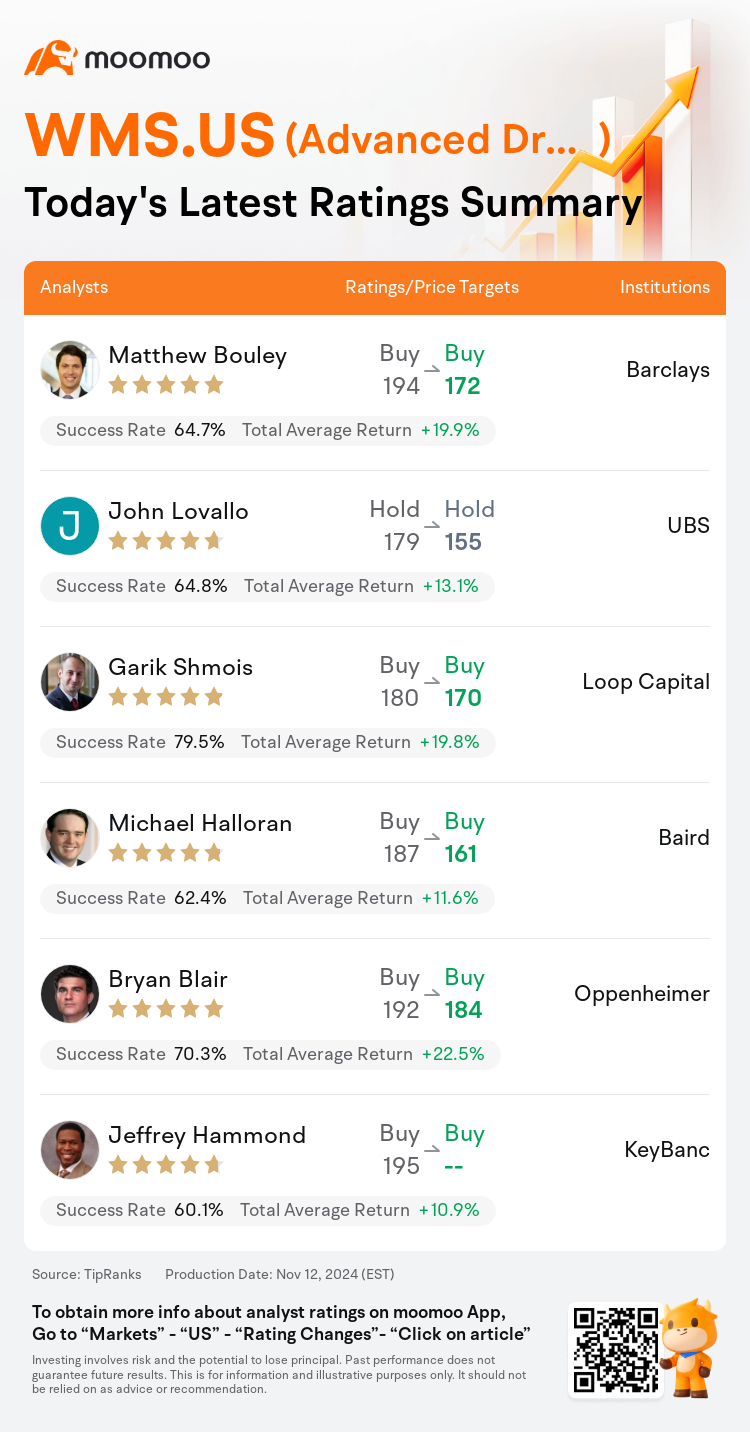

On Nov 12, major Wall Street analysts update their ratings for $Advanced Drainage (WMS.US)$, with price targets ranging from $155 to $184.

Barclays analyst Matthew Bouley maintains with a buy rating, and adjusts the target price from $194 to $172.

UBS analyst John Lovallo maintains with a hold rating, and adjusts the target price from $179 to $155.

Loop Capital analyst Garik Shmois maintains with a buy rating, and adjusts the target price from $180 to $170.

Loop Capital analyst Garik Shmois maintains with a buy rating, and adjusts the target price from $180 to $170.

Baird analyst Michael Halloran maintains with a buy rating, and adjusts the target price from $187 to $161.

Oppenheimer analyst Bryan Blair maintains with a buy rating, and adjusts the target price from $192 to $184.

