Top 4 Real Estate Stocks That May Rocket Higher In November

Top 4 Real Estate Stocks That May Rocket Higher In November

11月可能会大幅上涨的前四家房地产股票

The most oversold stocks in the real estate sector presents an opportunity to buy into undervalued companies.

房地产板块中最超卖的股票为买入低估公司提供良机。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI指标是一种动量指标,它比较了股票在价格上涨时的强度与在价格下跌时的强度。与股票的价格走势进行比较,可以给交易者更好的了解股票短期内表现的良好程度。当RSI低于30时,资产通常被认为是超卖的,根据Benzinga Pro的数据。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是本行业板块最近的主要超卖股票列表,RSI接近或低于30。

Lineage Inc (NASDAQ:LINE)

Lineage公司(纳斯达克: LINE)

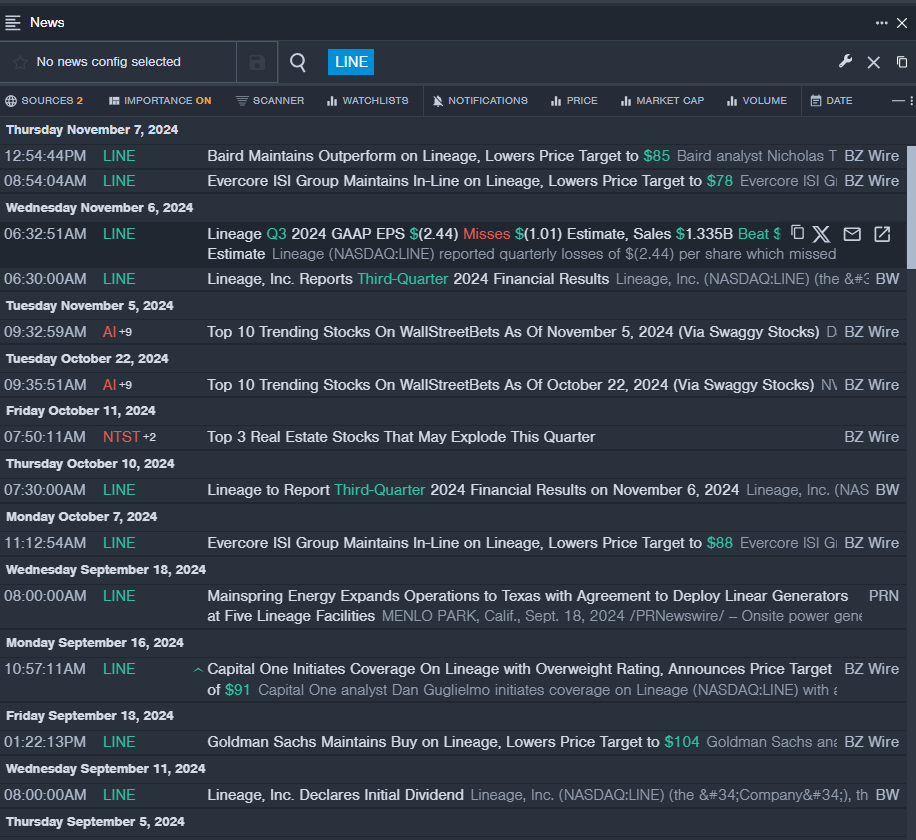

- On Nov. 6, Lineage reported a quarterly loss of $2.44 per share which missed the analyst consensus estimate of a loss of $1.01 per share. The company reported quarterly sales of $1.335 billion which beat the analyst consensus estimate of $1.329 billion by 0.44 percent. The company's stock fell around 11% over the past month and has a 52-week low of $66.94.

- RSI Value: 22.05

- LINE Price Action: Shares of Lineage fell 1.1% to close at $67.32 on Friday.

- Benzinga Pro's real-time newsfeed alerted to latest LINE news.

