Occidental Petroleum's Options Frenzy: What You Need to Know

Occidental Petroleum's Options Frenzy: What You Need to Know

Financial giants have made a conspicuous bullish move on Occidental Petroleum. Our analysis of options history for Occidental Petroleum (NYSE:OXY) revealed 21 unusual trades.

金融巨头对西方石油采取了明显的看涨举动。我们对西方石油公司(纽约证券交易所代码:OXY)期权历史的分析显示了21笔不寻常的交易。

Delving into the details, we found 57% of traders were bullish, while 23% showed bearish tendencies. Out of all the trades we spotted, 12 were puts, with a value of $2,429,711, and 9 were calls, valued at $780,442.

深入研究细节,我们发现57%的交易者看涨,而23%的交易者表现出看跌倾向。在我们发现的所有交易中,有12笔是看跌期权,价值为2429,711美元,9笔是看涨期权,价值780,442美元。

Projected Price Targets

预计价格目标

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $47.5 to $62.5 for Occidental Petroleum during the past quarter.

分析这些合约的交易量和未平仓合约,看来大型企业一直在关注西方石油在过去一个季度的价格范围从47.5美元到62.5美元不等。

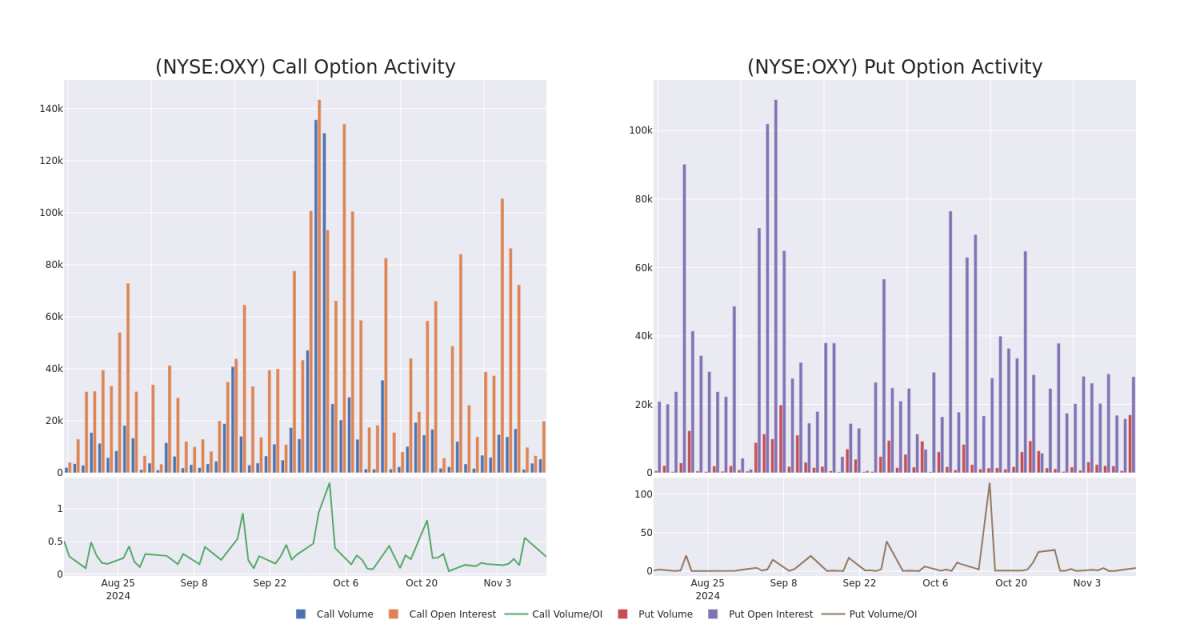

Volume & Open Interest Trends

交易量和未平仓合约趋势

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

查看交易量和未平仓合约是一种对股票进行尽职调查的有见地的方法。

This data can help you track the liquidity and interest for Occidental Petroleum's options for a given strike price.

