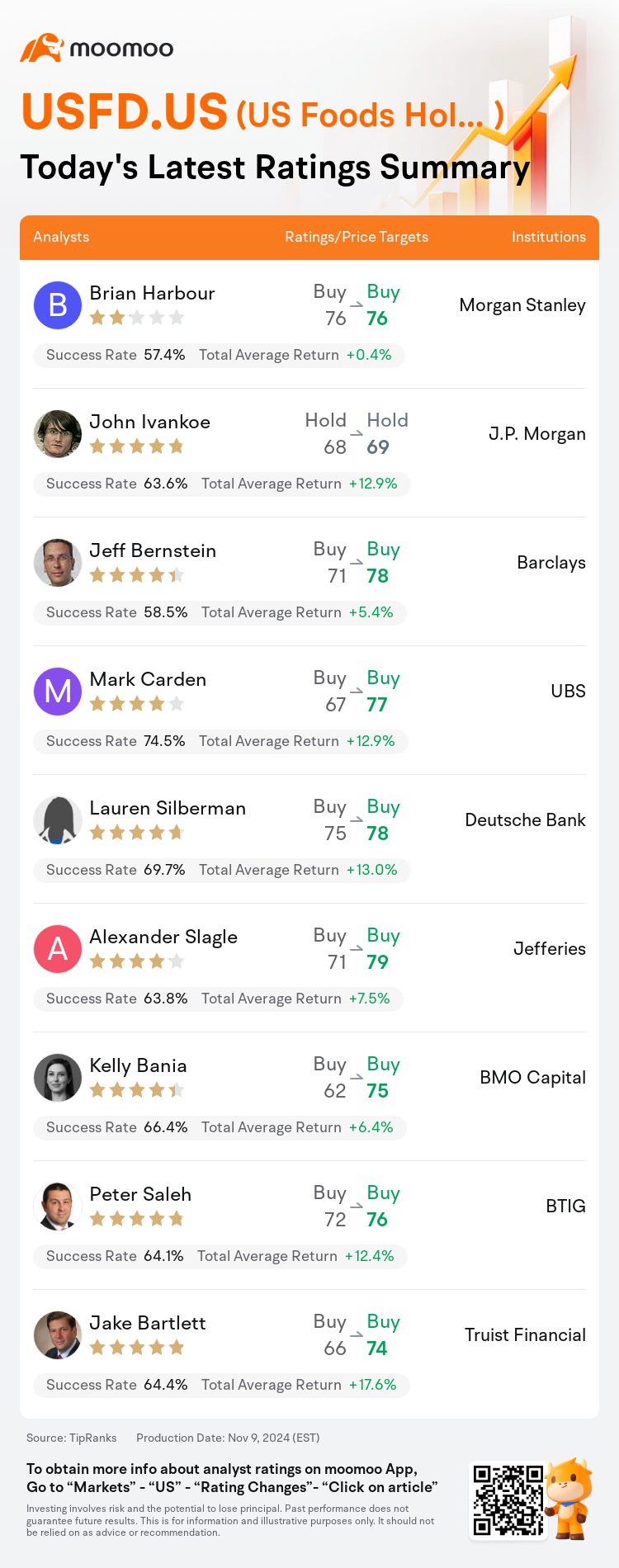

On Nov 09, major Wall Street analysts update their ratings for $US Foods Holding (USFD.US)$, with price targets ranging from $69 to $79.

Morgan Stanley analyst Brian Harbour maintains with a buy rating, and maintains the target price at $76.

J.P. Morgan analyst John Ivankoe maintains with a hold rating, and adjusts the target price from $68 to $69.

Barclays analyst Jeff Bernstein maintains with a buy rating, and adjusts the target price from $71 to $78.

Barclays analyst Jeff Bernstein maintains with a buy rating, and adjusts the target price from $71 to $78.

UBS analyst Mark Carden maintains with a buy rating, and adjusts the target price from $67 to $77.

Deutsche Bank analyst Lauren Silberman maintains with a buy rating, and adjusts the target price from $75 to $78.

Furthermore, according to the comprehensive report, the opinions of $US Foods Holding (USFD.US)$'s main analysts recently are as follows:

The firm acknowledges US Foods' strong performance despite challenging conditions, noting its resilience especially in light of the company's significant exposure to the hurricane-affected Southeast region in Q3.

The company has reported a robust quarter with double-digit EBITDA growth and a 20% increase in EPS, notwithstanding some modest headwinds, and this stands out even when compared to the mixed results of its peers. Observations indicate that with Q4 trends picking up pace and the company's initiatives being executed exceptionally well, it is anticipated that investor confidence in the multi-year growth strategy will continue to strengthen.

US Foods experienced a disruption in case volumes towards the end of Q3 and the beginning of Q4 due to hurricanes in the southeast. Nevertheless, there has been a noticeable recovery in recent weeks. Despite the disruptions, the company's earnings surpassed expectations, which was seen as a positive indicator by analysts.

Here are the latest investment ratings and price targets for $US Foods Holding (USFD.US)$ from 9 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月9日,多家华尔街大行更新了$美国食品控股 (USFD.US)$的评级,目标价介于69美元至79美元。

摩根士丹利分析师Brian Harbour维持买入评级,维持目标价76美元。

摩根大通分析师John Ivankoe维持持有评级,并将目标价从68美元上调至69美元。

巴克莱银行分析师Jeff Bernstein维持买入评级,并将目标价从71美元上调至78美元。

巴克莱银行分析师Jeff Bernstein维持买入评级,并将目标价从71美元上调至78美元。

瑞士银行分析师Mark Carden维持买入评级,并将目标价从67美元上调至77美元。

德意志银行分析师Lauren Silberman维持买入评级,并将目标价从75美元上调至78美元。

此外,综合报道,$美国食品控股 (USFD.US)$近期主要分析师观点如下:

尽管环境具有挑战性,但公司承认US Foods在Q3季度尤其在饱受飓风影响的东南部地域板块表现强劲,并注意到其抗压性。

公司报告显示,盈利提升了两位数的EBITDA增长,每股收益增长了20%,尽管存在一些轻微的阻力,与同行的业绩表现相比,这样的表现尤为突出。观察表明,随着Q4趋势加速并且公司的举措执行得异常出色,预计投资者对多年增长策略的信心将继续增强。

US Foods在Q3季末和Q4初期由于东南部飓风而经历了案例量的中断。然而,最近几周出现了明显的恢复。尽管出现了中断,公司的收益超出了预期,被分析师视为一个积极迹象。

以下为今日9位分析师对$美国食品控股 (USFD.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

巴克莱银行分析师Jeff Bernstein维持买入评级,并将目标价从71美元上调至78美元。

巴克莱银行分析师Jeff Bernstein维持买入评级,并将目标价从71美元上调至78美元。

Barclays analyst Jeff Bernstein maintains with a buy rating, and adjusts the target price from $71 to $78.

Barclays analyst Jeff Bernstein maintains with a buy rating, and adjusts the target price from $71 to $78.