Investment Guide: Leveraging Bitcoin's Rally Through Stocks

Investment Guide: Leveraging Bitcoin's Rally Through Stocks

$Bitcoin (BTC.CC)$ skyrocketed above $89,000, lifting its market value over $1.75 trillion and overtaking silver to rank as the world's eighth-largest asset.

$比特币 (BTC.CC)$ 比特币价格飙升至超过$89,000,市值超过$1.75万亿,超越白银成为世界第八大资产。

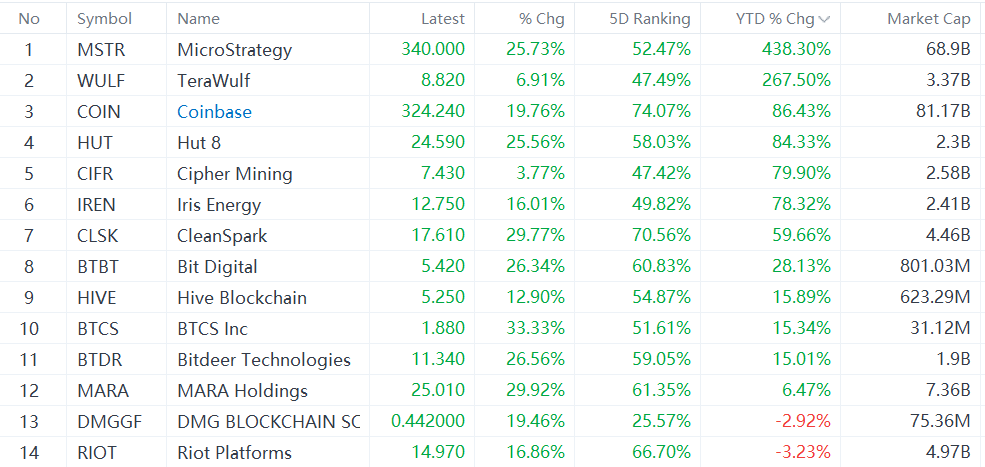

Cryptocurrency-linked stocks also rallied sharply. In the last five trading sessions, $Coinbase (COIN.US)$ and $CleanSpark (CLSK.US)$ surged over 70%, $Riot Platforms (RIOT.US)$ and $MARA Holdings (MARA.US)$ advanced more than 60%, while $MicroStrategy (MSTR.US)$ gained upwards of 50%.

与数字货币相关的股票也急剧上涨。在过去五个交易日中,$Coinbase (COIN.US)$ 和$CleanSpark (CLSK.US)$ 涨幅超过70%,$Riot Platforms (RIOT.US)$ and $MARA Holdings (MARA.US)$ 爱文思控股增长超过60%,而 $MicroStrategy (MSTR.US)$ 上涨超过50%。

The crypto market rally has been fueled by Donald Trump's election as US President. Trump has promised a more lenient approach to cryptocurrencies and intends to appoint crypto-friendly figures to key positions.

数字货币市场的上涨是特朗普当选美国总统推动的。特朗普承诺对数字货币采取更宽松的态度,并打算任命亲密数字货币的人担任重要职位。

Bitcoin Bull Market Set to Persist

比特币牛市有望持续

Bitcoin has surged 110% this year, supported by strong demand for Bitcoin spot ETFs and a Federal Reserve interest rate cut.

比特币今年已上涨110%,得到了比特币现货ETF的强劲需求和美联储降息的支持。

Data from crypto options exchange Deribit shows investors are betting on Bitcoin reaching $100,000 by year-end. Prediction market Polymarket indicates a 68% probability of Bitcoin hitting $100,000 by 2024.

数字货币期权交易所Deribit的数据显示,投资者在押注比特币在年底达到10万美元。预测市场Polymarket显示,比特币在2024年达到10万美元的概率为68%。

Bitwise Chief Investment Officer Matt Hougan noted that while more investors are eager to join the rally, long-term Bitcoin holders have not sold below the $100,000 mark.

