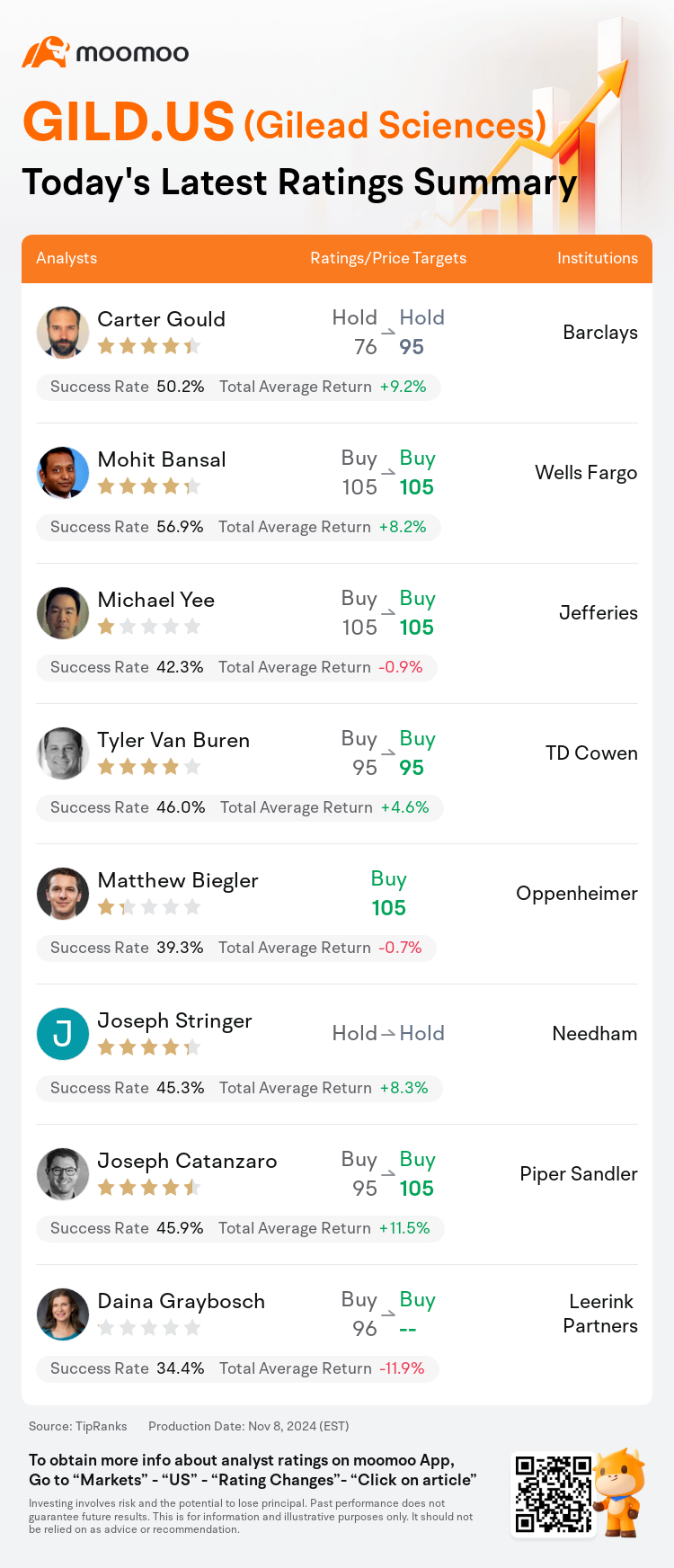

On Nov 08, major Wall Street analysts update their ratings for $Gilead Sciences (GILD.US)$, with price targets ranging from $95 to $105.

Barclays analyst Carter Gould maintains with a hold rating, and adjusts the target price from $76 to $95.

Wells Fargo analyst Mohit Bansal maintains with a buy rating, and maintains the target price at $105.

Jefferies analyst Michael Yee maintains with a buy rating, and maintains the target price at $105.

