Intel Options Trading: A Deep Dive Into Market Sentiment

Intel Options Trading: A Deep Dive Into Market Sentiment

Investors with a lot of money to spend have taken a bullish stance on Intel (NASDAQ:INTC).

有很多资金的投资者对英特尔(NASDAQ:INTC)持看好态度。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

我们在这里追踪的公开期权历史记录中发现,今天这些头寸已经出现了。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with INTC, it often means somebody knows something is about to happen.

不管这些投资者是机构还是富裕个人,我们不得而知。但当像INTC这样的大事发生时,通常意味着有人知道即将发生的事情。

Today, Benzinga's options scanner spotted 8 options trades for Intel.

今天,Benzinga的期权扫描器发现了8笔英特尔的期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 50% bullish and 37%, bearish.

这些大量资本的交易者的整体情绪一半看好,37%的看淡。

Out of all of the options we uncovered, there was 1 put, for a total amount of $33,705, and 7, calls, for a total amount of $434,355.

在我们发现的所有期权中,有1笔看跌交易,总金额为$33,705,还有7笔看涨交易,总金额为$434,355。

Projected Price Targets

预计价格目标

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $20.0 to $30.0 for Intel over the recent three months.

根据交易活动,似乎重要投资者正在瞄准英特尔在最近三个月内价格区间从20.0美元到30.0美元。

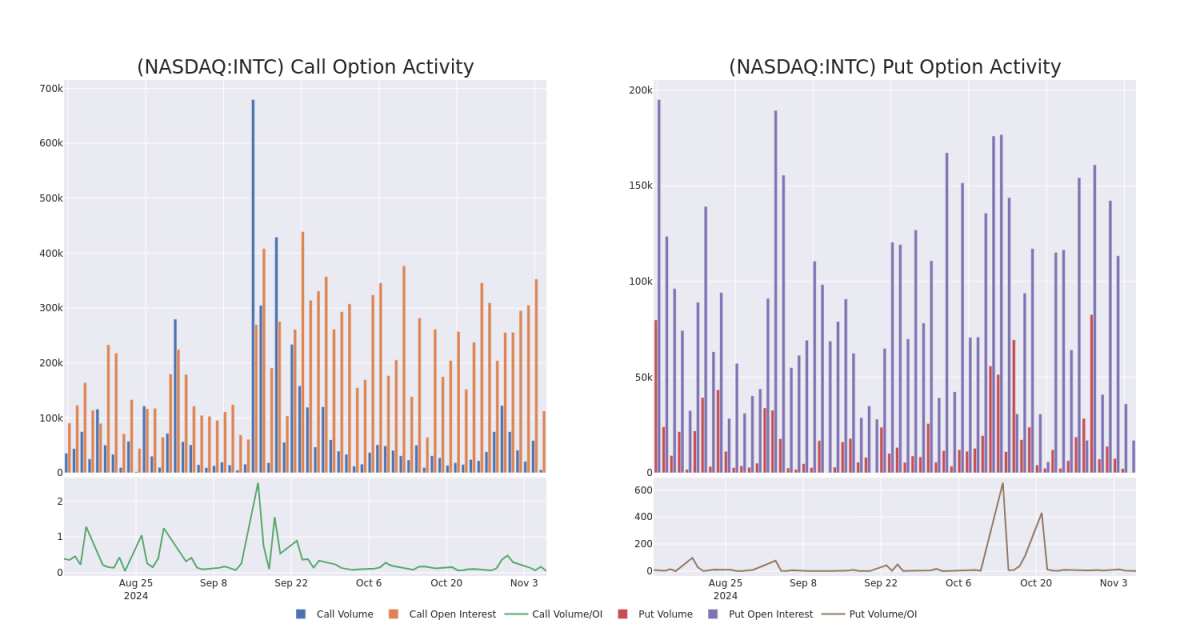

Analyzing Volume & Open Interest

分析成交量和未平仓合约

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Intel's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Intel's significant trades, within a strike price range of $20.0 to $30.0, over the past month.

