Federal Reserve Cuts Interest Rates by 25 Basis Points

Federal Reserve Cuts Interest Rates by 25 Basis Points

The Federal Open Market Committee lowered the target Federal Funds rate by 25 basis points, to a target of 4.5%-4.75%, citing the progress in inflation and slowing job gains on Thursday.

The 美联储公开市场委员会 将目标联邦基金利率降低25个基点,目标区间为4.5%-4.75%,周四称由于通胀进展和就业增长放缓。

"Recent indicators suggest that economic activity has continued to expand at a solid pace. Since earlier in the year, labor market conditions have generally eased, and the unemployment rate has moved up but remains low," the FOMC statement said. "Inflation has made progress toward the Committee's 2 percent objective but remains somewhat elevated."

“最近的指标表明经济活动继续以坚实的步伐扩张。自年初以来,劳动力市场状况普遍有所放缓,失业率有所上升但仍保持较低,”该 FOMC 声明称。“通胀已朝着委员会的2%目标迈出了一些进展,但仍然有些偏高。”

What Has Changed in the New Fed Statement

新联邦储备委员会声明中有哪些变化

Here is a detailed comparison of the Fed's current and previous statements, providing enlightening information for your investment choices.

这里详细比较了联邦储备委员会当前和以往的声明,为您的投资选择提供了启发性信息。

The last time the committee met on September 18, they unanimously voted to lower rates by 50 basis points, starting an aggressive rate reduction policy after they decided the economy was on track. In the lead-up to the U.S. Presidential election, the FOMC's direction of monetary policy looked more uncertain given the unknown effects of either presidential candidate's economic policy goals, and political appointment plans.

委员会上次会议于9月18日举行,一致同意降低50个基点的利率,决定在判断经济走势良好后启动积极的利率降低政策。在美国总统选举之前, 美国联邦公开市场委员会的货币政策方向变得更加不确定,因为两位总统候选人的经济政策目标和政治任命计划的未知影响。

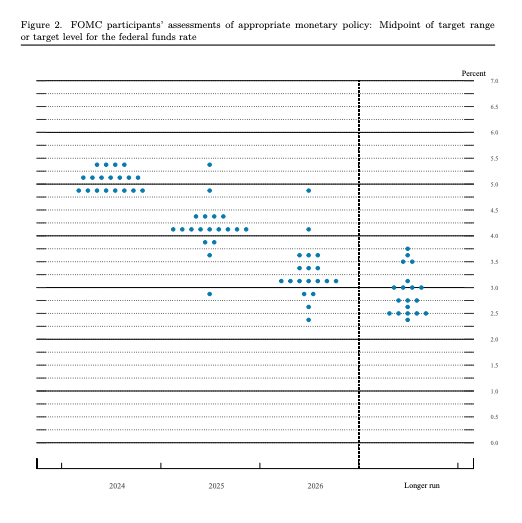

The Fed's dot plot graph from September forecasted the median key interest rate ending 2024 at 4.4%, before declining to 3.4% by the close of next year. At the last meeting, nine officials said they should cut rates again this year, and ten said just one more cut would do the trick.

美联储9月的点状图预测,到2024年底,中位数关键利率将达到4.4%,然后在明年年底前降至3.4%。在上次会议上,九名官员表示他们今年应再次降息,而另外十名官员表示再降息一次就够了。

For the target range to meet the 4.4% rate, the Fed would have to cut twice at 25 bps to a range of 4.25-4.5 or a cut of 50 bps or a similar combination of cuts.

为了达到4.4%的目标区间,美联储将不得不以25个基点的幅度再次降息两次,将区间降至4.25%-4.5%,或者降息50个基点,或者类似的降息组合。

In September, the unemployment rate had climbed to 4.3% in July from 3.7% in January. Since then, the most recent unemployment data showed a slight slowdown- numbers released on November 1st showed the rate lowered to 4.1%. PCE inflation, meanwhile, came on October 30th at 2.1% year over year, the lowest since 2021. While Core PCE was still higher at 2.7%, the numbers looked on track for a definite slowdown in prices.

在9月份,失业率从一月的3.7%攀升至7月的4.3%。此后,最新的失业数据显示略微放缓-11月1日公布的数据显示失业率降至4.1%。同时,PCE通胀数据显示,截至10月30日同比增长2.1%,是自2021年以来最低的。尽管核心PCE仍高达2.7%,但数字显示价格明显放缓。

The last time the committee met on September 18, they unanimously voted to lower rates by 50 basis points, starting an aggressive rate reduction policy after they decided the economy was on track. In the lead-up to the U.S. Presidential election, the

The last time the committee met on September 18, they unanimously voted to lower rates by 50 basis points, starting an aggressive rate reduction policy after they decided the economy was on track. In the lead-up to the U.S. Presidential election, the