Furthermore, according to the comprehensive report, the opinions of $Advanced Drainage (WMS.US)$'s main analysts recently are as follows:

The company's outlook has been adjusted due to a combination of factors including the non-residential sector, weather-related challenges, and rising input costs.

The company's Q2 earnings fell short of expectations, and subsequent guidance revision came unexpectedly as the quarter appeared to be aligning well despite the erratic non-residential environment. Sales did not meet forecasts due to storm-related impacts and adverse price-to-cost conditions. Nonetheless, the period's highlights were bolstered by robust infrastructure and residential sales.

The firm observed that shares declined by 14.3% following the company's Q2 performance, which fell short of expectations, and its subsequent reduction in FY25 guidance. This adjustment was made to account for ongoing volatility in non-residential demand, delays in projects due to hurricanes, and persisting challenges with pricing and costs. In light of the results from the first half of the year and prevailing business trends, the company has revised its FY25 sales forecast. Despite the disappointing results and lowered guidance, the opinion is that the risks for the second half of the year have been significantly mitigated. The firm suggests that the market's reaction may have been excessive and sees this as an opportune moment for investors to consider engaging with this unique water management asset.

The reduction in margins was anticipated due to well-known inconsistencies within the Non-Residential sector. The impression is that the investor concerns largely centered around the extent of margin pressures resulting from pricing strategies. However, this seems primarily linked to elevated input costs rather than a weakening of top-line pricing. Despite a more cautious outlook on end-market and margin trends, the view is that the current decline in share price presents an opportunity to invest in a robust narrative that is bolstered by material conversion drivers and numerous opportunities for sustained margin improvement.

Apart from reducing estimates and adjusting for lower non-residential expectations, the primary concern is centered on the challenge of increasing prices to counterbalance rising material costs, which is essentially a cyclical debate. However, pricing remains stable on a sequential basis, and it is anticipated to recover alongside demand. Moreover, the absolute margin levels remain noteworthy.

Here are the latest investment ratings and price targets for $Advanced Drainage (WMS.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

