We're Not Very Worried About Arcturus Therapeutics Holdings' (NASDAQ:ARCT) Cash Burn Rate

We're Not Very Worried About Arcturus Therapeutics Holdings' (NASDAQ:ARCT) Cash Burn Rate

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

毫无疑问,持有亏损企业的股份也可以赚钱。例如,虽然Amazon.com在上市后多年亏损,但如果你自1999年以来购买并持有其股份,你就会赚了大钱。但是,虽然成功案例已广为人知,投资者不应忽视那些只是在喀喀耗尽所有现金然后崩溃的许多无利可图的公司。

Given this risk, we thought we'd take a look at whether Arcturus Therapeutics Holdings (NASDAQ:ARCT) shareholders should be worried about its cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. Let's start with an examination of the business' cash, relative to its cash burn.

考虑到这种风险,我们决定看看Arcturus Therapeutics Holdings (NASDAQ:ARCT) 的股东是否应该担心其现金燃烧。 在这份报告中,我们将考虑该公司年度负面的自由现金流,简称为“现金燃烧”。让我们开始检查业务的现金存量,相对于其现金燃烧。

When Might Arcturus Therapeutics Holdings Run Out Of Money?

当Arcturus Therapeutics Holdings将会用尽资金?

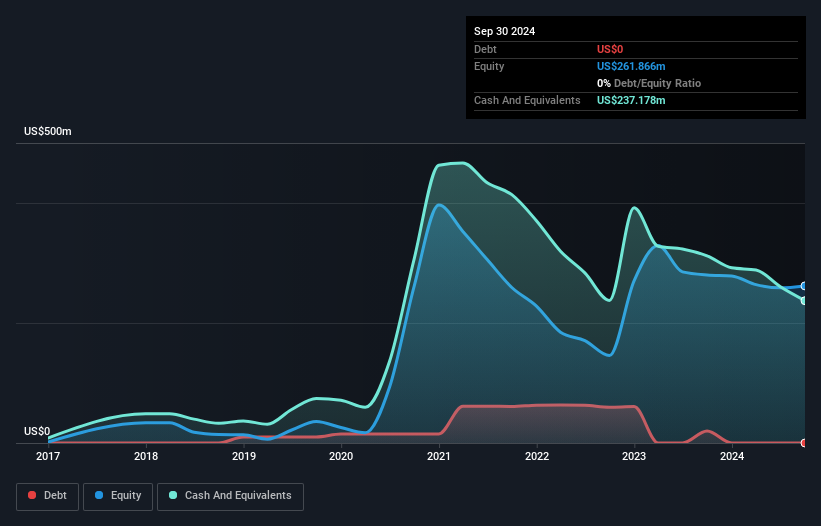

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When Arcturus Therapeutics Holdings last reported its September 2024 balance sheet in November 2024, it had zero debt and cash worth US$237m. Looking at the last year, the company burnt through US$62m. So it had a cash runway of about 3.8 years from September 2024. A runway of this length affords the company the time and space it needs to develop the business. You can see how its cash balance has changed over time in the image below.

公司的资金耗尽时间是通过将其现金储备除以其现金燃烧来计算的。当Arcturus Therapeutics Holdings于2024年9月在2024年11月报告其资产负债表时,它没有债务,现金价值为23700万美元。回顾过去一年,该公司耗掉了6200万美元。因此,从2024年9月开始,它有大约3.8年的资金耗尽时间。这样长度的资金耗尽时间为公司提供了发展业务所需的时间和空间。您可以在下面的图片中看到其现金余额是如何随时间变化的。

Is Arcturus Therapeutics Holdings' Revenue Growing?

Arcturus Therapeutics Holdings 的营业收入是否正在增长?