- 11月6日,Lineage报告每股亏损2.44美元,超过分析师共识预期的1.01美元亏损。公司每季度销售额为13.35亿美元,比分析师共识预期的13.29亿美元高出0.44%。该公司股价在过去一个月下跌约11%,52周最低价为66.94美元。

- RSI数值: 22.05

- LINE股价走势: Lineage股票周五下跌1.1%,收于67.32美元。

- Benzinga Pro的实时新闻提醒了最新LINE新闻。

Americold Realty Trust Inc (NYSE:COLD)

美寒地产信托公司(纽约交易所:COLD)

- On Nov, 7, Americold Realty Trust reported worse-than-expected third-quarter financial results. George Chappelle, Chief Executive Officer of Americold Realty Trust, stated, "We are pleased with our third quarter results where we delivered AFFO per share of $0.35, an increase of 11% versus prior year's quarter. This performance was again driven by organic growth as we produced double digit year-over-year growth in the Global Warehouse Same Store NOI of approximately 11% on a constant currency basis." The company's stock fell around 15% over the past month and has a 52-week low of $21.87.

- RSI Value: 18.80

- COLD Price Action: Shares of Americold Realty Trust fell 1.8% to close at $22.76 on Friday.

- Benzinga Pro's charting tool helped identify the trend in COLD stock.

- 11月7日,美寒地产信托公司报告了逊于预期的第三季度财务业绩。美寒地产信托公司首席执行官乔治·沙佩尔表示:“我们对第三季度的业绩感到满意,我们的每股经调节资金流量为0.35美元,比去年同期增长了11%。这一业绩再次得益于有机增长,我们在全球仓储相同店铺经营净营收方面获得了约11%的年度增长率,按恒定汇率计算。”该公司的股价在过去一个月左右下跌了约15%,52周最低价为21.87美元。

- RSI值:18.80

- COLD价格走势:美寒地产信托公司股票周五下跌1.8%,收于22.76美元。

- Benzinga Pro的图表工具帮助识别了COLD股票的趋势。

Diversified Healthcare Trust (NASDAQ:DHC)

多样化医疗保健信托基金(NASDAQ:DHC)

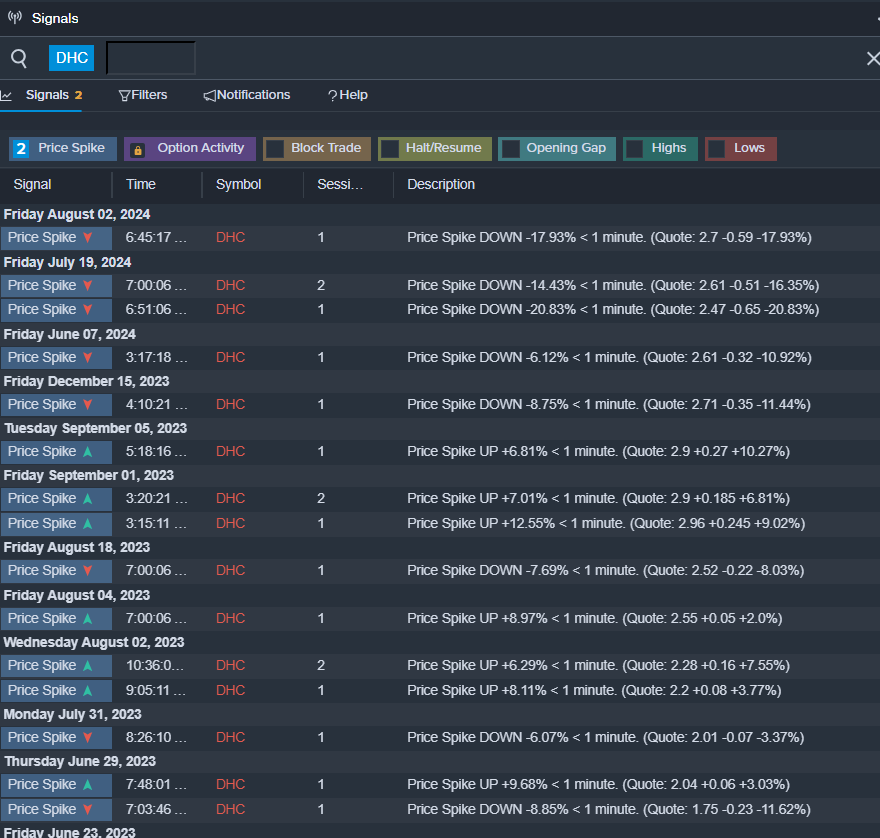

- On Nov. 4, Diversified Healthcare Trust shares are trading lower after the company reported worse-than-expected third-quarter financial results. The company's stock fell around 25% over the past five days and has a 52-week low of $1.94.

