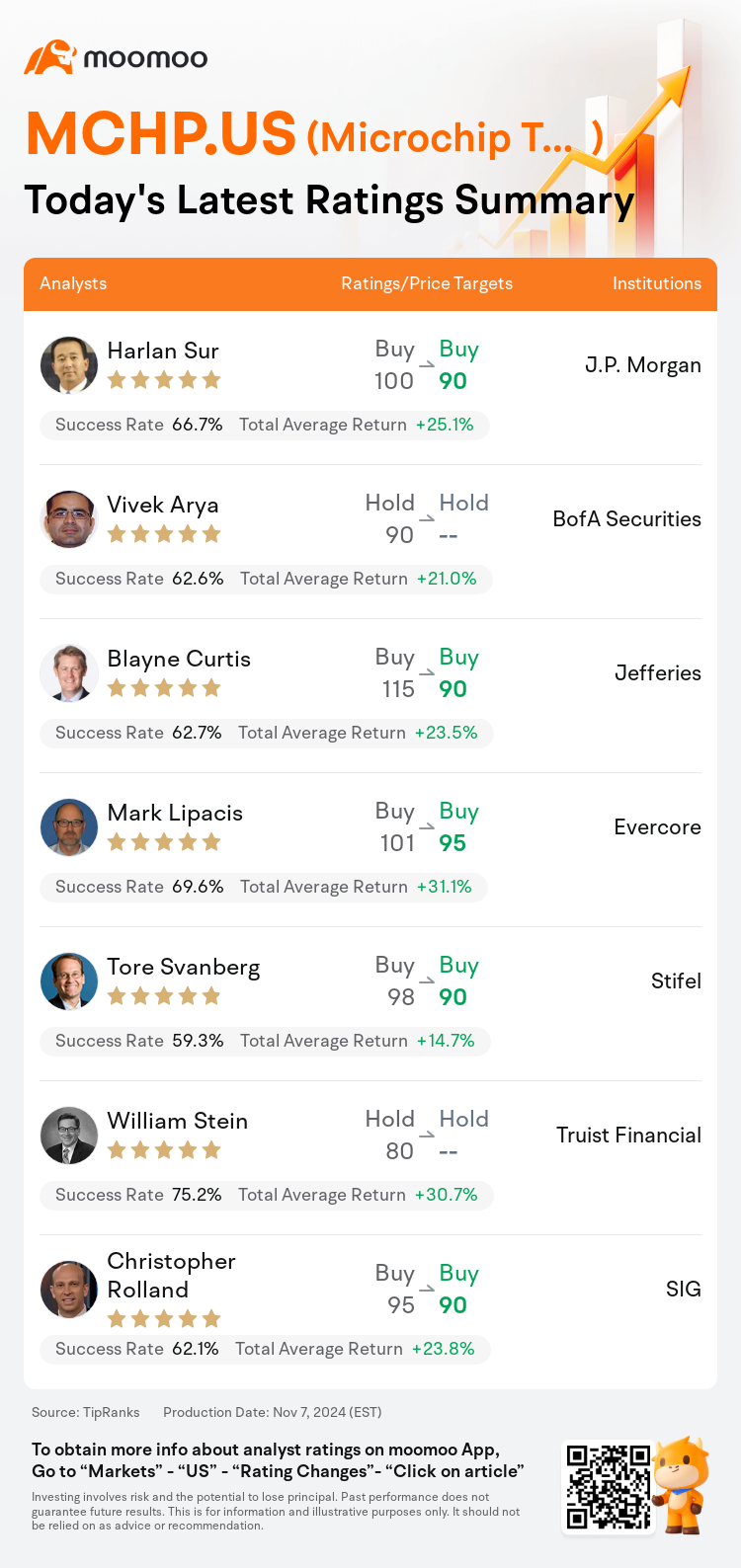

On Nov 07, major Wall Street analysts update their ratings for $Microchip Technology (MCHP.US)$, with price targets ranging from $90 to $95.

J.P. Morgan analyst Harlan Sur maintains with a buy rating, and adjusts the target price from $100 to $90.

BofA Securities analyst Vivek Arya maintains with a hold rating.

