Looking At PDD Holdings's Recent Unusual Options Activity

Looking At PDD Holdings's Recent Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bearish stance on PDD Holdings.

有大量资金可以花的鲸鱼对PDD Holdings采取了明显的看跌立场。

Looking at options history for PDD Holdings (NASDAQ:PDD) we detected 26 trades.

查看PDD Holdings(纳斯达克股票代码:PDD)的期权历史记录,我们发现了26笔交易。

If we consider the specifics of each trade, it is accurate to state that 15% of the investors opened trades with bullish expectations and 61% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,有15%的投资者以看涨的预期开启交易,61%的投资者持看跌预期。

From the overall spotted trades, 7 are puts, for a total amount of $335,427 and 19, calls, for a total amount of $1,182,566.

在已发现的全部交易中,有7笔是看跌期权,总额为335,427美元,19笔看涨期权,总额为1,182,566美元。

What's The Price Target?

目标价格是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $95.0 and $150.0 for PDD Holdings, spanning the last three months.

在评估了交易量和未平仓合约之后,很明显,主要市场走势者正在关注过去三个月中PDD Holdings在95.0美元至150.0美元之间的价格区间。

Insights into Volume & Open Interest

对交易量和未平仓合约的见解

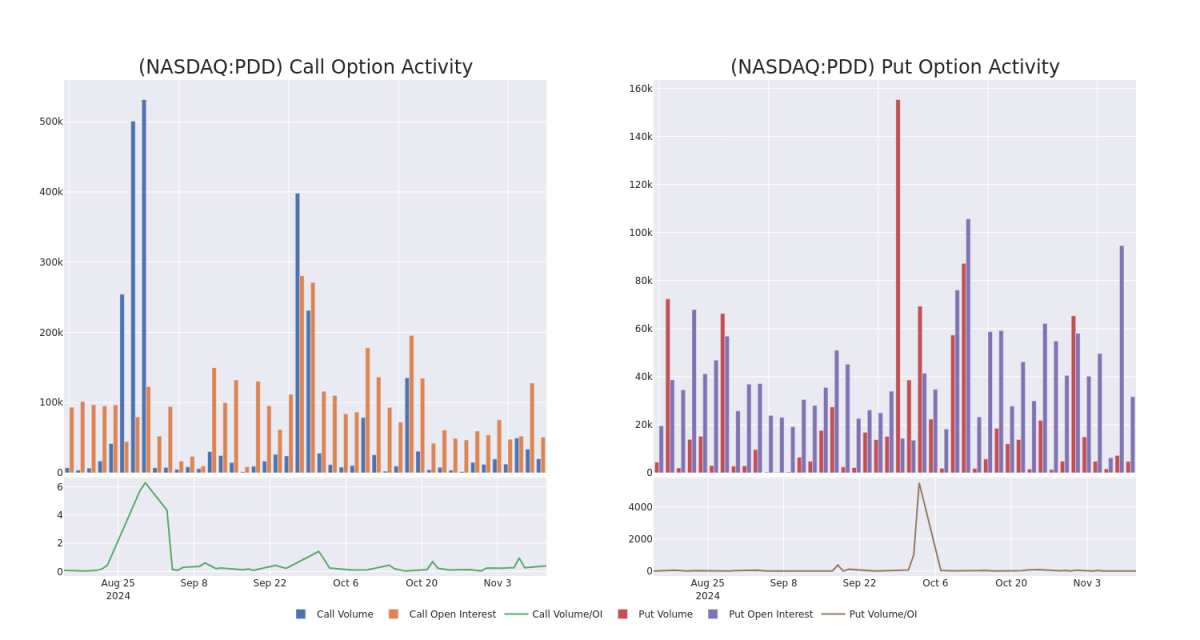

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

查看交易量和未平仓合约是一种对股票进行尽职调查的有见地的方法。

This data can help you track the liquidity and interest for PDD Holdings's options for a given strike price.

这些数据可以帮助您跟踪PDD Holdings期权在给定行使价下的流动性和利息。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of PDD Holdings's whale activity within a strike price range from $95.0 to $150.0 in the last 30 days.

