Check Out What Whales Are Doing With Sweetgreen

Check Out What Whales Are Doing With Sweetgreen

Financial giants have made a conspicuous bearish move on Sweetgreen. Our analysis of options history for Sweetgreen (NYSE:SG) revealed 11 unusual trades.

金融巨头在Sweetgreen上采取了明显的看淡举动。我们对Sweetgreen(纽交所:SG)的期权历史进行分析,发现了11笔飞凡交易。

Delving into the details, we found 27% of traders were bullish, while 54% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $198,935, and 7 were calls, valued at $782,021.

深入细节,我们发现27%的交易者看好,而54%显示出看淡倾向。在我们发现的所有交易中,有4笔看跌期权,价值198,935美元,7笔看涨期权,价值782,021美元。

What's The Price Target?

目标价是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $34.0 and $44.0 for Sweetgreen, spanning the last three months.

在评估交易量和未平仓合约后,明显看出主要市场参与者正在关注Sweetgreen在34.0美元至44.0美元之间的价格区间,跨越最近三个月。

Insights into Volume & Open Interest

成交量和持仓量分析

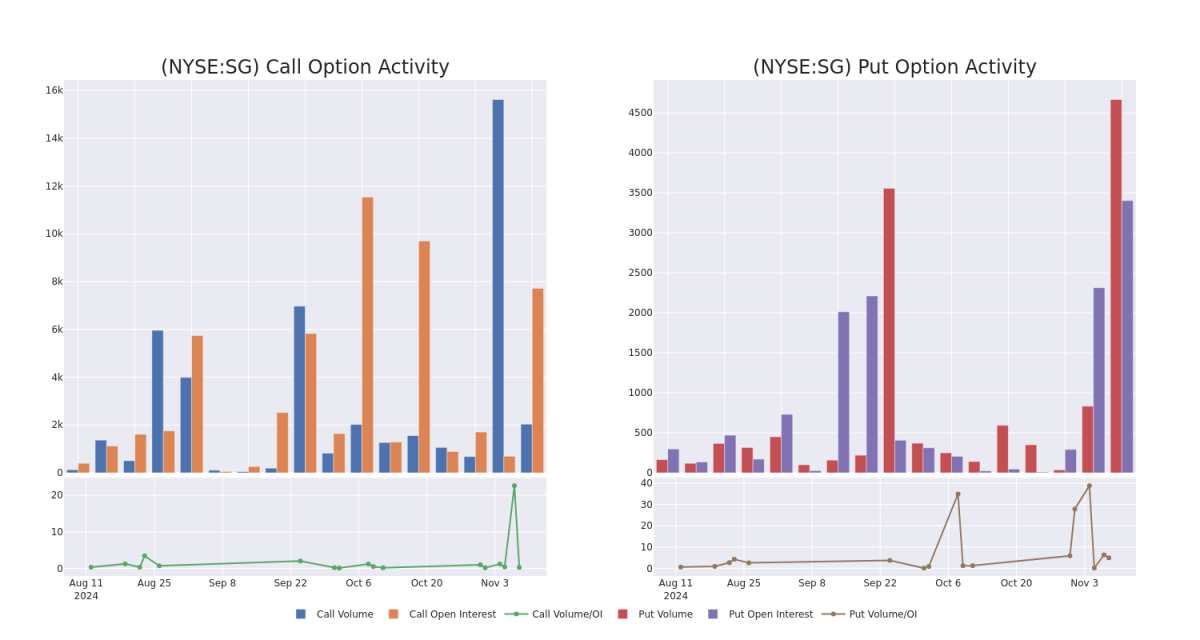

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Sweetgreen's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Sweetgreen's significant trades, within a strike price range of $34.0 to $44.0, over the past month.