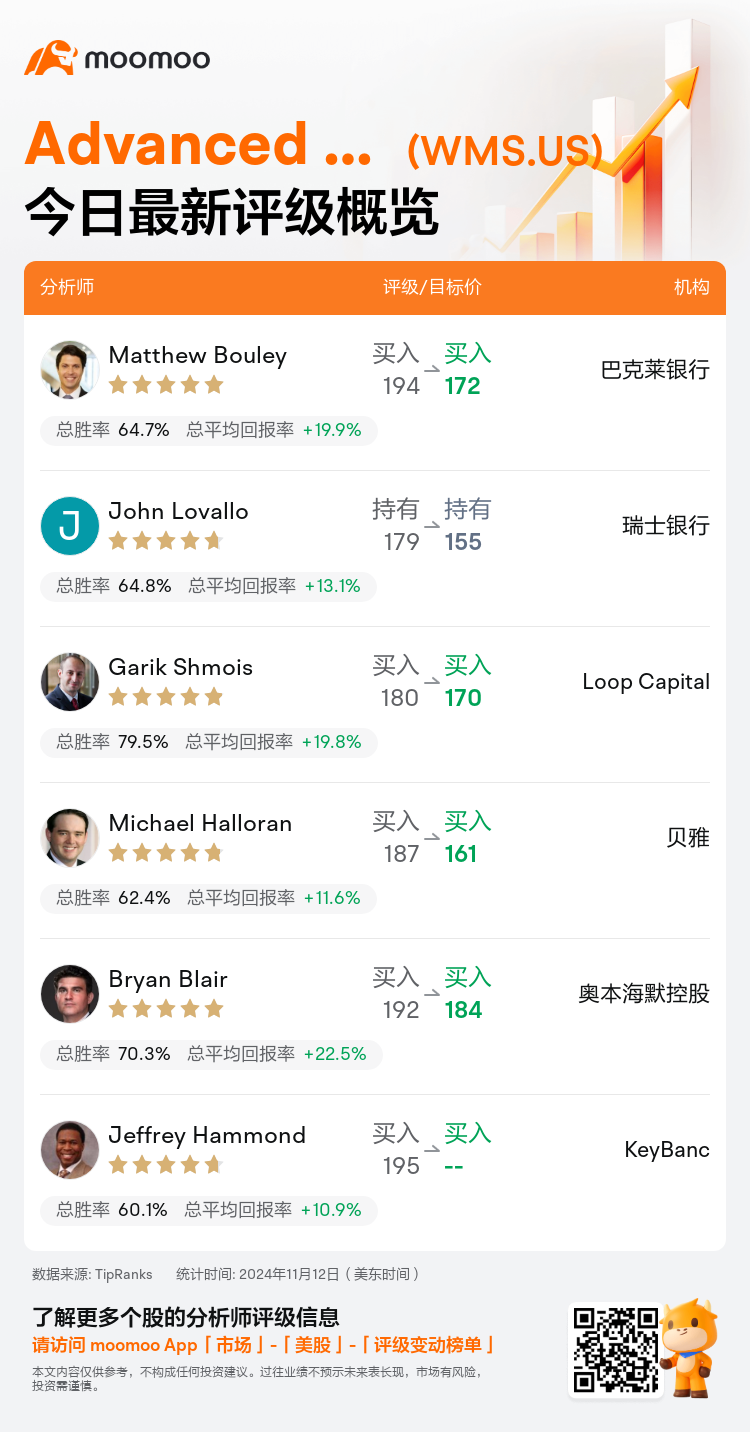

美东时间11月12日,多家华尔街大行更新了$Advanced Drainage (WMS.US)$的评级,目标价介于155美元至184美元。

巴克莱银行分析师Matthew Bouley维持买入评级,并将目标价从194美元下调至172美元。

瑞士银行分析师John Lovallo维持持有评级,并将目标价从179美元下调至155美元。

Loop Capital分析师Garik Shmois维持买入评级,并将目标价从180美元下调至170美元。

Loop Capital分析师Garik Shmois维持买入评级,并将目标价从180美元下调至170美元。

贝雅分析师Michael Halloran维持买入评级,并将目标价从187美元下调至161美元。

奥本海默控股分析师Bryan Blair维持买入评级,并将目标价从192美元下调至184美元。

此外,综合报道,$Advanced Drainage (WMS.US)$近期主要分析师观点如下:

由于多种因素的结合,包括非居住板块、与天气相关的挑战和不断上升的投入成本,公司的展望已经调整。

公司的第二季度收益不及预期,后续的指引修订出乎意料,因为尽管非居住环境表现不稳定,但当季似乎发展良好。销售未能达到预期,是因为风暴影响和逆价格成本条件。尽管如此,该时期的亮点还是得到了强劲的基础设施和住宅销售的支撑。

该公司注意到,股票价格在公司第二季度业绩不及预期以及随后降低FY25指引后下跌了14.3%。此调整是为了考虑到非居住需求持续波动、由于飓风导致项目延迟以及价格和成本方面的持续挑战。鉴于上半年的业绩和当前业务趋势,该公司已修订了FY25年度销售预测。尽管业绩不佳并降低了指引,但看法是今年下半年的风险已经得到显著减轻。公司建议市场反应可能过度,并认为这是投资者考虑参与这一独特水务资产的绝佳时机。

由于非居住板块内已知的不一致性,毛利率的降低是可以预期的。投资者关心的主要集中在毛利率受价格策略影响的程度上。然而,这似乎主要与高昂的投入成本有关,而非销售价格的减弱。尽管对终端市场和毛利趋势持更加谨慎的展望,但认为当前股价下跌为投资提供了机会,因为受到实质性转型推动因素和多项持续提升毛利的机会的支持的坚实故事。

除了降低预期和调整非住宅预期外,主要关注点集中在应对不断上涨的原材料成本,即本质上是一个周期性的讨论。然而,从顺序的角度来看,定价保持稳定,预计会随着需求的增加而恢复。此外,绝对的利润率水平仍值得关注。

以下为今日6位分析师对$Advanced Drainage (WMS.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

Loop Capital分析师Garik Shmois维持买入评级,并将目标价从180美元下调至170美元。

Loop Capital分析师Garik Shmois维持买入评级,并将目标价从180美元下调至170美元。

Loop Capital analyst Garik Shmois maintains with a buy rating, and adjusts the target price from $180 to $170.

Loop Capital analyst Garik Shmois maintains with a buy rating, and adjusts the target price from $180 to $170.