Given that Arcturus Therapeutics Holdings actually had positive free cash flow last year, before burning cash this year, we'll focus on its operating revenue to get a measure of the business trajectory. Regrettably, the company's operating revenue moved in the wrong direction over the last twelve months, declining by 46%. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

考虑到Arcturus Therapeutics Holdings去年实际上有正的自由现金流,在今年燃烧现金之前,我们将专注于其营业收入,以衡量其业务轨迹。遗憾的是,该公司过去十二个月的营业收入呈逆向发展,下降了46%。然而,显然,关键因素在于公司未来是否会发展其业务。因此,您可能想要看一看该公司未来几年预计增长多少。

How Hard Would It Be For Arcturus Therapeutics Holdings To Raise More Cash For Growth?

arcturus therapeutics控股公司要筹集更多现金以支持增长会有多难?

Given its problematic fall in revenue, Arcturus Therapeutics Holdings shareholders should consider how the company could fund its growth, if it turns out it needs more cash. Companies can raise capital through either debt or equity. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

鉴于arcturus therapeutics控股公司营业收入急剧下降,股东们应该考虑公司如何资助其增长,如果确实需要更多现金。公司可以通过债务或股权筹集资金。上市公司拥有的主要优势之一是他们可以向投资者出售股票以筹集现金并支持增长。我们可以比较公司的现金消耗与市值,了解公司需要发行多少新股才能资助一年的运营。

Since it has a market capitalisation of US$532m, Arcturus Therapeutics Holdings' US$62m in cash burn equates to about 12% of its market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

由于它的市值为53200万美元,arcturus therapeutics控股公司的6200万美元现金消耗相当于其市值的约12%。因此,我们认为该公司可以轻松筹集更多现金以支持增长,尽管会有一定程度的稀释成本。

Is Arcturus Therapeutics Holdings' Cash Burn A Worry?

Arcturus Therapeutics Holdings 的现金烧耗是否令人担忧?

As you can probably tell by now, we're not too worried about Arcturus Therapeutics Holdings' cash burn. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. While we must concede that its falling revenue is a bit worrying, the other factors mentioned in this article provide great comfort when it comes to the cash burn. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. When you don't have traditional metrics like earnings per share and free cash flow to value a company, many are extra motivated to consider qualitative factors such as whether insiders are buying or selling shares. Please Note: Arcturus Therapeutics Holdings insiders have been trading shares, according to our data. Click here to check whether insiders have been buying or selling.

您可能已经注意到,我们对arcturus therapeutics控股公司的现金消耗并不太担心。特别是,我们认为其现金储备证明了公司在控制支出方面做得非常出色。虽然必须承认其营业收入下降有点令人担忧,但本文提到的其他因素在处理现金消耗问题时提供了极大的安慰。根据本文提到的因素,我们认为其现金消耗情况值得股东们关注,但我们认为他们不应该担心。当您没有传统的指标如每股收益和自由现金流来评估一家公司时,很多人会更有动力考虑定性因素,比如内部人员是否在买卖股票。请注意:根据我们的数据,arcturus therapeutics控股公司的内部人员一直在交易股票。点击此处查看内部人员是否一直在买卖。

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies with significant insider holdings, and this list of stocks growth stocks (according to analyst forecasts)

当然,您也可以通过在其他地方寻找找到出色的投资机会。因此,请查看具有重要内部股权的公司的免费列表,以及此分析师预测的股票成长列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧吗?请直接与我们联系。或者,发送电子邮件至editorial-team @ simplywallst.com。

Simply Wall St的这篇文章是一般性质的。我们仅基于历史数据和分析师预测提供评论,使用公正的方法,我们的文章并非意在提供财务建议。这并不构成买入或卖出任何股票的建议,并且不考虑您的目标或财务状况。我们旨在为您带来基于基础数据驱动的长期聚焦分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St对提及的任何股票都没有持仓。

Given that Arcturus Therapeutics Holdings actually had positive free cash flow last year, before burning cash this year, we'll focus on its operating revenue to get a measure of the business trajectory. Regrettably, the company's operating revenue moved in the wrong direction over the last twelve months, declining by 46%. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

Given that Arcturus Therapeutics Holdings actually had positive free cash flow last year, before burning cash this year, we'll focus on its operating revenue to get a measure of the business trajectory. Regrettably, the company's operating revenue moved in the wrong direction over the last twelve months, declining by 46%. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.