下面,我们可以观察过去30天内PDD Holdings在行使价范围内所有鲸鱼活动的看涨和看跌期权交易量和未平仓合约的分别变化。

PDD Holdings 30-Day Option Volume & Interest Snapshot

PDD Holdings 30 天期权交易量和利息快照

Biggest Options Spotted:

发现的最大选择:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PDD | CALL | SWEEP | BEARISH | 12/06/24 | $5.9 | $5.85 | $5.9 | $115.00 | $177.1K | 1.8K | 1.7K |

| PDD | CALL | SWEEP | BULLISH | 12/13/24 | $19.55 | $19.45 | $19.55 | $95.00 | $89.9K | 1 | 300 |

| PDD | PUT | TRADE | BULLISH | 12/06/24 | $8.85 | $8.4 | $8.45 | $115.00 | $84.4K | 202 | 104 |

| PDD | CALL | TRADE | NEUTRAL | 12/06/24 | $8.55 | $8.3 | $8.41 | $110.00 | $84.1K | 1.4K | 616 |

| PDD | CALL | TRADE | NEUTRAL | 12/06/24 | $8.55 | $8.3 | $8.41 | $110.00 | $84.1K | 1.4K | 516 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PDD | 打电话 | 扫 | 粗鲁的 | 12/06/24 | 5.9 美元 | 5.85 美元 | 5.9 美元 | 115.00 美元 | 17.71 万美元 | 1.8K | 1.7K |

| PDD | 打电话 | 扫 | 看涨 | 12/13/24 | 19.55 美元 | 19.45 美元 | 19.55 美元 | 95.00 美元 | 89.9 万美元 | 1 | 300 |

| PDD | 放 | 贸易 | 看涨 | 12/06/24 | 8.85 美元 | 8.4 美元 | 8.45 美元 | 115.00 美元 | 84.4 万美元 | 202 | 104 |

| PDD | 打电话 | 贸易 | 中立 | 12/06/24 | 8.55 美元 | 8.3 美元 | 8.41 美元 | 110.00 美元 | 84.1 万美元 | 1.4K | 616 |

| PDD | 打电话 | 贸易 | 中立 | 12/06/24 | 8.55 美元 | 8.3 美元 | 8.41 美元 | 110.00 美元 | 84.1 万美元 | 1.4K | 516 |

About PDD Holdings

关于PDD Holdings

PDD Holdings is a multinational commerce group that owns and operates a portfolio of businesses. PDD aims to bring more businesses and people into the digital economy so that local communities and small businesses can benefit from the increased productivity and new opportunities. PDD has built a network of sourcing, logistics, and fulfillment capabilities that support its underlying businesses.

PDD Holdings是一家跨国商业集团,拥有并经营业务组合。PDD旨在将更多的企业和人员带入数字经济,使当地社区和小型企业能够从生产力的提高和新的机遇中受益。PDD 已经建立了一个采购、物流和配送能力网络,为其基础业务提供支持。

In light of the recent options history for PDD Holdings, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鉴于PDD Holdings最近的期权历史,现在应该将重点放在公司本身上。我们的目标是探索其目前的表现。

Where Is PDD Holdings Standing Right Now?

PDD Holdings现在处于什么位置?

- With a volume of 2,325,272, the price of PDD is down -4.23% at $112.19.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 14 days.

- PDD的交易量为2,325,272美元,下跌了-4.23%,至112.19美元。

- RSI 指标暗示标的股票可能已接近超卖。

- 下一份财报预计将在14天后公布。

Turn $1000 into $1270 in just 20 days?

在短短 20 天内将 1000 美元变成 1270 美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年专业期权交易员透露了他的单线图技术,该技术显示何时买入和卖出。复制他的交易,平均每20天获利27%。点击此处访问。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for PDD Holdings with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高利润的潜力。精明的交易者通过持续的教育、战略贸易调整、利用各种指标以及随时关注市场动态来降低这些风险。使用Benzinga Pro了解PDD Holdings的最新期权交易,以获取实时提醒。

From the overall spotted trades, 7 are puts, for a total amount of $335,427 and 19, calls, for a total amount of $1,182,566.

From the overall spotted trades, 7 are puts, for a total amount of $335,427 and 19, calls, for a total amount of $1,182,566.