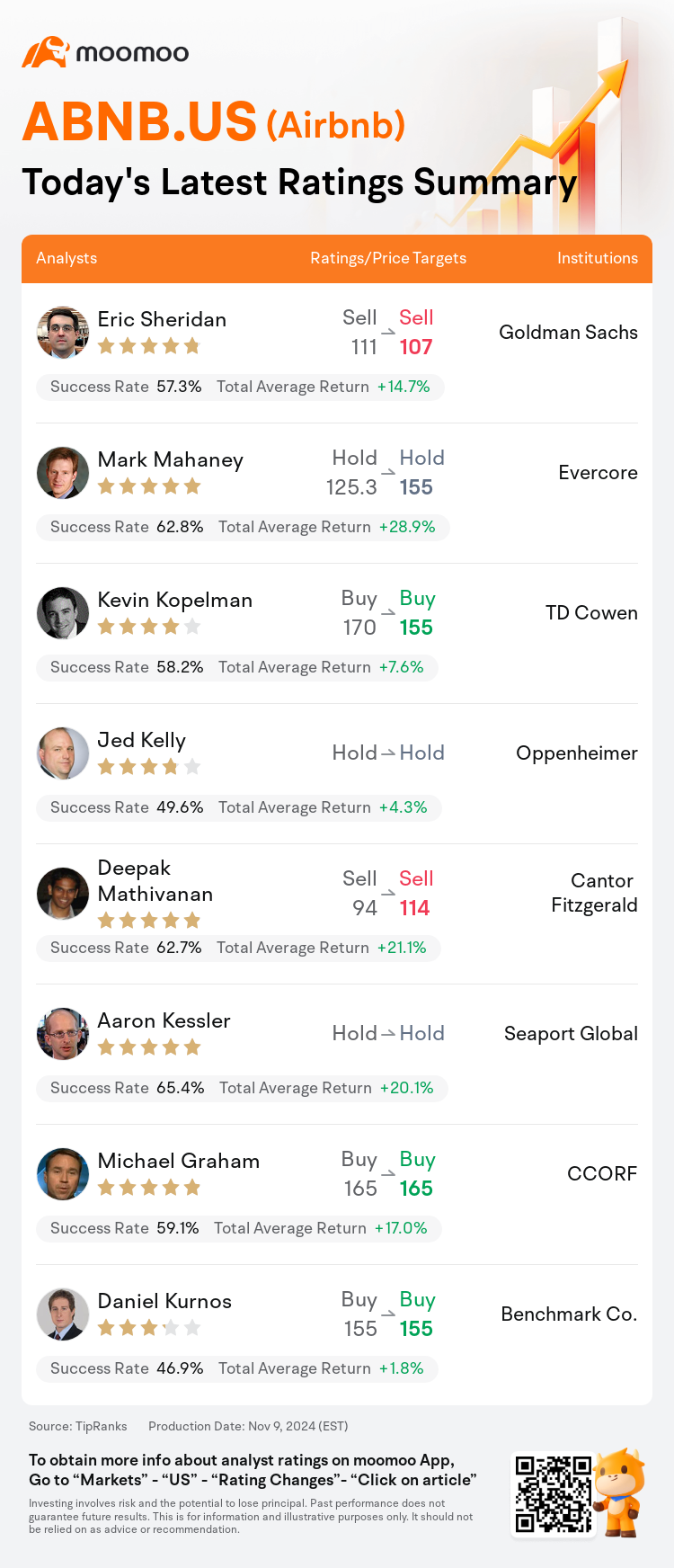

On Nov 09, major Wall Street analysts update their ratings for $Airbnb (ABNB.US)$, with price targets ranging from $107 to $165.

Goldman Sachs analyst Eric Sheridan maintains with a sell rating, and adjusts the target price from $111 to $107.

Evercore analyst Mark Mahaney maintains with a hold rating, and adjusts the target price from $125.3 to $155.

TD Cowen analyst Kevin Kopelman maintains with a buy rating, and adjusts the target price from $170 to $155.

TD Cowen analyst Kevin Kopelman maintains with a buy rating, and adjusts the target price from $170 to $155.

Oppenheimer analyst Jed Kelly maintains with a hold rating.

Cantor Fitzgerald analyst Deepak Mathivanan maintains with a sell rating, and adjusts the target price from $94 to $114.