Bitwise首席投资官马特·豪根指出,虽然越来越多的投资者渴望加入这波上涨行情,但长期持有比特币的投资者并未在10万美元以下出售。

In our recent article, "Bulls Are Eyeing Bitcoin's Next Target: $120K," some analysts predict Bitcoin could reach $120,000 by spring next year and potentially $200,000 by the end of 2025.

在我们最近的文章中,"牛市正在关注比特币的下一个目标:$120K,"一些分析师预测比特币可能在明年春季达到12万美元,有望在2025年底达到20万美元。

Related Stocks

相关股票

MicroStrategy: Leading Bitcoin Holder

MicroStrategy:最大的比特币持有者

MicroStrategy Inc., the largest corporate Bitcoin holder, is intensifying its cryptocurrency acquisition strategy. The company has accumulated nearly 280,000 Bitcoins after purchasing about 27,200 Bitcoins for $2.03 billion in its largest acquisition since December 2020. This brings MicroStrategy's total Bitcoin investment to $11.9 billion, with an unrealized profit of approximately $11 billion.

MicroStrategy公司,最大的企业比特币持有者,正加强其数字货币收购策略。该公司在自2020年12月以来最大规模的收购中购买了约27,200比特币,耗资20.3亿美元,累计持有近28万比特币。这将MicroStrategy的比特币总投资额提高到119亿美元,估计未实现利润约110亿美元。

In its third-quarter earnings report on Oct. 30, MicroStrategy unveiled a "21/21 Plan," aiming to raise $42 billion over three years—split evenly between equity and bonds—to expand its Bitcoin holdings further.

In its third-quarter earnings report on Oct. 30, MicroStrategy unveiled a "21/21 Plan," aiming to raise $420亿 over three years—split evenly between equity and bonds—to expand its Bitcoin holdings further.

Shares of $MicroStrategy (MSTR.US)$ have surged 438% this year, significantly outperforming Bitcoin’s 110% rally. This outperformance is attributed to two factors. First, MicroStrategy acts as a proxy for Bitcoin investment, appealing to investors who cannot directly purchase the cryptocurrency. Second, with rising Bitcoin prices, investors anticipate improvements in MicroStrategy’s earnings forecasts and valuation multiples, highlighting the differing valuation dynamics between equities and digital assets.

Shares of $MicroStrategy (MSTR.US)$ have surged 438% this year, significantly outperforming Bitcoin’s 110% rally. This outperformance is attributed to two factors. First, MicroStrategy acts as a proxy for Bitcoin investment, appealing to investors who cannot directly purchase the cryptocurrency. Second, with rising Bitcoin prices, investors anticipate improvements in MicroStrategy’s earnings forecasts and valuation multiples, highlighting the differing valuation dynamics between equities and digital assets.

Coinbase: Major Cryptocurrency Exchange

Coinbase: Major Cryptocurrency Exchange

$Coinbase (COIN.US)$, a leading cryptocurrency exchange in the U.S., offers direct buying and selling services for digital currencies, generating revenue through transaction fees among other means.

$Coinbase (COIN.US)$, a leading cryptocurrency exchange in the U.S., offers direct buying and selling services for digital currencies, generating revenue through transaction fees among other means.

Its stock has surged 86% this year, influenced not only by Bitcoin's price fluctuations but also by overall market activity, investor sentiment, and regulatory policy. When the broader cryptocurrency market performs well and trading activity increases, Coinbase's transaction volume and revenue are likely to rise, potentially driving its stock price higher.

Its stock has surged 86% this year, influenced not only by Bitcoin's price fluctuations but also by overall market activity, investor sentiment, and regulatory policy. When the broader cryptocurrency market performs well and trading activity increases, Coinbase's transaction volume and revenue are likely to rise, potentially driving its stock price higher.

MARA, RIOT and CLSK: Bitcoin Mining Firms

MARA、RIOt和CLSK:比特币挖矿公司

$MARA Holdings (MARA.US)$ and $Riot Platforms (RIOT.US)$, key players in Bitcoin mining, are leveraging their extensive operations to mine and sell Bitcoin. Marathon holds over 26,800 Bitcoins, while Riot holds more than 12,400.

