On Nov 09, major Wall Street analysts update their ratings for $Dynatrace (DT.US)$, with price targets ranging from $55 to $65.

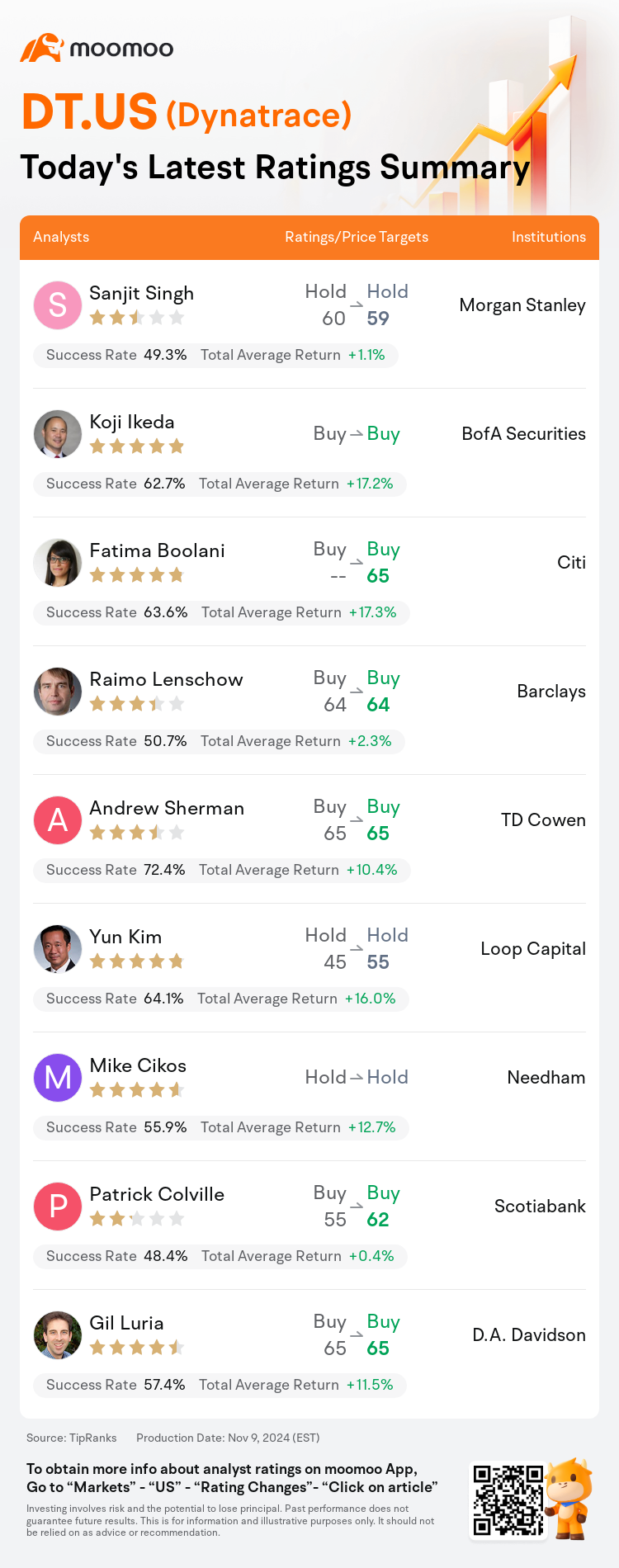

Morgan Stanley analyst Sanjit Singh maintains with a hold rating, and adjusts the target price from $60 to $59.

BofA Securities analyst Koji Ikeda maintains with a buy rating.

Citi analyst Fatima Boolani maintains with a buy rating, and sets the target price at $65.

Citi analyst Fatima Boolani maintains with a buy rating, and sets the target price at $65.

Barclays analyst Raimo Lenschow maintains with a buy rating, and maintains the target price at $64.

TD Cowen analyst Andrew Sherman maintains with a buy rating, and maintains the target price at $65.

Furthermore, according to the comprehensive report, the opinions of $Dynatrace (DT.US)$'s main analysts recently are as follows:

Dynatrace recorded a 'solid' fiscal second quarter, yet opted to maintain its outlook for FY25, citing a continuing sales transition. This stance is perceived as potentially too cautious, which leads to a more optimistic view.

After Dynatrace reported better-than-expected Q2 earnings, the total annual recurring revenue growth has shown signs of stability, maintaining around 19%-20% year-over-year for the past several quarters. This trend is gradually building investor confidence despite the heightened execution risks associated with changes in the company's sales structure and longer sales cycles due to larger deal sizes. Additionally, the company experienced some early renewals in the quarter, which may be influenced by its 6-month sales compensation cycle that incentivizes first-half sales activity.

Dynatrace delivered robust second-quarter results, surpassing expectations on both revenue and earnings, with the annual recurring revenue outperforming analyst projections by $30M, driven by both favorable currency exchange conditions and robust expansion bookings. Business trends are perceived to continue positively with increasing momentum towards 2025, bolstered by an expanding Dynatrace Platform Subscription contracting mix, strong log management performance, and evolving sales changes attributable to a growing customer preference for comprehensive, all-in-one observability platforms.

