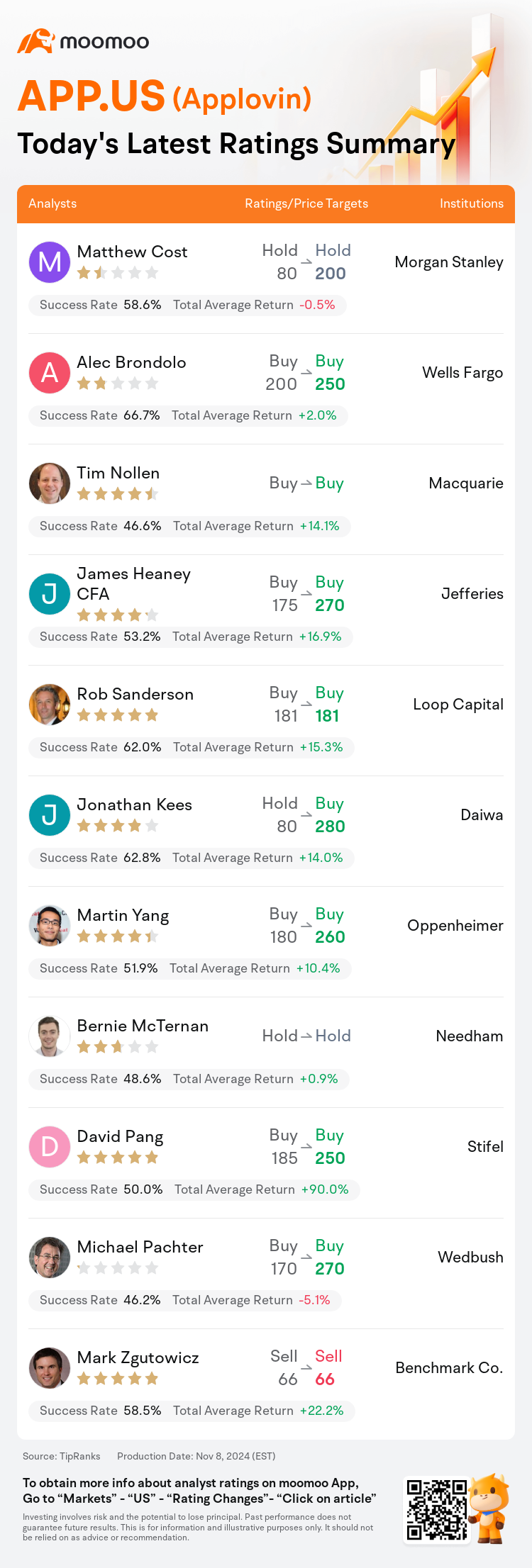

On Nov 08, major Wall Street analysts update their ratings for $Applovin (APP.US)$, with price targets ranging from $66 to $280.

Morgan Stanley analyst Matthew Cost maintains with a hold rating, and adjusts the target price from $80 to $200.

Wells Fargo analyst Alec Brondolo maintains with a buy rating, and adjusts the target price from $200 to $250.

Macquarie analyst Tim Nollen maintains with a buy rating.

Macquarie analyst Tim Nollen maintains with a buy rating.

Jefferies analyst James Heaney CFA maintains with a buy rating, and adjusts the target price from $175 to $270.

Loop Capital analyst Rob Sanderson maintains with a buy rating, and maintains the target price at $181.

Furthermore, according to the comprehensive report, the opinions of $Applovin (APP.US)$'s main analysts recently are as follows:

AppLovin's Q4 performance surpassed expectations, and the company's guidance for the subsequent quarter also looks promising, exceeding analyst predictions. The performance of the e-commerce pilot was notably better than what management anticipated.

The company delivered strong Q3 results, and its management provided Q4 guidance that surpassed expectations. Analysts received a positive impression of these outcomes and the company's confident stance on its market position, indicating potential for further appreciation in its share value.

Following AppLovin's strong quarterly report, where the company exceeded expectations and raised future guidance, an adjustment to the adjusted EBITDA forecasts for 2024 and 2025 was made. The shift to a straightforward enterprise value to EBITDA valuation method was noted, emphasizing the increasing significance of the Software Platform.

The firm notes that Q3 results have once again demonstrated that expectations regarding the timing of AXON 2.0's enhanced performance, the pace of margin expansion, and the duration of operating leverage sustainability were set too low. The firm further observes that, even in the absence of contributions from e-commerce, AppLovin's business and financial models warrant a more substantial valuation multiple.

The company's third-quarter outcomes and insights from the call support the thesis that gaming is increasingly becoming a winner-take-most sector. Additionally, it's projected that Commerce will become a substantial part of the business beginning the following year.

