促成一个有望产生大量自由现金流转化的势头,这可能导致大规模的股票回购活动。

以下为今日6位分析师对$Globus Medical (GMED.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

Needham分析师David Saxon维持持有评级。

Needham分析师David Saxon维持持有评级。

Needham analyst David Saxon maintains with a hold rating.

Needham analyst David Saxon maintains with a hold rating.