On Nov 08, major Wall Street analysts update their ratings for $Qualcomm (QCOM.US)$, with price targets ranging from $185 to $245.

Morgan Stanley analyst Joseph Moore maintains with a hold rating, and adjusts the target price from $207 to $204.

BofA Securities analyst Tal Liani maintains with a buy rating, and maintains the target price at $245.

Citi analyst Christopher Danely maintains with a hold rating, and maintains the target price at $185.

Citi analyst Christopher Danely maintains with a hold rating, and maintains the target price at $185.

Barclays analyst Thomas O'Malley maintains with a buy rating, and maintains the target price at $200.

UBS analyst Timothy Arcuri maintains with a hold rating, and adjusts the target price from $175 to $190.

Furthermore, according to the comprehensive report, the opinions of $Qualcomm (QCOM.US)$'s main analysts recently are as follows:

In the September quarter, Qualcomm experienced benefits from augmented content, a steady and expanding high-end handset market, along with normalized inventory dynamics. Post-report analysis indicates that forecasts remain relatively stable. Revenue expectations for the March quarter are set at $10.3 billion with EPS projections at $2.66, and for the year 2025, anticipated revenues and EPS stand at $42.6 billion and $11.32 respectively.

Qualcomm has projected strong guidance and presents a positive outlook for the flagship segment of the China market, attributed to the introduction of new models and an increase in selling prices stemming from its new Snapdragon 8 Elite. Despite a relatively stable overall unit market, Qualcomm's mobile business is experiencing growth, particularly due to its significant presence in the premium tier.

The analyst notes an improvement in revenue and margins which led to earnings surpassing consensus forecasts. Expectations for revenue and earnings have been raised for the company, with particular attention on the IOT and Autos sectors. These sectors are anticipated to shift investor focus towards long-term prospects concerning market diversification, which Qualcomm is expected to detail at the forthcoming investor day.

The firm acknowledges Qualcomm's delivery of Q4 results that surpassed expectations, along with a favorable Q1 2025 guidance. Nonetheless, the firm maintains a cautious perspective due to several factors: the anticipated increase in competition in the AI PC market, concerns over Apple's foray into the 5G modem space, and the ongoing licensing disagreements with Arm.

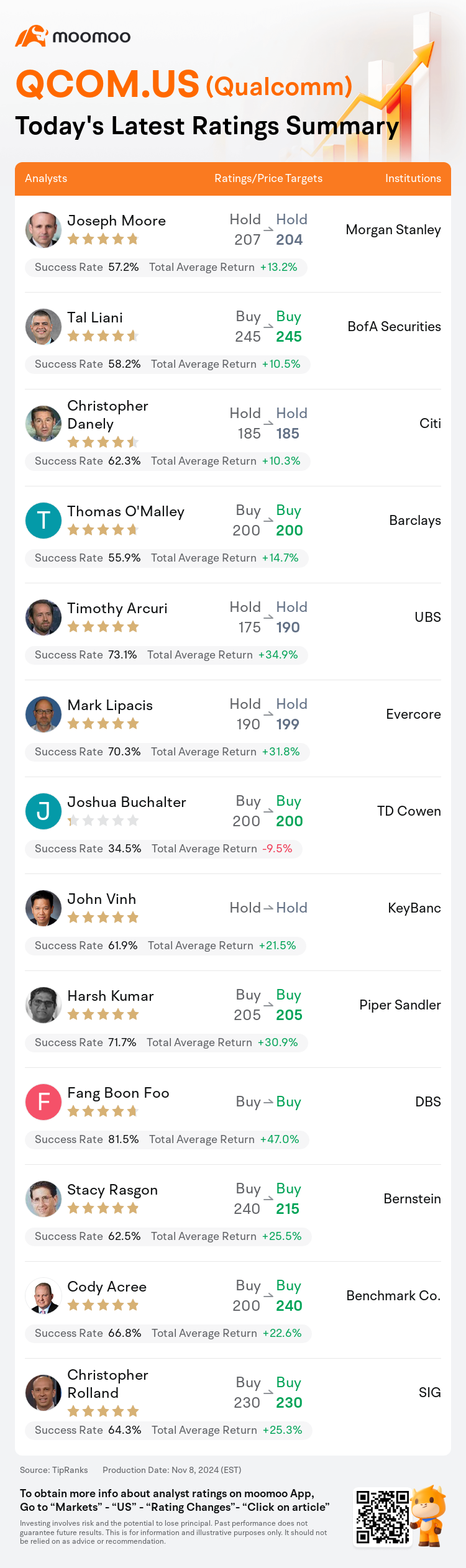

Here are the latest investment ratings and price targets for $Qualcomm (QCOM.US)$ from 13 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月8日,多家华尔街大行更新了$高通 (QCOM.US)$的评级,目标价介于185美元至245美元。

摩根士丹利分析师Joseph Moore维持持有评级,并将目标价从207美元下调至204美元。

美银证券分析师Tal Liani维持买入评级,维持目标价245美元。

花旗分析师Christopher Danely维持持有评级,维持目标价185美元。

花旗分析师Christopher Danely维持持有评级,维持目标价185美元。

巴克莱银行分析师Thomas O'Malley维持买入评级,维持目标价200美元。

瑞士银行分析师Timothy Arcuri维持持有评级,并将目标价从175美元上调至190美元。

此外,综合报道,$高通 (QCOM.US)$近期主要分析师观点如下:

在9月季度,高通从增强内容、稳定且不断扩大的高端手机市场以及库存动态的正常化中受益。报告后的分析表明,预测仍然相对稳定。预计3月季度的营业收入预期为103亿美元,每股收益预计为2.66美元,到2025年,预计营业收入和每股收益分别为426亿美元和11.32美元。

高通已经预计了强劲的指导,并为中国市场旗舰部分展示了积极的前景,这归功于新款手机的推出以及由新的骁龙8 Elite 带来的销售价格上涨。尽管整体销量市场相对稳定,但高通的手机业务正在经历增长,特别是由于其在高端市场的显著存在。

分析师指出,营业收入和利润率的改善导致收益超过共识预测。公司的营业收入和收益预期已经提高,特别关注物联网和汽车领域。预计这些领域将引起投资者关注市场多元化的长期前景,预计高通将在即将到来的投资者日详细说明。

公司承认高通在Q4的业绩超出预期,以及对2025年Q1的有利指导。尽管如此,公司仍保持谨慎的态度,原因有几个:人工智能个人电脑市场竞争预期增加,对苹果进军5g调制解调器领域的担忧,以及与Arm的持续许可争议。

以下为今日13位分析师对$高通 (QCOM.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

花旗分析师Christopher Danely维持持有评级,维持目标价185美元。

花旗分析师Christopher Danely维持持有评级,维持目标价185美元。

Citi analyst Christopher Danely maintains with a hold rating, and maintains the target price at $185.

Citi analyst Christopher Danely maintains with a hold rating, and maintains the target price at $185.