检验成交量和未平仓合约可为股票研究提供重要见解。这些信息对于评估Sweetgreen特定行权价格期权的流动性和利息水平至关重要。在下文中,我们展示了过去一个月内在34.0美元至44.0美元行权价格范围内,对Sweetgreen的重要交易的看涨和看跌期权成交量和未平仓合约的趋势快照。

Sweetgreen 30-Day Option Volume & Interest Snapshot

Sweetgreen 30天期权成交量和利息快照

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SG | CALL | TRADE | BEARISH | 01/16/26 | $11.2 | $10.9 | $10.9 | $42.00 | $327.0K | 171 | 300 |

| SG | CALL | SWEEP | BEARISH | 07/18/25 | $9.1 | $8.3 | $8.3 | $40.00 | $174.3K | 278 | 30 |

| SG | CALL | SWEEP | BULLISH | 04/17/25 | $5.6 | $4.9 | $5.6 | $43.00 | $117.6K | 228 | 210 |

| SG | PUT | SWEEP | NEUTRAL | 11/15/24 | $0.8 | $0.75 | $0.75 | $40.00 | $92.9K | 3.2K | 3.1K |

| SG | CALL | TRADE | BEARISH | 04/17/25 | $10.2 | $10.0 | $10.0 | $34.00 | $60.0K | 162 | 60 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 新加坡 | 看涨 | 交易 | 看淡 | 01/16/26 | $11.2 | $10.9 | $10.9 | $42.00 | $327.0K | 171 | 300 |

| SG | CALL | SWEEP | BEARISH | 07/18/25 | $9.1 | $8.3 | $8.3 | $40.00 | $174.3K | 278 | 30 |

| SG | 看涨 | SWEEP | 看好 | 04/17/25 | $5.6 | $4.9 | $5.6 | $43.00 | $117.6K | 228 | 210 |

| 新加坡 | 看跌 | SWEEP | 中立 | 11/15/24 | $0.8 | $0.75 | $0.75 | $40.00 | $92.9K | 3.2K | 3.1K |

| 新加坡 | 看涨 | 交易 | 看淡 | 04/17/25 | $10.2 | $10.0 | $10.0 | $34.00 | $60.0K | 162 | 60 |

About Sweetgreen

关于Sweetgreen

Sweetgreen Inc is a next-generation restaurant and lifestyle brand that serves healthy food at scale. It is creating plant-forward, seasonal, and earth-friendly meals from fresh ingredients and produce that prioritizes organic, regenerative, and local sourcing.

Sweetgreen Inc是一家新一代的餐厅和生活方式品牌,以规模化为重点提供健康食品。它从新鲜食材和农产品中创造植物为主导、季节性和友好地球的餐点,并优先选择有机、再生和当地采购。

Present Market Standing of Sweetgreen

Sweetgreen目前的市场地位

- Trading volume stands at 4,706,541, with SG's price down by -5.12%, positioned at $40.04.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 111 days.

- 成交量为4,706,541,SG的价格下跌了-5.12%,位于40.04美元。

- RSI指标显示该股票可能接近超买。

- 预计111天内公布收益公告。

Professional Analyst Ratings for Sweetgreen

Sweetgreen的专业分析师评级

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $43.75.

过去30天中,共有4位专业分析师对该股票发表了看法,设定了43.75美元的平均目标价格。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Consistent in their evaluation, an analyst from UBS keeps a Buy rating on Sweetgreen with a target price of $45. * An analyst from TD Cowen has decided to maintain their Buy rating on Sweetgreen, which currently sits at a price target of $45. * An analyst from Oppenheimer persists with their Outperform rating on Sweetgreen, maintaining a target price of $45. * In a cautious move, an analyst from Goldman Sachs downgraded its rating to Neutral, setting a price target of $40.

Benzinga Edge的飞凡期权板块在市场变动发生之前发现潜在的市场推动因素。看看大户在您最喜爱的股票上采取何种仓位。单击此处获取更多信息。* UBS的一名分析师坚持给予甜绿公司买入评级,目标价为45美元。* TD Cowen的一名分析师决定维持他们对甜绿公司的买入评级,目前的目标价为45美元。* Oppenheimer的一名分析师坚持给予甜绿公司超越预期的评级,目标价为45美元。* 作为谨慎之举,高盛的一位分析师将评级下调为中立,目标价为40美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Sweetgreen options trades with real-time alerts from Benzinga Pro.

期权交易带来更高的风险和潜在回报。精明的交易员通过不断学习,调整策略,监控多种因子,并密切关注市场动向来管理这些风险。通过Benzinga Pro实时警报,及时了解最新的Sweetgreen期权交易。

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Sweetgreen's options at certain strike prices. Below, we present a snapshot of the

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Sweetgreen's options at certain strike prices. Below, we present a snapshot of the