Jefferies analyst Blayne Curtis maintains with a buy rating, and adjusts the target price from $115 to $90.

Jefferies analyst Blayne Curtis maintains with a buy rating, and adjusts the target price from $115 to $90.

Evercore analyst Mark Lipacis maintains with a buy rating, and adjusts the target price from $101 to $95.

Stifel analyst Tore Svanberg maintains with a buy rating, and adjusts the target price from $98 to $90.

Furthermore, according to the comprehensive report, the opinions of $Microchip Technology (MCHP.US)$'s main analysts recently are as follows:

Microchip's recent performance was deemed satisfactory, however, their forward guidance fell short of the general market consensus, influenced by persistent softness in the auto and industrial sectors. It's assessed that the company's shipments are trailing behind demand, suggesting the potential for a robust recovery in fundamental performance.

Microchip's shares experienced a 5% decline in aftermarket trading following the company's forecast for the December quarter, which fell short of the consensus by a significant margin both in terms of revenues and EPS. Despite this underperformance, analysts suggest that purchasing the company's shares could be advantageous, given that Microchip's shipping rates are reported to be 46% below consumption levels. This discrepancy is seen as of the end of September, and as a result, visibility into the company's operations is perceived to be at unprecedentedly low levels. Nevertheless, the company's management is believed to have offered conservative guidance and remarks, which analysts interpret as setting the stage for potential positive surprises through the year 2025.

The adjustment in the cycle is expected to extend longer due to continued inventory reductions and macroeconomic uncertainties. It is anticipated that there will be a business recovery sometime in the following year.

The firm indicated that Microchip's recent performance fell short on sales and gross margin guidance due to persistent weakness in end markets, which continues to prolong the inventory digestion period.

Here are the latest investment ratings and price targets for $Microchip Technology (MCHP.US)$ from 7 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月7日,多家华尔街大行更新了$微芯科技 (MCHP.US)$的评级,目标价介于90美元至95美元。

摩根大通分析师Harlan Sur维持买入评级,并将目标价从100美元下调至90美元。

美银证券分析师Vivek Arya维持持有评级。

富瑞集团分析师Blayne Curtis维持买入评级,并将目标价从115美元下调至90美元。

富瑞集团分析师Blayne Curtis维持买入评级,并将目标价从115美元下调至90美元。

Evercore分析师Mark Lipacis维持买入评级,并将目标价从101美元下调至95美元。

斯迪富分析师Tore Svanberg维持买入评级,并将目标价从98美元下调至90美元。

此外,综合报道,$微芯科技 (MCHP.US)$近期主要分析师观点如下:

Microchip最近的表现被认为令人满意,但他们的前瞻指引未能达到市场共识,受到汽车和工业领域持续疲软的影响。有分析认为,公司的出货量落后于需求,暗示了基本表现可能强劲复苏的潜力。

Microchip的股票在公司预测12月季度的情况下经历了5%的下跌,该预测在收入和EPS方面大幅落后于共识。尽管表现不佳,分析师建议购买该公司的股票可能会带来优势,因为据报道,Microchip的出货速率低于消耗水平46%。这种差距被视为截至9月底,因此,公司运营的透明度被认为是空前低水平。然而,有分析认为该公司管理层提供了保守的指引和言论,分析人士解释称,这为可能在2025年通过的积极意外提供了舞台。

由于持续的库存减少和宏观经济不确定性,预计周期调整将延长。预计在接下来的一年内会有业务复苏。

该公司表示,由于终端市场持续疲软,Microchip最近的业绩在销售和毛利率指引上表现不佳,继续延长存货消化期。

以下为今日7位分析师对$微芯科技 (MCHP.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

富瑞集团分析师Blayne Curtis维持买入评级,并将目标价从115美元下调至90美元。

富瑞集团分析师Blayne Curtis维持买入评级,并将目标价从115美元下调至90美元。

Jefferies analyst Blayne Curtis maintains with a buy rating, and adjusts the target price from $115 to $90.

Jefferies analyst Blayne Curtis maintains with a buy rating, and adjusts the target price from $115 to $90.