Here are the latest investment ratings and price targets for $Dynatrace (DT.US)$ from 9 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月9日,多家华尔街大行更新了$Dynatrace (DT.US)$的评级,目标价介于55美元至65美元。

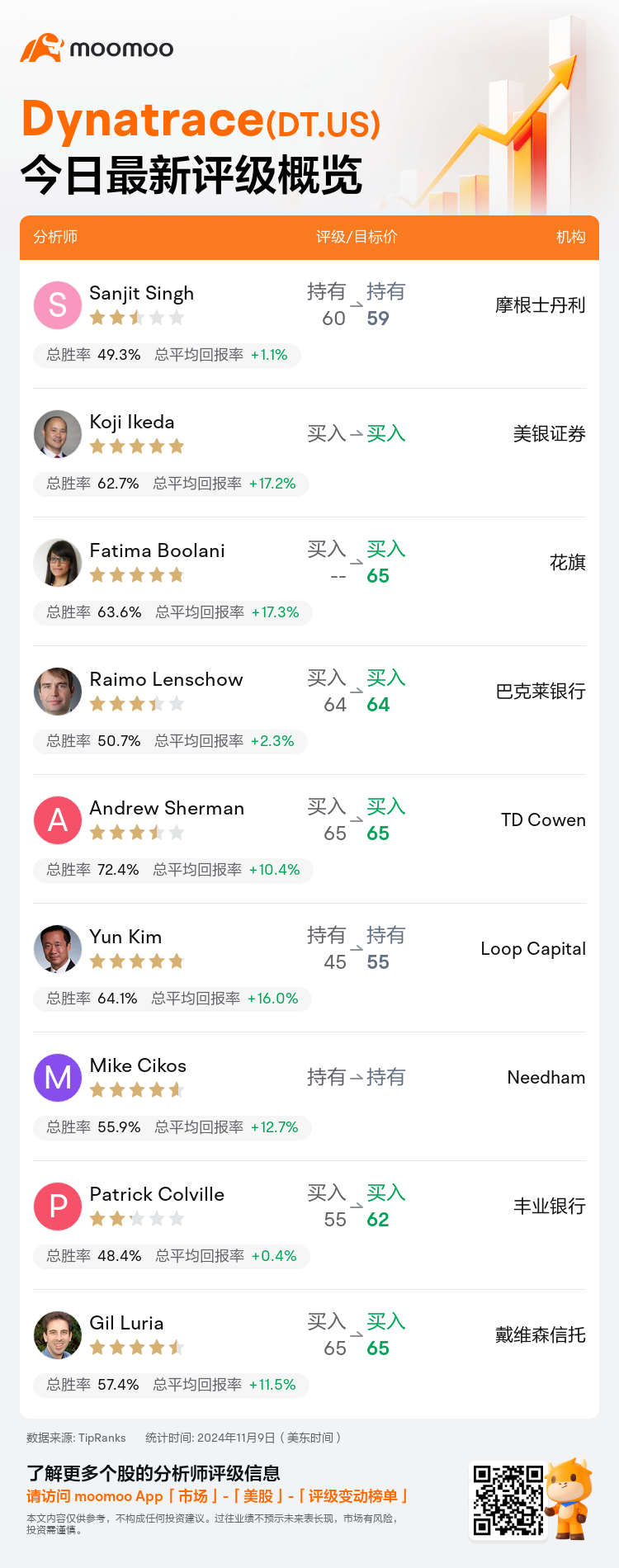

摩根士丹利分析师Sanjit Singh维持持有评级,并将目标价从60美元下调至59美元。

美银证券分析师Koji Ikeda维持买入评级。

花旗分析师Fatima Boolani维持买入评级,目标价65美元。

花旗分析师Fatima Boolani维持买入评级,目标价65美元。

巴克莱银行分析师Raimo Lenschow维持买入评级,维持目标价64美元。

TD Cowen分析师Andrew Sherman维持买入评级,维持目标价65美元。

此外,综合报道,$Dynatrace (DT.US)$近期主要分析师观点如下:

Dynatrace在财务第二季度实现了“实力雄厚”的业绩,但选择维持其对FY25的前景展望,称这是出于持续的销售转型考虑。这种立场被认为可能过于谨慎,这导致了更加乐观的看法。

在Dynatrace报告超过预期的Q2收益后,全年循环营收增长呈现稳定迹象,过去几个季度年增长率维持在19%-20%左右。尽管公司销售结构变化和较大交易规模导致的销售周期加长会带来执行风险的提高,但这一趋势逐渐增强了投资者的信心。此外,公司在本季度提前续约的情况,可能受其为期6个月的销售奖励周期影响,这鼓励了上半年的销售活动。

Dynatrace交出了强劲的第二季度业绩,收入和盈利均超过预期,年度循环营收超出了分析师的预期3000万,得益于有利的货币兑换条件和强劲的扩张预订。业务趋势被视为将继续走强,向2025年增长势头增强,这得益于扩大的Dynatrace平台订阅合同组合,良好的日志管理表现,以及增长客户对全面、一体化可观察性平台的偏好导致的销售变化。

以下为今日9位分析师对$Dynatrace (DT.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

花旗分析师Fatima Boolani维持买入评级,目标价65美元。

花旗分析师Fatima Boolani维持买入评级,目标价65美元。

Citi analyst Fatima Boolani maintains with a buy rating, and sets the target price at $65.

Citi analyst Fatima Boolani maintains with a buy rating, and sets the target price at $65.