What You Need To Know About The SmartRent, Inc. (NYSE:SMRT) Analyst Downgrade Today

What You Need To Know About The SmartRent, Inc. (NYSE:SMRT) Analyst Downgrade Today

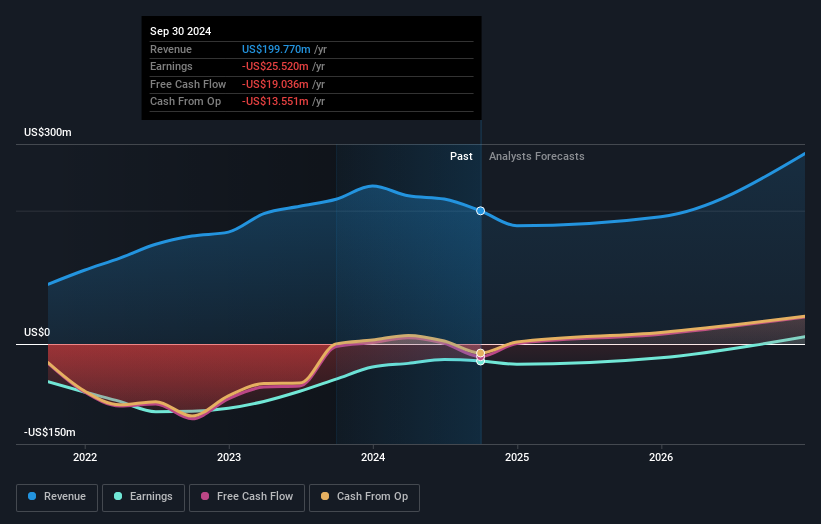

The latest analyst coverage could presage a bad day for SmartRent, Inc. (NYSE:SMRT), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative.

最新的分析师报道可能预示着SmartRent, Inc.(纽交所: SMRT)将迎来糟糕的一天,分析师们普遍削减了他们的财务预测,这可能会让股东感到有些震惊。这份报告侧重于营业收入预估,似乎业务的共识观点变得更为保守。

Following the downgrade, the consensus from four analysts covering SmartRent is for revenues of US$191m in 2025, implying a discernible 4.5% decline in sales compared to the last 12 months. Losses are predicted to fall substantially, shrinking 90% to US$0.013 per share. Yet before this consensus update, the analysts had been forecasting revenues of US$215m and losses of US$0.05 per share in 2025. We can see there's definitely been a change in sentiment in this update, with the analysts administering a meaningful downgrade to next year's revenue estimates, while at the same time reducing their loss estimates.

在降级之后,四位分析师对SmartRent的2025年营业收入预测为19100万美元,相比过去12个月销售额出现明显下降4.5%。预计亏损将大幅下降,每股亏损将缩水90%,至0.013美元。然而,在这次共识更新之前,分析师们曾预测2025年的营业收入为21500万美元,每股亏损为0.05美元。我们可以看到这次更新中情绪明显有所变化,分析师们对明年的营收预测实施了实质性的下调,同时减少了他们的亏损预测。

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. We would highlight that sales are expected to reverse, with a forecast 3.6% annualised revenue decline to the end of 2025. That is a notable change from historical growth of 32% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 7.3% annually for the foreseeable future. It's pretty clear that SmartRent's revenues are expected to perform substantially worse than the wider industry.

要对这些预测获得更多背景信息的一种方法是查看它们与过去表现以及同行业其他公司的表现如何相比。我们需要强调的是,销售额有望逆转,预计到2025年底将出现年均3.6%的营业收入下降。这与过去五年32%的历史增长形成了明显对比。相比之下,我们的数据显示,同行业其他公司(受到分析师覆盖)预计未来会保持年均7.3%的营业收入增长。很明显,SmartRent的营收预计将远远低于更广泛的行业。

The Bottom Line

最重要的事情是分析师增加了它对下一年每股亏损的估计。令人欣慰的是,营收预测未发生重大变化,业务仍有望比整个行业增长更快。共识价格目标稳定在28.50美元,最新估计不足以对价格目标产生影响。

Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. Given the stark change in sentiment, we'd understand if investors became more cautious on SmartRent after today.

令人遗憾的是,他们还下调了他们的营业收入预测,最新的预测暗示该业务的销售增长速度将低于更广泛的市场。鉴于情绪的明显变化,我们理解如果投资者今天变得对SmartRent更加谨慎。

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. At Simply Wall St, we have a full range of analyst estimates for SmartRent going out to 2026, and you can see them free on our platform here.

即使如此,业务的长期发展轨迹对股东的价值创造更为重要。在 Simply Wall St,我们为 SmartRent 到 2026 年提供了完整的分析师预估范围,您可以免费在我们的平台上查看。

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies backed by insiders.

跟踪管理层是购买还是销售,是寻找可能达到关键点的有趣公司的另一种方法,我们的免费公司列表由内部支持的增长公司组成。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧吗?请直接与我们联系。或者,发送电子邮件至editorial-team @ simplywallst.com。

Simply Wall St的这篇文章是一般性质的。我们仅基于历史数据和分析师预测提供评论,使用公正的方法,我们的文章并非意在提供财务建议。这并不构成买入或卖出任何股票的建议,并且不考虑您的目标或财务状况。我们旨在为您带来基于基础数据驱动的长期聚焦分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St对提及的任何股票都没有持仓。

Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. Given the stark change in sentiment, we'd understand if investors became more cautious on SmartRent after today.

Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. Given the stark change in sentiment, we'd understand if investors became more cautious on SmartRent after today.