What to Expect From FGI Industries's Earnings

What to Expect From FGI Industries's Earnings

FGI Industries (NASDAQ:FGI) is preparing to release its quarterly earnings on Monday, 2024-11-11. Here's a brief overview of what investors should keep in mind before the announcement.

FGI Industries(纳斯达克股票代码:FGI)准备在2024-11年星期一发布其季度财报。以下是投资者在宣布之前应记住的内容的简要概述。

Analysts expect FGI Industries to report an earnings per share (EPS) of $0.03.

分析师预计,FGI Industries公布的每股收益(EPS)为0.03美元。

Anticipation surrounds FGI Industries's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

人们对FGI Industries的宣布充满期待,投资者希望听到既超出预期,又能获得对下一季度的积极指导。

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

新投资者应该明白,尽管盈利表现很重要,但市场反应通常是由指导推动的。

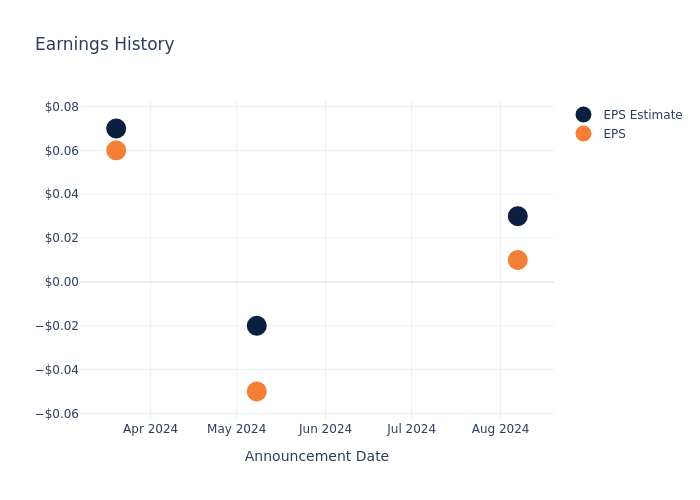

Earnings History Snapshot

收益历史快照

Last quarter the company missed EPS by $0.02, which was followed by a 3.83% increase in the share price the next day.

上个季度,该公司每股收益低于0.02美元,随后第二天股价上涨了3.83%。

Here's a look at FGI Industries's past performance and the resulting price change:

以下是FGI Industries过去的表现以及由此产生的价格变化:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.03 | -0.02 | 0.07 | 0.13 |

| EPS Actual | 0.01 | -0.05 | 0.06 | 0.05 |

| Price Change % | 4.0% | -10.0% | 8.0% | 2.0% |

| 季度 | 2024 年第二季度 | 2024 年第一季度 | 2023 年第四季度 | 2023 年第三季度 |

|---|---|---|---|---|

| 每股收益估算 | 0.03 | -0.02 | 0.07 | 0.13 |

| 实际每股收益 | 0.01 | -0.05 | 0.06 | 0.05 |

| 价格变动% | 4.0% | -10.0% | 8.0% | 2.0% |

Stock Performance

股票表现

Shares of FGI Industries were trading at $0.93 as of November 07. Over the last 52-week period, shares are down 38.67%. Given that these returns are generally negative, long-term shareholders are likely unhappy going into this earnings release.

截至11月7日,FGI Industries的股票交易价格为0.93美元。在过去的52周中,股价下跌了38.67%。鉴于这些回报率通常为负数,长期股东可能会对本次财报感到不满。

To track all earnings releases for FGI Industries visit their earnings calendar on our site.

要追踪FGI Industries发布的所有财报,请访问我们网站上的财报日历。

This article was generated by Benzinga's automated content engine and reviewed by an editor.

本文由Benzinga的自动化内容引擎生成,并由编辑审阅。

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.