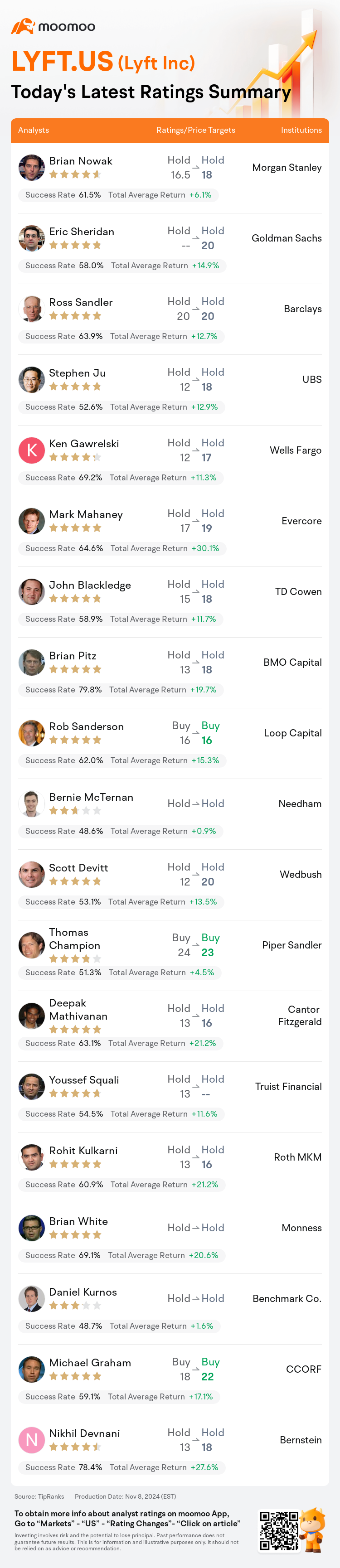

On Nov 08, major Wall Street analysts update their ratings for $Lyft Inc (LYFT.US)$, with price targets ranging from $16 to $23.

Morgan Stanley analyst Brian Nowak maintains with a hold rating, and adjusts the target price from $16.5 to $18.

Goldman Sachs analyst Eric Sheridan maintains with a hold rating, and sets the target price at $20.

Barclays analyst Ross Sandler maintains with a hold rating, and maintains the target price at $20.

Barclays analyst Ross Sandler maintains with a hold rating, and maintains the target price at $20.

UBS analyst Stephen Ju maintains with a hold rating, and adjusts the target price from $12 to $18.

Wells Fargo analyst Ken Gawrelski maintains with a hold rating, and adjusts the target price from $12 to $17.

Furthermore, according to the comprehensive report, the opinions of $Lyft Inc (LYFT.US)$'s main analysts recently are as follows:

Lyft's unexpected increase in free cash flow during Q3 was partially due to an insurance mix and underlying margin improvement. The company's core metrics largely met expectations, displaying steady growth trends in ride-hailing activities during the second half of the year, which contrasts with Uber's performance.

Lyft's recent financial outcomes, which surpassed Street forecasts, demonstrated strong performance in bookings, revenue, and EBITDA. Their guidance for the upcoming quarter suggests bookings that exceed previous market expectations, coupled with EBITDA projections that are significantly higher than forecasted by analysts.

Lyft has shown profitable growth, which is reflected in better-than-expected bookings for Q3/Q4. This, along with operational efficiencies and expenditure discipline, has resulted in strong EBITDA performance.

The firm noted that Lyft's Q3 revenue exceeded expectations by 6%, spurred by robust demand and a record number of rides, while EBITDA surpassed consensus estimates by 14%, indicating efficiency in incentives.

The company's Q3 Bookings growth of 16% surpassed projections, bolstered by its Canadian expansion and back-to-school activations that were more robust than anticipated. While these figures did exceed forecasts, there remains a need for more substantial evidence of the longevity of these trends and the implications of the partnership with a peer company, which is anticipated to bear fruit in the latter half of FY25.

