Market Mover | Shares of AI Lending Company Upstart Jump nearly 19% on Strong Financial Results

Market Mover | Shares of AI Lending Company Upstart Jump nearly 19% on Strong Financial Results

November 7, 2024 - $Upstart (UPST.US)$ shares surged 18.93% to $65.97 in post-market trading on Thursday. It announced financial results for its third quarter of fiscal year 2024 ended September 30, 2024.

2024年11月7日 - $Upstart (UPST.US)$ 股价在周四的美股盘后交易中暴涨18.93%,达到65.97美元。该公司宣布截至2024年9月30日的2024财年第三季度财务业绩。

“With 43% sequential growth in lending volume and a return to positive adjusted EBITDA, we continue to strengthen Upstart’s position as the fintech leader in artificial intelligence,” said Dave Girouard, co-founder and CEO of Upstart. “Even without a significant boost from the macroeconomy, we’re back in growth mode.”

“在贷款成交量环比增长43%和再次实现正调整后EBITDA的情况下,我们继续巩固Upstart作为人工智能领域金融科技领导者的地位,”Upstart的联合创始人兼首席执行官戴夫·吉罗德表示。“即使没有宏观经济的显著提振,我们也正在恢复增长模式。”

Third Quarter 2024 Financial Highlights

2024年第三季度财务亮点

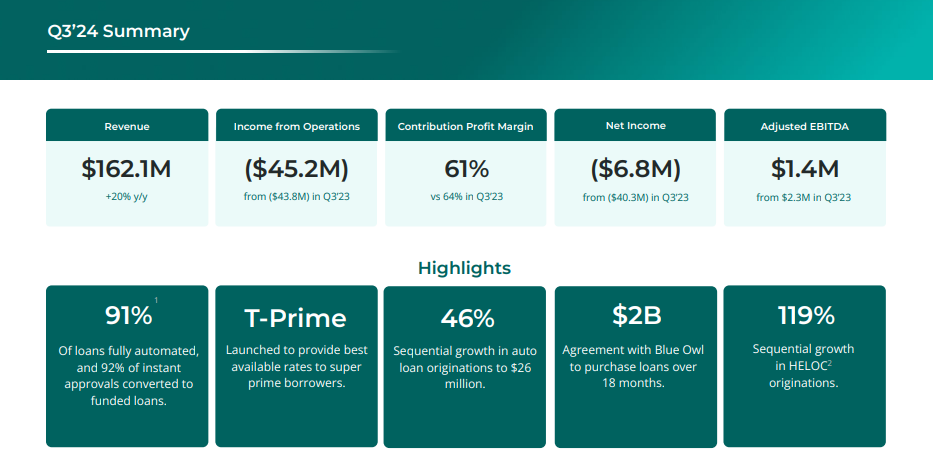

Revenue. Total revenue was $162 million, an increase of 20% from the third quarter of 2023, and up 27% sequentially. Total fee revenue was $168 million, an increase of 14% year-over-year, and up 28% sequentially.

Transaction Volume and Conversion Rate. 188,149 loans were originated, totaling $1.6 billion across our platform in the third quarter of 2024, up 30% from the same quarter of the prior year, and up 43% sequentially. Conversion on rate requests was 16.3% in the third quarter of 2024, up from 9.5% in the same quarter of the prior year.

Income (Loss) from Operations. Income (loss) from operations was ($45.2) million, down from ($43.8) million in the same quarter of the prior year.

Net Income (Loss) and EPS. GAAP net income (loss) was ($6.8) million, up from ($40.3) million in the third quarter of the prior year. Adjusted net income (loss) was ($5.3) million, down from ($3.9) million in the same quarter of the prior year. Accordingly, GAAP diluted earnings per share was ($0.07), and diluted adjusted earnings per share was ($0.06) based on the weighted-average common shares outstanding during the quarter.

Contribution Profit. Contribution profit was $102.4 million in the third quarter of 2024, up 9% year-over-year, with a contribution margin of 61% compared to a 64% contribution margin in the same quarter of the prior year.

Adjusted EBITDA. Adjusted EBITDA was $1.4 million, down from $2.3 million in the same quarter of the prior year. The third quarter 2024 Adjusted EBITDA margin was 1% of total revenue, down from 2% in the same quarter of the prior year.

营业收入。总收入为16200万美元,比2023年第三季度增长20%,环比增长27%。总费用收入为16800万美元,同比增长14%,环比增长28%。

交易量和转换率。第三季度,我们平台上共产生了181,149笔贷款,总额达到16亿美元,比去年同期增长30%,环比增长43%。第三季度2024年请求率转换率为16.3%,比去年同期的9.5%有所提高。

营业收入(亏损)。 营业收入(亏损)为(4520万)美元,低于去年同期的(4380万)美元。

净利润(亏损)和每股收益。根据GAAP,净利润(亏损)为(680万)美元,高于去年同期的(4030万)美元。调整后的净利润(亏损)为(530万)美元,低于去年同期的(390万)美元。因此,根据加权平均普通股,GAAP摊薄每股收益为(0.07)美元,调整后的摊薄每股收益为(0.06)美元。

利润贡献。2024年第三季度贡献利润为10240万美元,同比增长9%,贡献率为61%,较去年同期的64%降低。

调整后的EBITDA。调整后的EBITDA为140万美元,低于去年同期的230万美元。2024年第三季度调整后的EBITDA利润率为总收入的1%,低于去年同期的2%。

Financial Outlook

财务展望

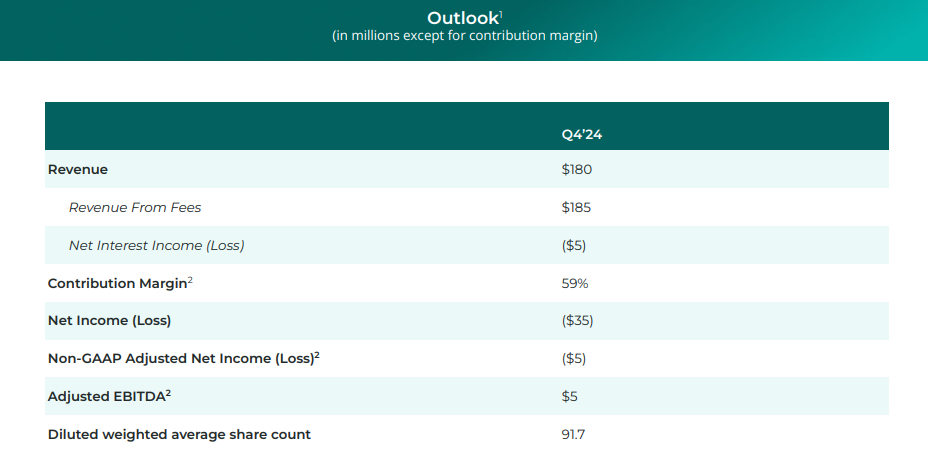

For the fourth quarter of 2024, Upstart expects:

2024年第四季度,Upstart预计:

Revenue of approximately $180 million

Contribution Margin of approximately 59%

Net Income (Loss) of approximately ($35) million

Adjusted Net Income (Loss) of approximately ($5) million

Adjusted EBITDA of approximately $5 million

Basic Weighted-Average Share Count of approximately 91.7 million shares

Diluted Weighted-Average Share Count of approximately 91.7 million shares

大约18000万美元的营业收入

大约59%的贡献边际

净利润(亏损)约为(35)百万美元

调整后的净利润(亏损)约为(5)百万美元

约500万美元的调整后EBITDA

基本加权平均股份约9170万股

稀释加权平均股份约9170万股