Here are the latest investment ratings and price targets for $Applovin (APP.US)$ from 11 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

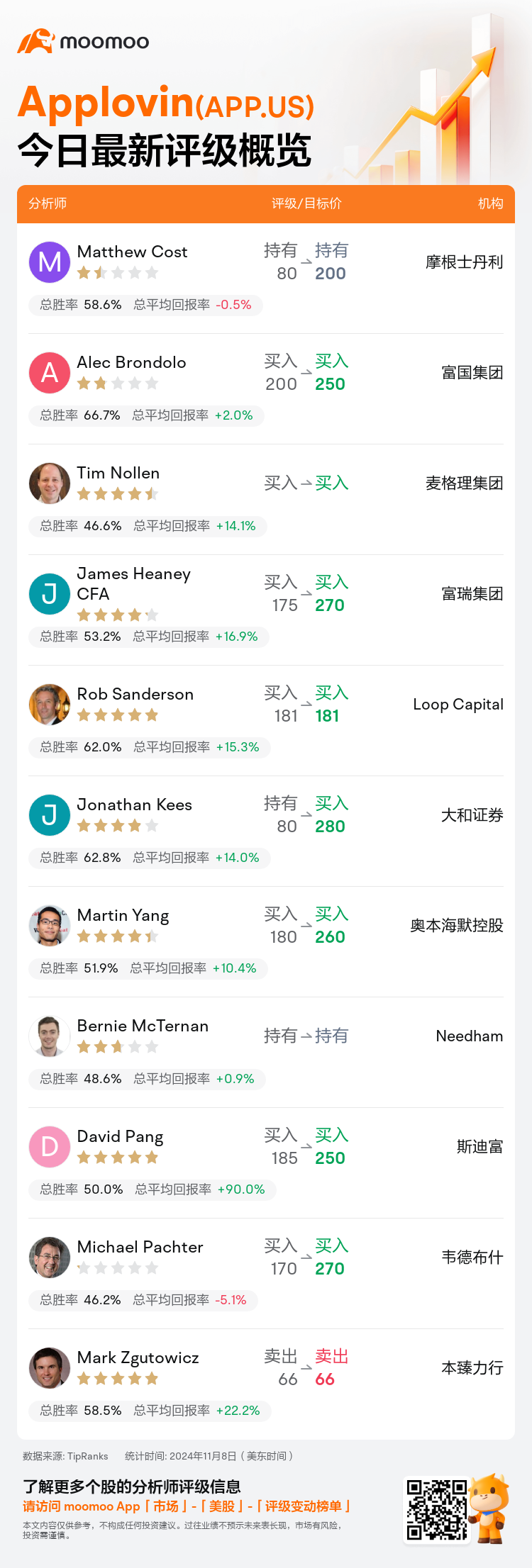

美东时间11月8日,多家华尔街大行更新了$Applovin (APP.US)$的评级,目标价介于66美元至280美元。

摩根士丹利分析师Matthew Cost维持持有评级,并将目标价从80美元上调至200美元。

富国集团分析师Alec Brondolo维持买入评级,并将目标价从200美元上调至250美元。

麦格理集团分析师Tim Nollen维持买入评级。

麦格理集团分析师Tim Nollen维持买入评级。

富瑞集团分析师James Heaney CFA维持买入评级,并将目标价从175美元上调至270美元。

Loop Capital分析师Rob Sanderson维持买入评级,维持目标价181美元。

此外,综合报道,$Applovin (APP.US)$近期主要分析师观点如下:

AppLovin的第四季表现超出预期,公司对接下来季度的指导也看起来很有前景,超出了分析师的预测。电子商务试点的表现明显优于管理层的预期。

公司交出了强劲的第三季度业绩,管理层提供了超出预期的第四季度指导。分析师对这些成果产生了积极印象,公司对自身市场地位的自信立场表明其股价有进一步上涨的潜力。

在AppLovin强劲的季度报告之后,公司超出预期并提高了未来指导,对2024年和2025年调整了调整后的EBITDA预测。注意到转向直接企业价值与EBITDA估值方法的转变,强调了软件平台日益重要的意义。

公司指出第三季度的业绩再次表明,关于AXON 2.0性能增强的时间安排、利润率扩张的速度以及经营杠杆持续性的预期设置得太低了。公司进一步观察到,即使在没有电子商务的贡献下,AppLovin的业务和财务模式也值得获得更高的估值倍数。

公司的第三季度业绩和电话会议的见解支持了arvr游戏正在逐渐成为赢者通吃的板块的观点。此外,预计电子商务将在明年成为业务的重要部分。

以下为今日11位分析师对$Applovin (APP.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

麦格理集团分析师Tim Nollen维持买入评级。

麦格理集团分析师Tim Nollen维持买入评级。

Macquarie analyst Tim Nollen maintains with a buy rating.

Macquarie analyst Tim Nollen maintains with a buy rating.