- RSI Value: 25.68

- DHC Price Action: Shares of Diversified Healthcare Trust fell 1.9% to close at $2.63 on Friday.

- Benzinga Pro's signals feature notified of a potential breakout in DHC shares.

- 11月4日,diversified healthcare trust股票下跌,因为该公司财报低于预期。过去五天,该公司的股价下跌了约25%,52周最低价为1.94美元。

- RSI数值:25.68

- DHC价格走势:Diversified Healthcare Trust股价下跌1.9%,周五收盘价为2.63美元。

- 贝宁港Pro的信号功能提醒DHC股票存在潜在突破。

Innovative Industrial Properties Inc (NYSE:IIPR)

创新工业房地产(纽约证券交易所:IIPR)

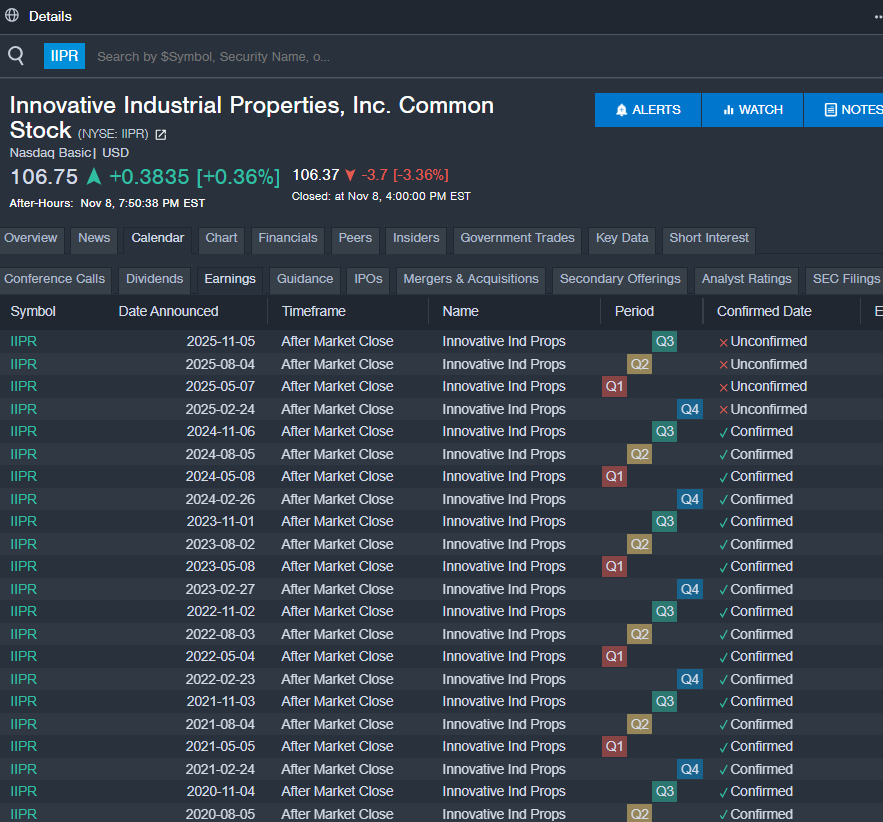

- On Nov. 6, Innovative Industrial Properties reported worse-than-expected third-quarter financial results. The company's shares lost around 16% over the past five days. The company's 52-week low is $73.04.

- RSI Value: 20.87

- IIPR Price Action: Shares of IIPR fell 3.4% to close at $106.37 on Friday.

- Benzinga Pro's earnings calendar was used to track upcoming IIPR earnings reports.

- 11月6日,创新工业房地产公布了财务报告,低于预期。过去五天,该公司股票下跌了约16%,52周最低价为73.04美元。

- RSI数值:20.87

- IIPR股价走势:周五收盘时,IIPR股价下跌3.4%,至106.37美元。

- Benzinga Pro的财报日历被用于跟踪即将发布的IIPR财报。

Read More:

阅读更多:

- Dow, S&P 500 Notch Best Week Of Year As Tesla Surges Post Trump Win: Investor Sentiment Improves, Fear & Greed Index Remains In 'Neutral' Zone

- 道指、标普500创下本年度最佳一周,特斯拉飙升,特朗普赢得后股市投资者情绪改善,恐惧与贪婪指数仍处于'中立'区域