Jefferies analyst Michael Yee maintains with a buy rating, and maintains the target price at $105.

TD Cowen analyst Tyler Van Buren maintains with a buy rating, and maintains the target price at $95.

Oppenheimer analyst Matthew Biegler initiates coverage with a buy rating, and sets the target price at $105.

Furthermore, according to the comprehensive report, the opinions of $Gilead Sciences (GILD.US)$'s main analysts recently are as follows:

Gilead's recent report showed a sales surge, bolstered by robust performance across its HIV product range and surpassing expected revenues for Veklury. The strong quarter for the HIV division was marked by sustained volume expansion and a positive product mix.

The company achieved a third-quarter performance that exceeded expectations, bolstered not only by Veklury but also by Biktarvy.

The analyst expresses that a transformative period is on the horizon for Gilead, as the company is breaking away from past questionable business development decisions and returning to its foundational strength in antiviral research and development. This resurgence is highlighted by lenacapavir, which is poised to become a versatile cornerstone for HIV treatment and has the potential to broaden the applicability of PrEP beyond its traditional high-risk user base. Furthermore, the analyst points out that the PrEP market may experience substantial growth by reaching a wider audience. In the field of oncology, the company is experiencing robust growth, particularly with the drug TRODELVY, and its collaboration with a partner that may possess a leading CAR-T therapy option for multiple myeloma.

Gilead has exhibited a 'consistent steady performance' this quarter, demonstrating ongoing reliability in its HIV business. This performance is seen as a positive indicator in anticipation of the U.S. filing of lenacapavir for PrEP.

The firm acknowledged another solid quarter for Gilead and mentioned that the revised expectations are largely due to the anticipation that the Sunlenca PrEP opportunity, alongside Livdelzi in PBC, presents new commercial possibilities.

Here are the latest investment ratings and price targets for $Gilead Sciences (GILD.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

