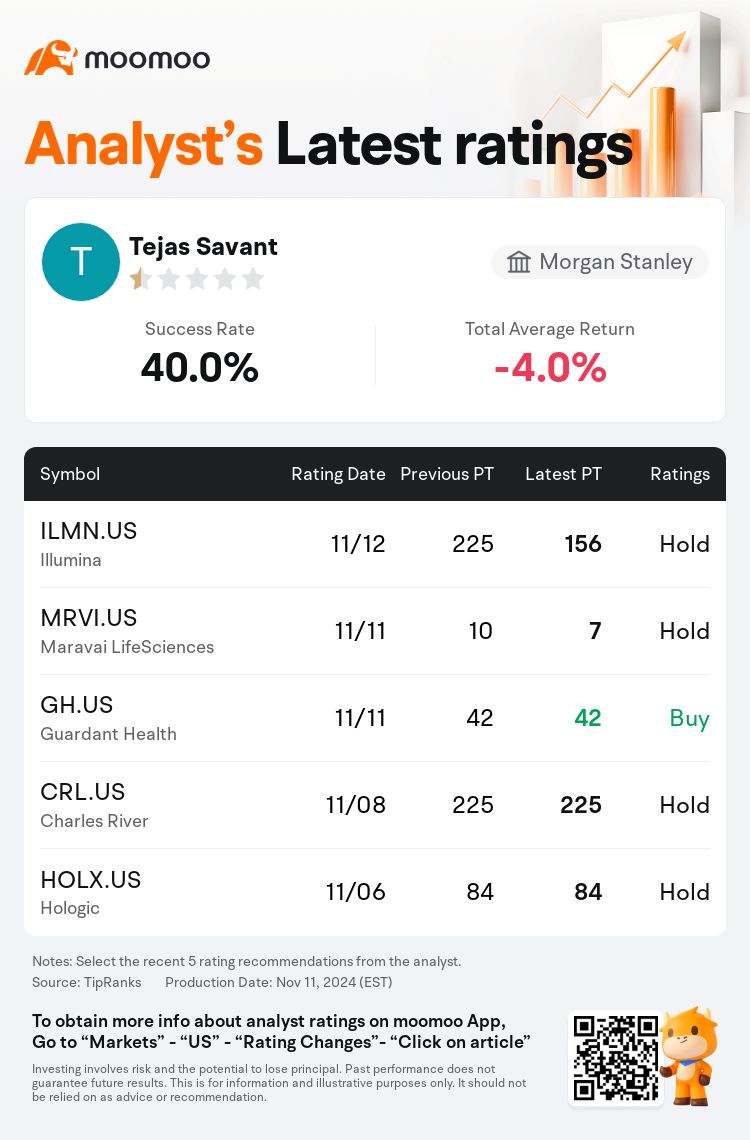

Morgan Stanley analyst Tejas Savant maintains $Maravai LifeSciences (MRVI.US)$ with a hold rating, and adjusts the target price from $10 to $7.

According to TipRanks data, the analyst has a success rate of 40.0% and a total average return of -4.0% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Maravai LifeSciences (MRVI.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Maravai LifeSciences (MRVI.US)$'s main analysts recently are as follows:

Maravai Lifesciences' outlook indicates a lower forecast for Q4 due to delays, general economic weakness in Nucleic Acid Production (NAP) and early-stage exposure in Biologics Safety Testing (BST). The current outlook reveals persistent unclear prospects and margin pressure due to a fixed cost structure, without signs of imminent improvement.

After a sequence of three quarters where Maravai Lifesciences consistently surpassed guidance, the company experienced a setback attributed to the broader weakness in biotech sector spending and the unpredictable nature of customer orders that is typical for their industry.