Furthermore, according to the comprehensive report, the opinions of $Airbnb (ABNB.US)$'s main analysts recently are as follows:

Airbnb's third-quarter results were characterized as 'relatively strong' due to solid performances spanning all regions. However, despite increasing investments, the persistent 'tepid' growth in the company's B2C business casts a shadow over its earnings growth prospects for 2025.

Airbnb's Q3 Gross Bookings surpassed expectations, reaching $20.1B due to an increase in nights booked and higher Average Daily Rates (ADRs). The company anticipates that the growth in booked nights will speed up in Q4, continuing from the 8% increase seen in Q3, although it projects a year-over-year decline in margins as investment spending escalates. The general preference within the gig economy space leans towards stocks with faster growth compared to Online Travel Agencies (OTAs).

Airbnb's Q3 outcomes aligned closely with investor anticipations. Despite earlier concerns over shorter booking durations and a deceleration in demand from U.S. customers in Q2, the company witnessed a widespread uptick in demand and a return to more typical booking timelines, contributing to growth that carried into Q4.

The performance of Airbnb presents arguments for both optimistic and pessimistic investors, as reflected by the company's third-quarter nights surpassing consensus and aligning with buy-side forecasts, followed by projections of stronger momentum in the fourth quarter. It is anticipated that there will be a contraction in EBITDA margin extending into 2025.

The company's third-quarter performance presented a blend of slight improvements in near-term fundamentals, which were, however, eclipsed by less optimistic guidance for fourth-quarter margins and indications of an impending investment phase anticipated in FY25 due to its novel and growing business segments.

Here are the latest investment ratings and price targets for $Airbnb (ABNB.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月9日,多家华尔街大行更新了$爱彼迎 (ABNB.US)$的评级,目标价介于107美元至165美元。

高盛集团分析师Eric Sheridan维持卖出评级,并将目标价从111美元下调至107美元。

Evercore分析师Mark Mahaney维持持有评级,并将目标价从125.3美元上调至155美元。

TD Cowen分析师Kevin Kopelman维持买入评级,并将目标价从170美元下调至155美元。

TD Cowen分析师Kevin Kopelman维持买入评级,并将目标价从170美元下调至155美元。

奥本海默控股分析师Jed Kelly维持持有评级。

坎托·菲茨杰拉德分析师Deepak Mathivanan维持卖出评级,并将目标价从94美元上调至114美元。

此外,综合报道,$爱彼迎 (ABNB.US)$近期主要分析师观点如下:

爱彼迎第三季度业绩被描述为"相对强劲",由于所有板块表现稳健。然而,尽管不断增加投资,公司B2C业务的持续"温和"增长投下阴影,对其2025年盈利增长前景构成挑战。

爱彼迎第三季度总订单额超出预期,达到201亿美元,这归因于预订夜晚增加和更高的平均每日价格(ADR)。公司预计,在第四季度,预订的夜晚增长将加速,在第三季度8%的增长基础上延续,尽管它预计营收将同比下滑,因为投资支出加剧。零工经济领域的一般偏好倾向于股票,这些股票增长速度比在线旅行社(OTAs)快。

爱彼迎第三季度业绩与投资者预期高度一致。尽管过去担忧第二季度预订时间缩短和美国顾客需求减缓,但公司目睹需求普遍回升,并恢复更典型的预订时间表,为增长开拓道路,这一增长延续至第四季度。

爱彼迎的表现同时为乐观和悲观投资者提供了论据,正如公司第三季度预订夜晚超出共识,并与买方预测一致,随后预测第四季度动能将更强劲。预计EBITDA利润率将在2025年继续收缩。

公司第三季度业绩呈现近期基本面略有改善,然而,第四季度利润指引较少乐观,并有迹象表明,由于新颖且增长迅猛的业务板块,FY25将迎来即将到来的投资阶段。

以下为今日8位分析师对$爱彼迎 (ABNB.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

TD Cowen分析师Kevin Kopelman维持买入评级,并将目标价从170美元下调至155美元。

TD Cowen分析师Kevin Kopelman维持买入评级,并将目标价从170美元下调至155美元。

TD Cowen analyst Kevin Kopelman maintains with a buy rating, and adjusts the target price from $170 to $155.

TD Cowen analyst Kevin Kopelman maintains with a buy rating, and adjusts the target price from $170 to $155.