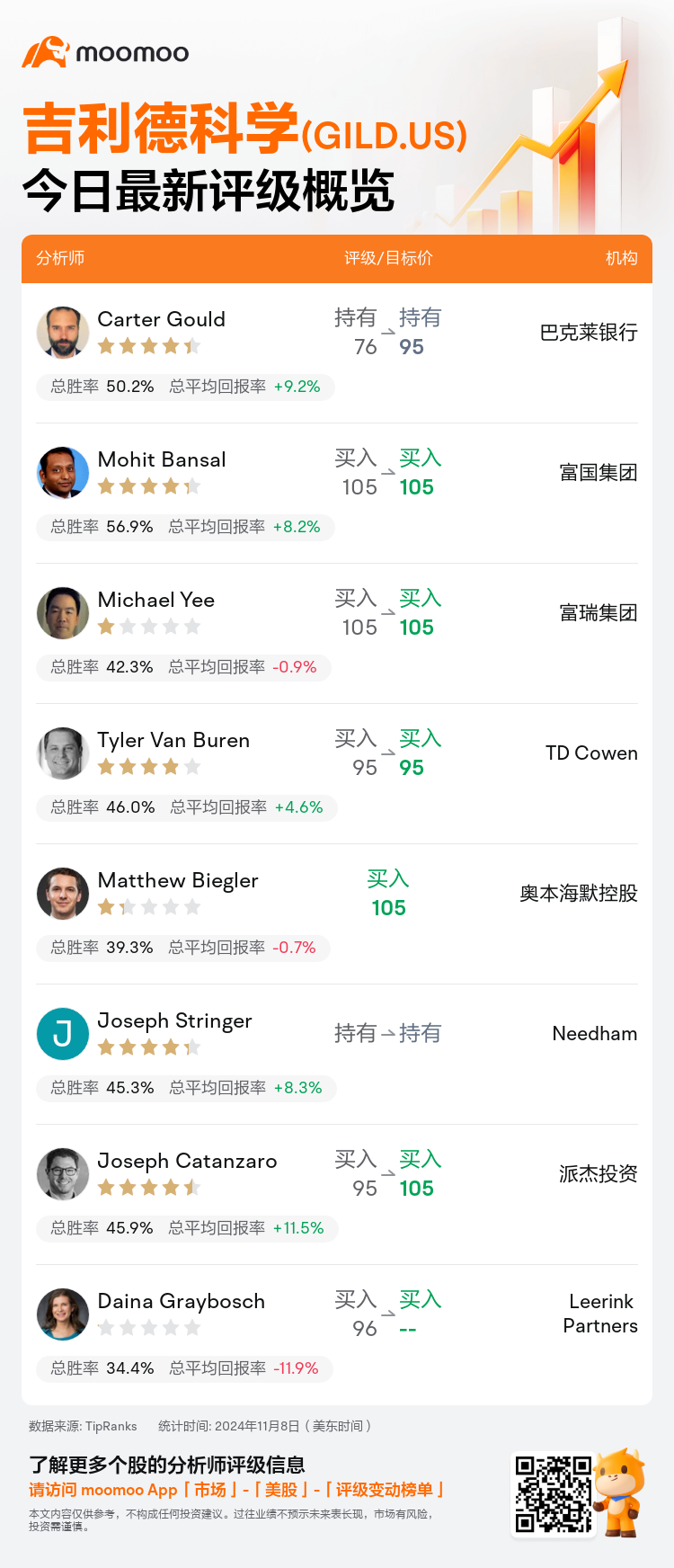

美东时间11月8日,多家华尔街大行更新了$吉利德科学 (GILD.US)$的评级,目标价介于95美元至105美元。

巴克莱银行分析师Carter Gould维持持有评级,并将目标价从76美元上调至95美元。

富国集团分析师Mohit Bansal维持买入评级,维持目标价105美元。

富瑞集团分析师Michael Yee维持买入评级,维持目标价105美元。

富瑞集团分析师Michael Yee维持买入评级,维持目标价105美元。

TD Cowen分析师Tyler Van Buren维持买入评级,维持目标价95美元。

奥本海默控股分析师Matthew Biegler首予买入评级,目标价105美元。

此外,综合报道,$吉利德科学 (GILD.US)$近期主要分析师观点如下:

吉利德最近的报告显示销售激增,得益于HIV产品区间的强劲表现,超过了Veklury的预期收入。HIV部门强劲的季度表现表现出持续增长的成交量和积极的产品组合。

该公司取得了超出预期的第三季度表现,不仅得益于Veklury,还得益于Biktarvy。

分析师表示,吉利德即将迎来变革性时期,因为公司正在摆脱过去有争议的业务发展决策,回归到其在抗病毒研发方面的基础优势。这一复苏得到了lenacapavir的突出,该药物有望成为HIV治疗的多功能基石,并有潜力将PrEP的适用性扩展到传统高风险用户群之外。此外,分析师指出PrEP市场可能通过吸引更广泛的受众而实现实质性增长。在肿瘤领域,该公司正在经历强劲增长,特别是与合作伙伴合作生产的TRODELVY,还有可能拥有对多发性骨髓瘤具有领先优势的CAR-t疗法选择。

吉利德本季度展示出“持续稳定的表现”,在其HIV业务中展现出持续的可靠性。这种表现被视为对即将在美国提交lenacapavir用于PrEP的积极指示。

公司承认吉利德又度过了一个扎实的季度,并提到修订后的预期很大程度上归因于预计Sunlenca PrEP机会,以及Livdelzi在原发性胆汁性胆管炎中,带来了新的商业机会。

以下为今日8位分析师对$吉利德科学 (GILD.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

富瑞集团分析师Michael Yee维持买入评级,维持目标价105美元。

富瑞集团分析师Michael Yee维持买入评级,维持目标价105美元。

Jefferies analyst Michael Yee maintains with a buy rating, and maintains the target price at $105.

Jefferies analyst Michael Yee maintains with a buy rating, and maintains the target price at $105.