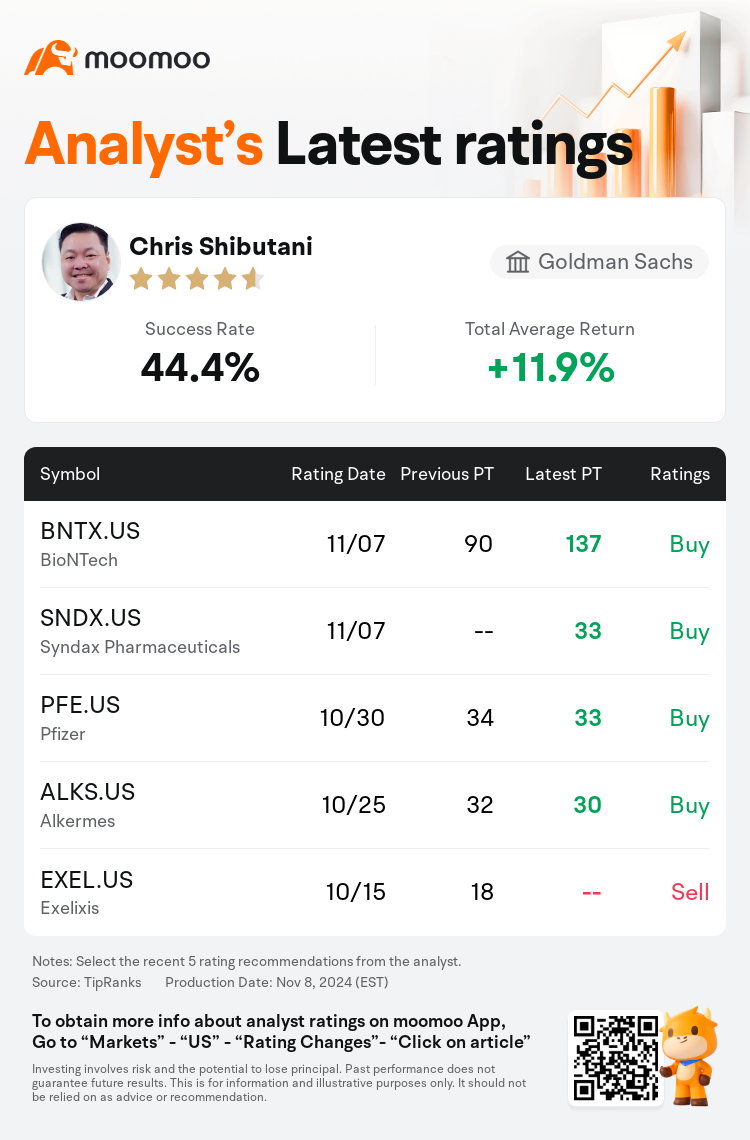

Goldman Sachs analyst Chris Shibutani upgrades $BioNTech (BNTX.US)$ to a buy rating, and adjusts the target price from $90 to $137.

According to TipRanks data, the analyst has a success rate of 44.4% and a total average return of 11.9% over the past year.

Furthermore, according to the comprehensive report, the opinions of $BioNTech (BNTX.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $BioNTech (BNTX.US)$'s main analysts recently are as follows:

The upgrade of BioNTech's rating reflects the incorporation of projections for BNT327, an innovative immuno-oncology candidate under clinical trials for various solid tumor types, into valuation models. The investment rationale for BioNTech is observed to be shifting from the challenging-to-predict COVID-19 vaccine market to the emerging substantial opportunity presented by BNT327. Success in the development of BNT327 could significantly contribute to BioNTech's ambition of establishing a dominant commercial presence in the oncology sector.

The firm noted that while financial results surpassed expectations and forecasts were maintained, attention is now shifting to the Oncology pipeline. This area is anticipated to provide multiple data outcomes from mid-to-late stage research in the latter part of 2024 and throughout 2025.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

高盛集团分析师Chris Shibutani上调$BioNTech (BNTX.US)$至买入评级,并将目标价从90美元上调至137美元。

根据TipRanks数据显示,该分析师近一年总胜率为44.4%,总平均回报率为11.9%。

此外,综合报道,$BioNTech (BNTX.US)$近期主要分析师观点如下:

此外,综合报道,$BioNTech (BNTX.US)$近期主要分析师观点如下:

BioNTech评级的上调反映了对估值模型中,BNT327(一种正在进行各种实体瘤类型临床试验的创新免疫肿瘤学候选药物)的预测已纳入估值模型。据观察,BioNTech 的投资理由正在从难以预测的 COVID-19 疫苗市场转向 BNT327 带来的新兴实质性机遇。BNT327 的成功开发可以显著促进 BioNTech 在肿瘤学领域建立主导商业地位的雄心。

该公司指出,尽管财务业绩超出预期且预测得以维持,但现在注意力正在转移到肿瘤学产品线上。预计该领域将在2024年下半年和整个2025年提供中后期研究的多种数据成果。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$BioNTech (BNTX.US)$近期主要分析师观点如下:

此外,综合报道,$BioNTech (BNTX.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of