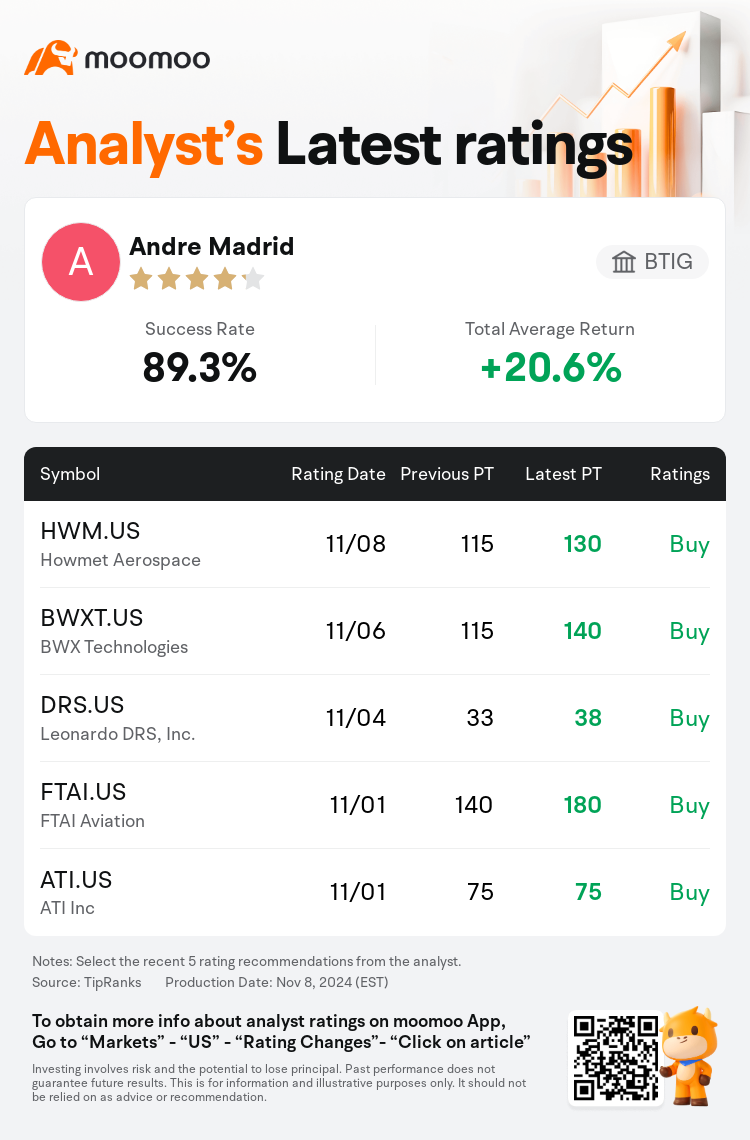

BTIG analyst Andre Madrid maintains $Howmet Aerospace (HWM.US)$ with a buy rating, and adjusts the target price from $115 to $130.

According to TipRanks data, the analyst has a success rate of 89.3% and a total average return of 20.6% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Howmet Aerospace (HWM.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Howmet Aerospace (HWM.US)$'s main analysts recently are as follows:

Howmet Aerospace's third-quarter outcomes were robust, benefiting from rising airfoil spares volumes and pricing amidst the aerospace industry's challenges with engine time on wing and subdued OEM production rates. The company is poised to outpace its end markets, leveraging market share gains and pricing prospects, alongside margin expansion and capital deployment that is beneficial to shareholders.

Howmet Aerospace's third-quarter results were characterized by outstanding incrementals, indicative of robust pricing, product mix, and execution. The company's guidance for the fourth quarter surpasses the consensus expectations.

