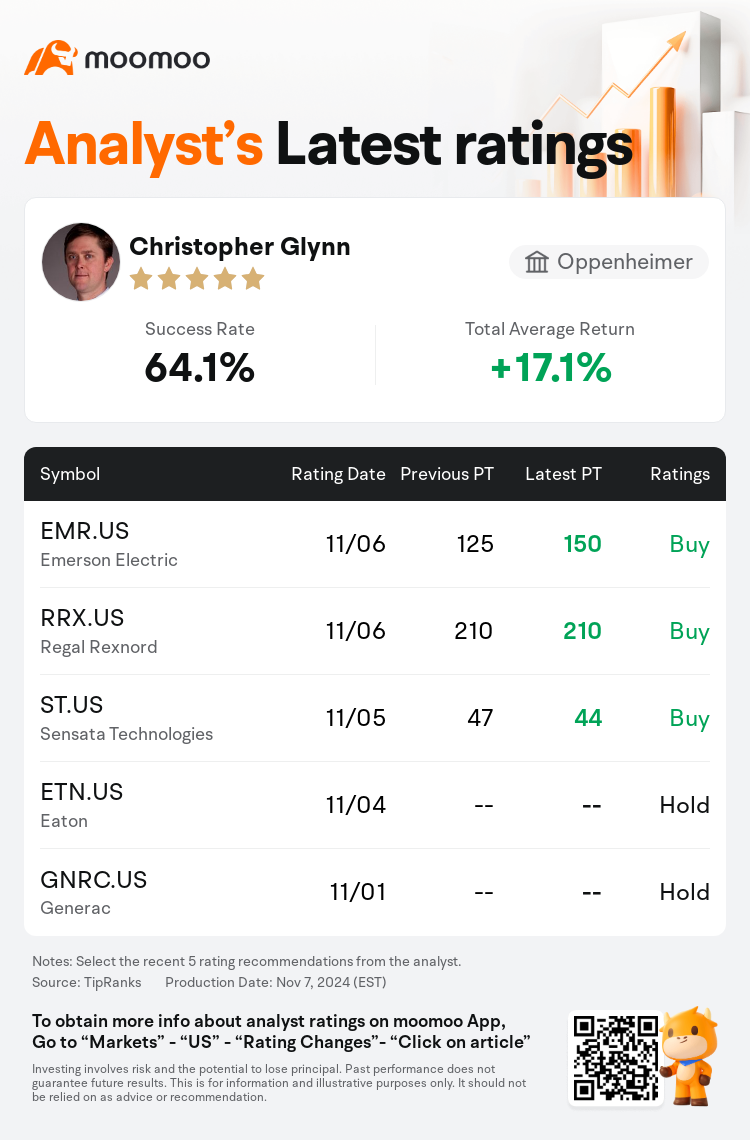

Oppenheimer analyst Christopher Glynn maintains $Emerson Electric (EMR.US)$ with a buy rating, and adjusts the target price from $125 to $150.

According to TipRanks data, the analyst has a success rate of 64.1% and a total average return of 17.1% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Emerson Electric (EMR.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Emerson Electric (EMR.US)$'s main analysts recently are as follows:

Post-fiscal Q4 reporting, expectations are for a favorable market response as the completion of the Aspen Technology transaction is imminent. This, coupled with guidance for Q1 that aligns with current projections and prevailing bearish investor sentiment, could sway share performance positively.

Emerson's fourth quarter core adjusted segment EBITA outperformance and fiscal 2025 guidance, which was slightly above the consensus, played a role in the positive market response. The primary driver for the rally in shares, however, is attributed to strategic announcements made by the company. Emerson revealed three critical strategic actions that finalizes its transformation into a leading industrial technology company with a focus on advanced automation solutions. The market has yet to fully recognize the value of the revamped Emerson in its current stock valuation.

The performance of shares was noted to have improved following the announcement of Q4 results and portfolio transformation actions. Management indicated that FY24 growth is expected to be propelled by Process and Hybrid businesses, although this is somewhat counterbalanced by the continuing softness in Discrete end markets. Nevertheless, a positive inflection in Discrete orders was observed in Q4, and the outlook is cautiously optimistic based on management's suggestion that these markets may have reached their lowest point.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

奥本海默控股分析师Christopher Glynn维持$艾默生电气 (EMR.US)$买入评级,并将目标价从125美元上调至150美元。

根据TipRanks数据显示,该分析师近一年总胜率为64.1%,总平均回报率为17.1%。

此外,综合报道,$艾默生电气 (EMR.US)$近期主要分析师观点如下:

此外,综合报道,$艾默生电气 (EMR.US)$近期主要分析师观点如下:

发布财政第四季度报告后,市场预计将会做出积极回应,因为艾斯本科技交易的完成即将到来。这个消息,加上第一季度的指引与当前预期和普遍看淡的投资者情绪一致,可能会积极影响股价表现。

爱文思控股第四季度核心调整后段落EBITA业绩超出预期,2025财年指引略高于共识,对市场的积极回应起了一定作用。然而,推动股价上涨的主要原因是该公司宣布的战略性公告。爱文思控股公布了3项关键战略举措,最终将其转变为以先进自动化解决方案为重点的领先工业技术公司。市场尚未充分认识到重组后的爱文思控股在当前股价估值中的价值。

股票表现的改善是在公布第四季度业绩和组合转型举措后被注意到的。管理层表示,FY24增长预计将受到过程业务和混合业务的推动,尽管这在一定程度上受到离散型终端市场持续疲软的影响。然而,在第四季度观察到了离散型订单的积极转折,根据管理层的建议,这些市场可能已经触底,前景谨慎乐观。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$艾默生电气 (EMR.US)$近期主要分析师观点如下:

此外,综合报道,$艾默生电气 (EMR.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of