检查成交量和持仓量可为股票研究提供关键见解。这些信息对于衡量某些行权价格下的英特尔期权的流动性和兴趣水平至关重要。下面,我们提供了过去一个月内关于看涨期权和看跌期权的成交量和持仓量趋势快照,涵盖了英特尔在20.0美元至30.0美元行权价格范围内的重要交易。

Intel 30-Day Option Volume & Interest Snapshot

Intel 30天期权成交量和持仓量简报

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| INTC | CALL | SWEEP | BEARISH | 01/17/25 | $2.39 | $2.35 | $2.35 | $25.00 | $117.2K | 49.9K | 552 |

| INTC | CALL | SWEEP | BULLISH | 11/15/24 | $0.57 | $0.55 | $0.57 | $26.00 | $71.8K | 22.9K | 2.0K |

| INTC | CALL | SWEEP | BEARISH | 06/20/25 | $7.4 | $7.05 | $7.12 | $20.00 | $56.8K | 25.3K | 0 |

| INTC | CALL | TRADE | BEARISH | 06/20/25 | $5.5 | $5.3 | $5.33 | $23.00 | $53.8K | 7.0K | 101 |

| INTC | CALL | SWEEP | BULLISH | 12/19/25 | $3.7 | $3.6 | $3.7 | $30.00 | $51.8K | 7.3K | 140 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 英特尔 | 看涨 | SWEEP | 看淡 | 01/17/25 | $2.39 | $2.35 | $2.35 | $25.00 | $117.2K | 49.9千 | 552 |

| 英特尔 | 看涨 | SWEEP | BULLISH | 11/15/24 | $0.57 | $0.55 | $0.57 | $26.00 | $71.8千美元 | 22.9K | 2.0K |

| 英特尔 | 看涨 | SWEEP | 看淡 | 06/20/25 | $7.4 | $7.05 | $7.12 | $20.00 | 56.8K美元 | 25.3K | 0 |

| 英特尔 | 看涨 | 交易 | 看淡 | 06/20/25 | $5.5 | $5.3 | $5.33 | $23.00 | $53.8K | 7.0K | 101 |

| 英特尔 | 看涨 | SWEEP | 看好 | 12/19/25 | $3.7 | $3.6 | $3.7 | $30.00 | $51.8K | 7.3K | 140 |

About Intel

关于英特尔

Intel is a leading digital chipmaker, focused on the design and manufacturing of microprocessors for the global personal computer and data center markets. Intel pioneered the x86 architecture for microprocessors and was the prime proponent of Moore's law for advances in semiconductor manufacturing. Intel remains the market share leader in central processing units in both the PC and server end markets. Intel has also been expanding into new adjacencies, such as communications infrastructure, automotive, and the Internet of Things. Further, Intel expects to leverage its chip manufacturing capabilities into an outsourced foundry model where it constructs chips for others.

英特尔是一家领先的数字芯片制造商,专注于为全球个人电脑和数据中心市场设计和制造微处理器。英特尔率先提出了微处理器的x86架构,并是Moore's law在半导体制造方面的主要支持者。英特尔在PC和服务器终端市场的中央处理单元方面保持市场份额领先地位。英特尔还扩展到了新的附加领域,如通信基础设施、汽车和物联网。此外,英特尔希望利用其芯片制造能力进入外包晶圆厂模式,在此模式下为他人构建芯片。

After a thorough review of the options trading surrounding Intel, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

经过对围绕英特尔的期权交易的彻底审查,我们开始更详细地评估该公司的市场状况和业绩。

Intel's Current Market Status

Intel目前的市场状况

- With a volume of 3,158,738, the price of INTC is up 1.43% at $25.41.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 77 days.

- 成交量为3,158,738,英特尔股票价格上涨1.43%,报25.41美元。

- RSI指标暗示该股票可能要超买了。

- 下一次盈利预计在77天内发布。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期权异动模块可以提前发现潜在的市场热点。了解大笔的资金在您喜欢的股票上的仓位变动。点击这里获取访问权限。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Intel with Benzinga Pro for real-time alerts.

期权交易涉及更大的风险,但也提供更高利润的潜力。 精明的交易员通过持续的教育、策略性的交易调整、利用各种因子并保持对市场动态的敏感来减轻这些风险。 通过Benzinga Pro实时警报及时了解英特尔的最新期权交易。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with INTC, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with INTC, it often means somebody knows something is about to happen.