Maravai Lifesciences reported third-quarter results that did not meet expectations, with performance falling short in both business segments compared to projections. The company observed a decline in research and discovery demand within its NAP segment, an absence of significant one-time orders, and some delays in GMP program timelines extending into 2025.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

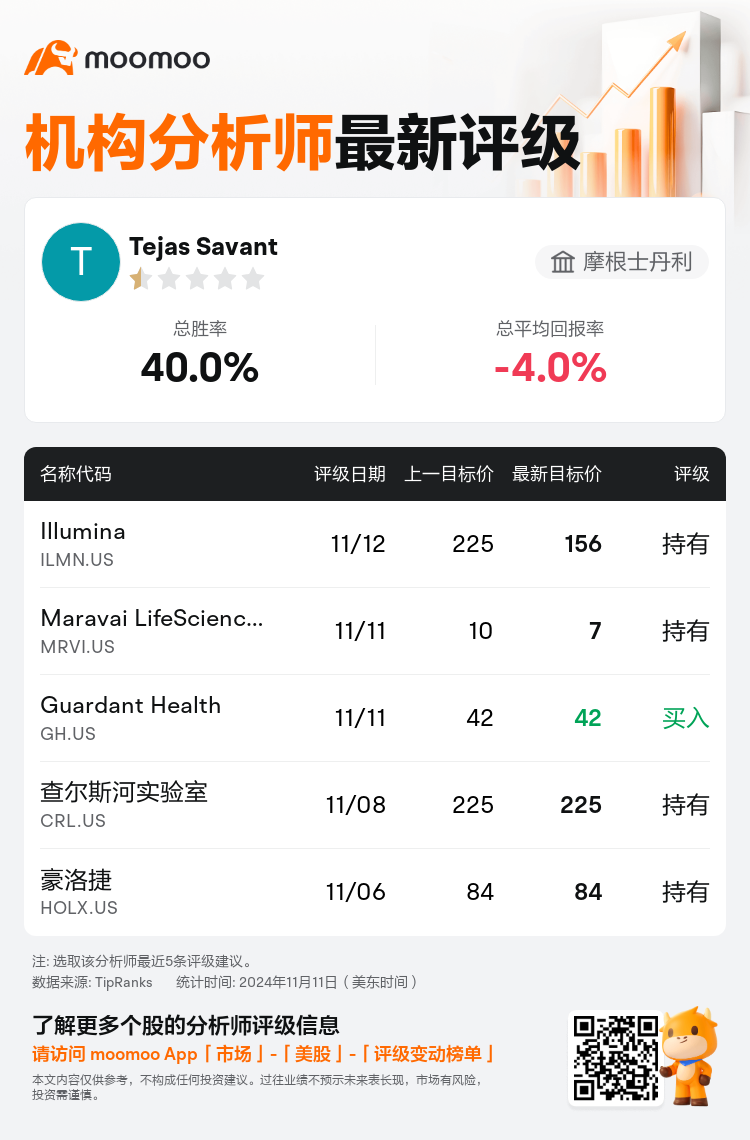

摩根士丹利分析师Tejas Savant维持$Maravai LifeSciences (MRVI.US)$持有评级,并将目标价从10美元下调至7美元。

根据TipRanks数据显示,该分析师近一年总胜率为40.0%,总平均回报率为-4.0%。

此外,综合报道,$Maravai LifeSciences (MRVI.US)$近期主要分析师观点如下:

此外,综合报道,$Maravai LifeSciences (MRVI.US)$近期主要分析师观点如下:

Maravai Lifesciences的展望显示,由于延迟、核酸生产(NAP)总体经济疲软以及生物制剂安全测试(BST)的早期暴露,对第四季度的预测有所降低。当前的前景显示,由于固定成本结构,前景仍然不明朗,利润压力仍然很大,没有即将改善的迹象。

在连续三个季度中,Maravai Lifesciences持续超过预期,但该公司经历了挫折,这要归因于生物技术行业支出普遍疲软,以及该行业典型的客户订单的不可预测性。

Maravai Lifesciences公布的第三季度业绩未达到预期,与预期相比,两个业务领域的业绩均不及预期。该公司观察到,其NAP领域的研究和发现需求下降,没有大量的一次性订单,延迟到2025年的GMP计划时间表也有所延迟。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$Maravai LifeSciences (MRVI.US)$近期主要分析师观点如下:

此外,综合报道,$Maravai LifeSciences (MRVI.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of