$MARA Holdings (MARA.US)$ 和$Riot Platforms (RIOT.US)$,比特币挖矿领域的关键参与者,正在利用其庞大的运营来进行比特币的挖掘和销售。Marathon拥有超过26,800比特币,而Riot控股超过12,400。

Marathon's shares have climbed 6.5% this year, whereas Riot's have slid 3.2%. In the near term, their profits are highly responsive to Bitcoin price fluctuations due to relatively stable mining costs. However, long-term profitability and share performance could be pressured by rising mining costs, competitive computational demands, or a downturn in Bitcoin prices or increased mining difficulty.

Marathon的股价今年上涨了6.5%,而Riot的下跌了3.2%。在短期内,由于挖矿成本相对稳定,他们的利润对比特币价格波动非常敏感。然而,长期盈利能力和股票表现可能受到不断上升的挖矿成本、竞争性计算需求或比特币价格下跌或挖矿难度增加的压力。

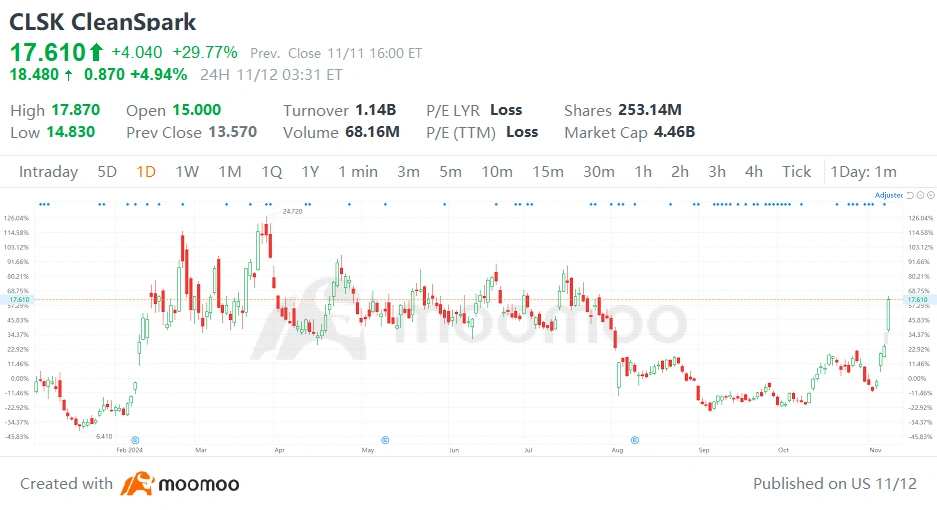

Besides, $CleanSpark (CLSK.US)$ focuses on delivering technical support and services for cryptocurrency mining, offering efficient equipment and optimizing processes. Its performance is linked to the health of the crypto mining industry. When the market thrives and the sector expands, demand for CLSK's services rises, driving up its stock. This year, CLSK shares have jumped 60%.

此外, $CleanSpark (CLSK.US)$ 专注于为数字货币挖矿提供技术支持和服务,提供高效设备并优化流程。其表现与加密挖矿行业的健康状况密切相关。当市场繁荣,行业扩大时,对CLSK服务的需求增加,推高其股票价格。今年,CLSK股价上涨了60%。

Notably, uncertainty remains over whether Donald Trump will fulfill his previous commitments to support cryptocurrencies after he takes office. Bitcoin's volatility underscores the need for investors to stay vigilant, closely tracking market sentiment and news developments to manage risk effectively.

值得注意的是,特朗普概念能否兑现他在上任后支持加密货币的先前承诺仍存在不确定性。比特币的波动凸显了投资者需要保持警惕,密切追踪市场情绪和新闻动向,以有效管理风险。

Source: Bloomberg, Companies Market Cap, FXStreet, Crypto Briefing

资讯来源:彭博社、公司市值、FXStreet、加密简报

by moomoo News Olivia

由moomoo资讯Olivia提供

Bitcoin Bull Market Set to Persist

Bitcoin Bull Market Set to Persist