Howmet Aerospace's Q3 earnings surpassed expectations. The company's Engine Products have been identified as the primary catalyst for growth and margin improvement. Additionally, the Aftermarket segment is contributing to growth and is expected to comprise a larger share of sales over time.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

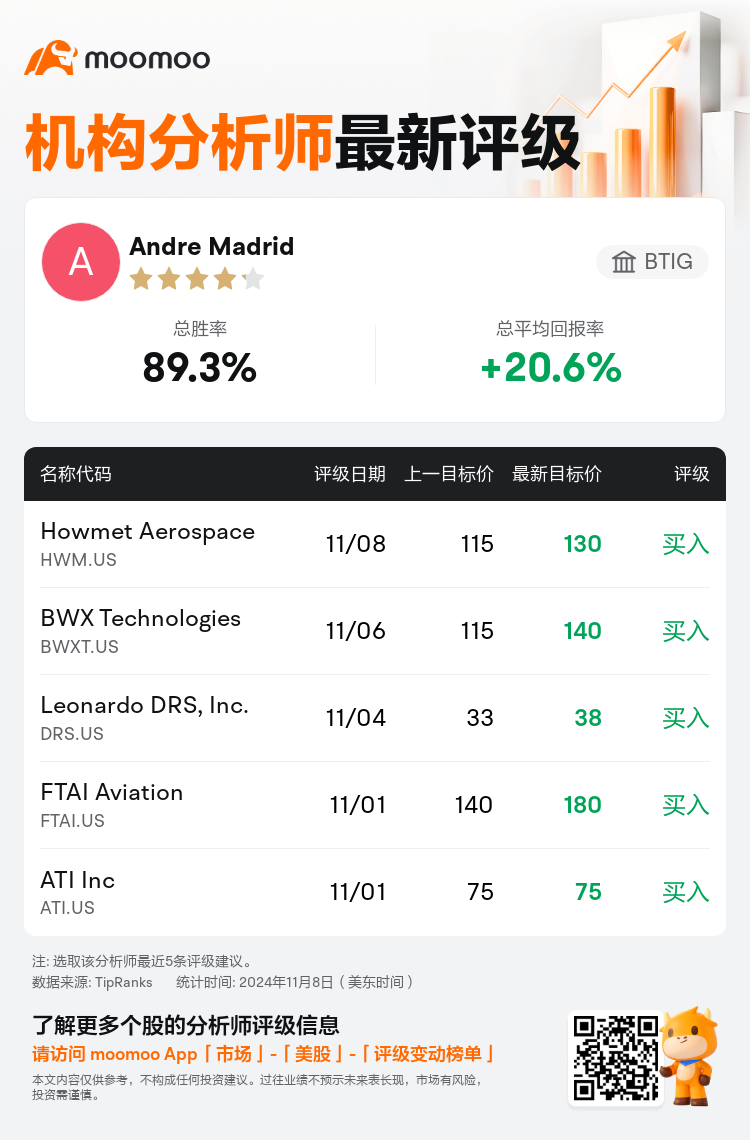

BTIG分析师Andre Madrid维持$Howmet Aerospace (HWM.US)$买入评级,并将目标价从115美元上调至130美元。

根据TipRanks数据显示,该分析师近一年总胜率为89.3%,总平均回报率为20.6%。

此外,综合报道,$Howmet Aerospace (HWM.US)$近期主要分析师观点如下:

此外,综合报道,$Howmet Aerospace (HWM.US)$近期主要分析师观点如下:

Howmet Aerospace第三季度的业绩表现强劲,这得益于在航空航天业面临发动机续航时间和OEM生产率低迷的挑战下,翼型备件数量和价格的增加。该公司有望超越其终端市场,利用市场份额的增长和定价前景,同时扩大利润率和有利于股东的资本部署。

Howmet Aerospace的第三季度业绩以出色的增量增长为特征,这表明了稳健的定价、产品组合和执行力。该公司对第四季度的预期超出了市场普遍预期。

Howmet Aerospace第三季度的收益超出了预期。该公司的发动机产品已被确定为增长和利润率提高的主要催化剂。此外,售后市场为增长做出了贡献,随着时间的推移,预计将在销售额中占更大的份额。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$Howmet Aerospace (HWM.US)$近期主要分析师观点如下:

此外,综合报道,$Howmet Aerospace (HWM.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of