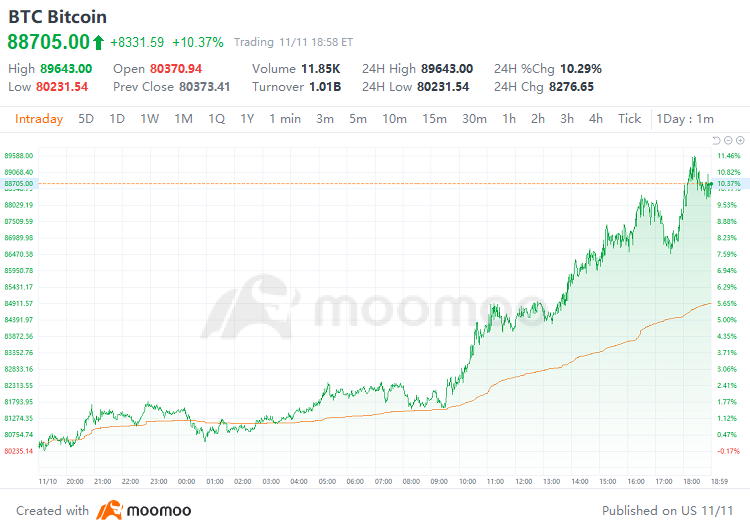

Bitcoin Soars Past $89,000 as Digital Currencies Experience Major Gains into Monday

Bitcoin Soars Past $89,000 as Digital Currencies Experience Major Gains into Monday

During Monday’s US trading hours, the crypto market continued to rally, fueled by Donald Trump’s recent electoral victory. $Bitcoin (BTC.CC)$ began its ascent over the weekend and gained further traction throughout the week, breaking several significant psychological thresholds and briefly topping $89,000.

周一的美股盘中,加密市场继续上涨,受特朗普最近的选举胜利的推动。 $比特币 (BTC.CC)$ 在周末开始上升,并在整个周中获得了进一步的推动,突破了几个重要的心理阈值,并短暂突破了89,000美元。

All major cryptocurrencies saw a uniform surge. $Ethereum (ETH.CC)$ boasted a 7-day cumulative increase of approximately 40%, markedly outperforming Bitcoin’s 31%.

所有主要加密货币都出现了统一的激增。 $以太坊 (ETH.CC)$ 狗狗币在7天内累计增长约40%,明显优于比特币的31%。

Supported by endorsements from Elon Musk, $Dogecoin (DOGE.CC)$ ’s value doubled within a week.

得到特斯拉首席执行官埃隆·马斯克的支持, $狗狗币 (DOGE.CC)$ 的价值在一周内翻倍。

As optimism grows following Trump's election, Bitcoin futures premiums have surged. Data from derivatives exchange Deribit shows that wagers exceeding $2.8 billion were placed on Bitcoin surpassing the $90,000 mark.

随着特朗普当选后乐观情绪的增长,比特币期货溢价激增。衍生品交易所Deribit的数据显示,有超过28亿美元的赌注押注比特币超过9.万美元。

On the same day, prominent Bitcoin stakeholder $MicroStrategy (MSTR.US)$ announced a substantial acquisition of approximately 0.0272 million bitcoins for around $2.03 billion, marking its largest purchase since December 2020.

在同一天,知名比特币利益相关者 $MicroStrategy (MSTR.US)$ 宣布以约20.3亿美元收购了大约2.72万比特币,这是自2020年12月以来最大的购买。

In their third-quarter report on October 30, MicroStrategy introduced their "21/21 plan," aiming to secure $42 billion through $21 billion in equity and $210 billion in debt over the next three years to further invest in Bitcoin.

在10月30日的第三季度报告中,microstrategy 提出了他们的"21/21 计划",旨在通过21亿美元的股权和2100亿美元的债务,在未来三年内筹集420亿美元以进一步投资比特币。

During regular trading hours on Monday, $iShares Bitcoin Trust (IBIT.US)$ surpassed $Gold Trust Ishares (IAU.US)$ in managed assets. Although IBIT's current management scale is still about $30 billion shy of the world’s largest gold ETF, $SPDR Gold ETF (GLD.US)$, its overtaking of IAU marks a significant milestone.

在周一的美股盘中, $比特币ETF-iShares (IBIT.US)$ 超过了 $黄金信托ETF-iShares (IAU.US)$ 资产管理。尽管IBIT目前的管理规模还差约300亿美元才能达到全球最大的黄金etf, $SPDR黄金ETF (GLD.US)$,其超越IAU标志着一个重要的里程碑。

According to FactSet, IBIT received approximately $1 billion in inflows last week alone, accumulating a total of $27 billion since its January launch. The recent spike in Bitcoin’s price is expected to push the ETF's asset management scale above $30 billion.

根据FactSet的数据,IBIT仅上周就吸引了约10亿美元的资金流入,自1月份推出以来累计达到了270亿美元。预计比特币价格的最近上涨将推动该etf的资产管理规模超过300亿美元。

By last Friday, IBIT managed assets worth $34.3 billion, slightly ahead of IAU’s nearly $33 billion.

截至上周五,IBIT的管理资产价值达到了343亿美元,略领先于IAU的近330亿美元。

Bitcoin has the highest correlation with global liquidity, making this undoubtedly a significant trend. With zero-commission trading, are you sure you don't want to give it a try?

比特币与全球货币流动性的相关性最高,这无疑是一个重要的趋势。在零佣金交易的情况下,您确定不想尝试一下吗?

As optimism grows following Trump's election, Bitcoin futures premiums have surged. Data from derivatives exchange Deribit shows that wagers exceeding $2.8 billion were placed on Bitcoin surpassing the $90,000 mark.

As optimism grows following Trump's election, Bitcoin futures premiums have surged. Data from derivatives exchange Deribit shows that wagers exceeding $2.8 billion were placed on Bitcoin surpassing the $90,000 mark.