Here are the latest investment ratings and price targets for $Lyft Inc (LYFT.US)$ from 19 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

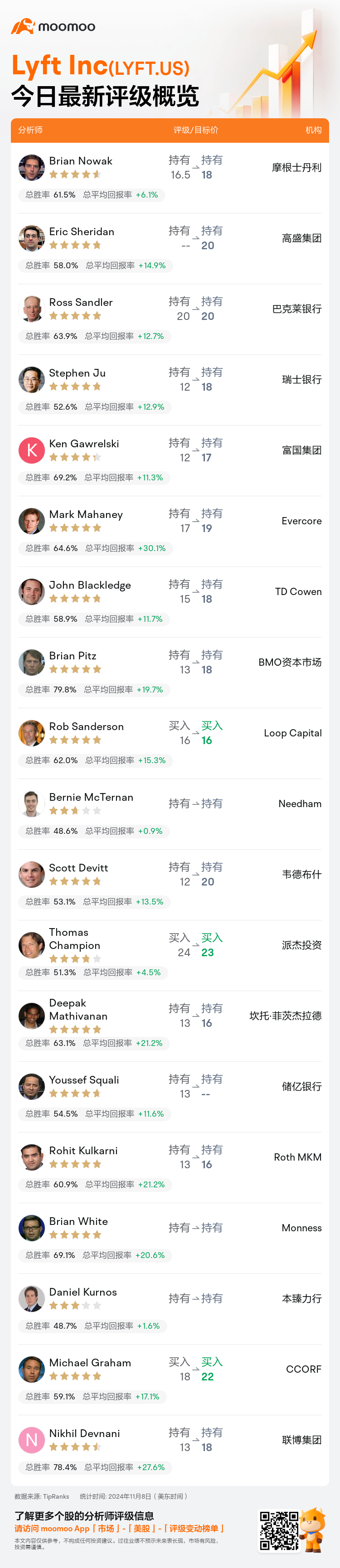

美东时间11月8日,多家华尔街大行更新了$Lyft Inc (LYFT.US)$的评级,目标价介于16美元至23美元。

摩根士丹利分析师Brian Nowak维持持有评级,并将目标价从16.5美元上调至18美元。

高盛集团分析师Eric Sheridan维持持有评级,目标价20美元。

巴克莱银行分析师Ross Sandler维持持有评级,维持目标价20美元。

巴克莱银行分析师Ross Sandler维持持有评级,维持目标价20美元。

瑞士银行分析师Stephen Ju维持持有评级,并将目标价从12美元上调至18美元。

富国集团分析师Ken Gawrelski维持持有评级,并将目标价从12美元上调至17美元。

此外,综合报道,$Lyft Inc (LYFT.US)$近期主要分析师观点如下:

Lyft第三季度自由现金流意外增加,部分原因是由于保险结构和基础利润率的改善。公司的核心指标基本符合预期,在第二年下半年的网约车活动中显示出稳定增长趋势,与优步的表现形成鲜明对比。

Lyft最近的财务业绩超出了街头预期,展现了在订单、营业收入和EBITDA方面的强劲表现。他们对即将到来的季度的指引表明订单将超出先前的市场预期,加上分析师预测的EBITDA预测明显高于预期。

Lyft已经展现出盈利增长,并在第三/第四季度的订单超出了预期。这一点,再加上运营效率和支出管理纪律,已经带来了强劲的EBITDA表现。

公司指出Lyft第三季度的营业收入超出预期6%,得益于强劲需求和创纪录的搭载次数,而EBITDA超出共识估计14%,表明激励措施效率提高。

公司第三季度订单增长16%,超出预期,得益于加拿大市场扩张和学校开学活动比预期更活跃。尽管这些数字超出了预测,但仍然需要更有力的证据来证明这些趋势的持久性,以及与同业公司合作伙伴关系的影响,预计将在第25财年下半年收到成果。

以下为今日19位分析师对$Lyft Inc (LYFT.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

巴克莱银行分析师Ross Sandler维持持有评级,维持目标价20美元。

巴克莱银行分析师Ross Sandler维持持有评级,维持目标价20美元。

Barclays analyst Ross Sandler maintains with a hold rating, and maintains the target price at $20.

Barclays analyst Ross Sandler maintains with a hold rating, and maintains the target price at $20.