AT&T Buys $1 Billion in Spectrum Licenses From US Cellular to Boost Network Reach

AT&T Buys $1 Billion in Spectrum Licenses From US Cellular to Boost Network Reach

United States Cellular Corp (NYSE:USM) has agreed with AT&T Inc (NYSE:T) to sell a portion of its retained spectrum licenses for $1.018 billion.

美国电信公司(纽交所:USM)已与AT&t公司(纽交所:T)达成协议,以10.18亿美元出售其保留的频谱许可证的一部分。

The transaction aligns with UScellular's strategy, announced in May 2024, to capitalize on its remaining spectrum assets, which are not included in the proposed sale to T-Mobile US Inc (NASDAQ:TMUS).

该交易与UScellular在2024年5月宣布的战略一致,旨在充分利用其剩余的频谱资产,这些资产未包括在拟议销售给t-Mobile US公司(纳斯达克:TMUS)的范围内。

This sale follows agreements made in October 2024 to sell other retained licenses to Verizon Communications Inc (NYSE:VZ) and two additional mobile network operators.

该销售跟随在2024年10月与Verizon通信公司(纽交所:VZ)和其他两家移动网络运营商协议,出售其他保留的许可证。

Also Read: Datadog Beats Q3 Estimates, Margins Show Mixed Results

还阅读:Datadog超越Q3估值,利润率呈现参差不齐

Laurent C. Therivel, President and CEO of UScellular, emphasized the value generated through recent deals, noting that AT&T's inclusion as a buyer expands the roster of networks set to benefit from UScellular's assets.

UScellular总裁兼首席执行官Laurent C. Therivel强调最近交易带来的价值,指出AT&t作为买方,扩大了将受益于UScellular资产的网络名单。

Therivel expressed confidence that AT&T will utilize the acquired licenses to support communities across the U.S.

Therivel表示,他相信AT&t将利用收购的许可证来支持美国各地社区。

With this transaction and previous agreements, UScellular has established deals to monetize around 55% of its spectrum holdings (excluding mmWave) on an MHz-Pops basis.

通过这次交易和先前的协议,UScellular已建立了交易,以MHz-Pops基础上对约55%的频谱持有权(不包括mmWave)进行货币化。

These deals collectively amount to approximately $2.02 billion. Once the proposed T-Mobile transaction is finalized, UScellular will have agreements to monetize approximately 70% of its overall spectrum assets.

这些交易总额约为20.2亿美元。一旦提议的t-Mobile交易完成,UScellular将达成协议,以变现其整体频谱资产约70%。

Therivel added that UScellular would retain 1.86 billion MHz-Pops of low- and mid-band spectrum and 17.2 billion MHz-Pops of mmWave spectrum. He highlighted the strategic value of UScellular's C-band licenses, which offer competitive mid-band frequencies, strong support in the 5G ecosystem, and extended build-out timelines through 2029 and 2033.

Therivel补充说,UScellular将保留18.6亿MHz-Pops的低中频段频谱和172亿MHz-Pops的mmWave频谱。他强调了UScellular C-band许可证的战略价值,提供竞争力强的中频段频率,在5g概念生态系统中获得强有力支持,并延长建设时间表至2029年和2033年。

This flexibility allows UScellular to leverage or sell these assets in the future, with plans to explore further monetization options for the C-band and other remaining spectrum.

这种灵活性使UScellular能够未来利用或出售这些资产,并计划探索进一步变现C-band和其他剩余频谱的选项。

The agreement involves selling 1,250 million MHz-Pops of 3.45 GHz licenses and 331 million MHz-Pops of 700 MHz B/C block licenses to AT&T for $1.018 billion, subject to potential adjustments outlined in the purchase agreement.

协议涉及向AT&t出售125000万MHz-Pops的3.45 GHz许可证和33100万MHz-Pops的700 MHz B/C频段许可证,价格为10.18亿美元,根据购买协议中概述的潜在调整。

The transaction's completion hinges on closing the T-Mobile deal and obtaining regulatory approvals and customary closing conditions.

交易的完成取决于t-Mobile交易的关闭以及获得监管批准和惯例的结束条件。

Some licenses to be transferred to AT&T are partially owned by a third party. Their sale will depend on UScellular's purchase of remaining equity in the third party, which is pending regulatory approval. These licenses account for around 15% of the MHz-Pops covered in this sale.

部分将转让给AT&t的许可证部分由第三方拥有。它们的出售将取决于UScellular对第三方剩余股权的购买,该股权正在等待监管批准。这些许可证占此交易所涵盖的MHz-Pops约15%。

TDS, which holds an 83% stake in UScellular, has formally approved the transaction with AT&T.

美国电信服务公司(TDS)持有UScellular83%的股份,已正式批准与AT&t的交易。

AT&T generated $10.24 billion in operating cash flow and $5.095 billion in free cash flow for the September 30, 2024 quarter. T is down 0.94%.

AT&t在2024年9月30日季度实现102.4亿美元的营业现金流和50.95亿美元的自由现金流。t下跌0.94%。

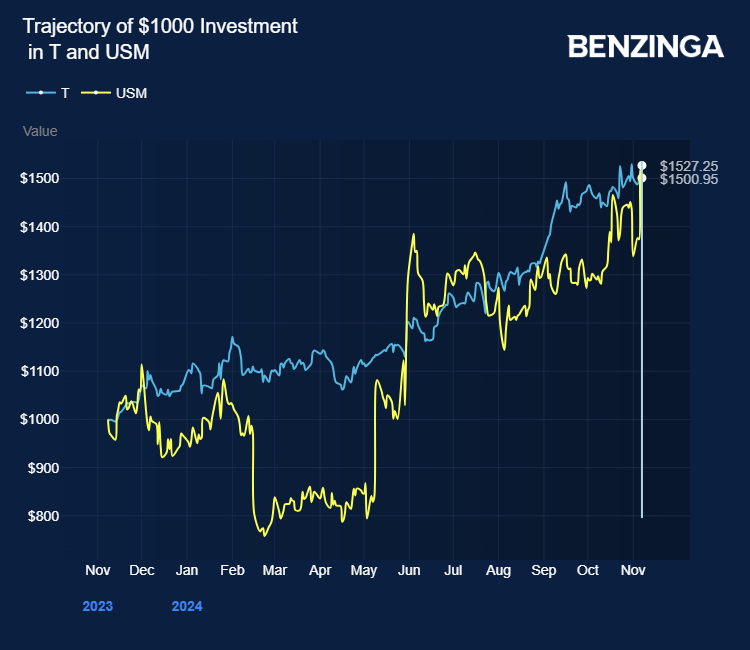

Price Action: USM stock is up 0.20% at $65.28 at the last check on Thursday.

价格走势:USm股票上涨0.20%,报65.28美元,在周四最后一次查看时。

Also Read:

还阅读:

- Appian Projects Positive Adjusted EBITDA, Boasts Strong Subscription Revenue In Q3

- Appian在第三季度项目调整后的EBITDA呈现正向增长,并以强劲的订阅营业收入为荣

Photo by Tdorante10 via Wikimedia Commons

特邀嘉宾/维基媒体/Tdorante10拍摄。