这些数据可以帮助您跟踪西方石油公司在给定行使价下的期权的流动性和利息。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Occidental Petroleum's whale activity within a strike price range from $47.5 to $62.5 in the last 30 days.

下面,我们可以观察西方石油公司在过去30天行使价范围内所有鲸鱼活动的看涨和看跌期权交易量和未平仓合约的变化。

Occidental Petroleum Option Activity Analysis: Last 30 Days

西方石油期权活动分析:过去 30 天

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| OXY | PUT | TRADE | NEUTRAL | 12/20/24 | $4.85 | $4.75 | $4.8 | $55.00 | $1.4M | 15.7K | 3.0K |

| OXY | PUT | SWEEP | BEARISH | 01/16/26 | $12.9 | $12.8 | $12.9 | $62.50 | $250.2K | 1.2K | 202 |

| OXY | CALL | SWEEP | BULLISH | 01/16/26 | $6.5 | $6.4 | $6.5 | $52.50 | $194.3K | 2.3K | 301 |

| OXY | PUT | SWEEP | BEARISH | 01/16/26 | $13.0 | $12.9 | $13.0 | $62.50 | $176.8K | 1.2K | 344 |

| OXY | CALL | TRADE | BULLISH | 11/15/24 | $1.6 | $1.57 | $1.6 | $50.00 | $160.0K | 4.5K | 1.4K |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 氧气 | 放 | 贸易 | 中立 | 12/20/24 | 4.85 美元 | 4.75 美元 | 4.8 美元 | 55.00 美元 | 140 万美元 | 15.7K | 3.0K |

| 氧气 | 放 | 扫 | 粗鲁的 | 01/16/26 | 12.9 美元 | 12.8 美元 | 12.9 美元 | 62.50 美元 | 250.2 万美元 | 1.2K | 202 |

| 氧气 | 打电话 | 扫 | 看涨 | 01/16/26 | 6.5 美元 | 6.4 美元 | 6.5 美元 | 52.50 美元 | 194.3 万美元 | 2.3K | 301 |

| 氧气 | 放 | 扫 | 粗鲁的 | 01/16/26 | 13.0 美元 | 12.9 美元 | 13.0 美元 | 62.50 美元 | 176.8 万美元 | 1.2K | 344 |

| 氧气 | 打电话 | 贸易 | 看涨 | 11/15/24 | 1.6 美元 | 1.57 美元 | 1.6 美元 | 50.00 美元 | 160.0K | 4.5K | 1.4K |

About Occidental Petroleum

关于西方石油公司

Occidental Petroleum is an independent exploration and production company with operations in the United States, Latin America, and the Middle East. At the end of 2023, the company reported net proved reserves of nearly 4 billion barrels of oil equivalent. Net production averaged 1,234 thousand barrels of oil equivalent per day in 2023 at a ratio of roughly 50% oil and natural gas liquids and 50% natural gas.

西方石油公司是一家独立的勘探和生产公司,业务遍及美国、拉丁美洲和中东。截至2023年底,该公司报告的净探明储量为近40亿桶石油当量。2023 年日均净产量为 12.4 万桶石油当量,比例约为 50% 的液化石油和天然气以及 50% 的天然气。

Following our analysis of the options activities associated with Occidental Petroleum, we pivot to a closer look at the company's own performance.

在分析了与西方石油相关的期权活动之后,我们将转向仔细研究公司自身的表现。

Occidental Petroleum's Current Market Status

西方石油公司目前的市场地位

- Trading volume stands at 5,960,348, with OXY's price down by -0.83%, positioned at $50.39.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 0 days.

- 交易量为5,960,348美元,OXY的价格下跌了-0.83%,为50.39美元。

- RSI指标显示,该股目前在超买和超卖之间处于中立状态。

- 预计将在0天内公布财报。

What Analysts Are Saying About Occidental Petroleum

分析师对西方石油的看法

In the last month, 3 experts released ratings on this stock with an average target price of $63.333333333333336.

上个月,3位专家公布了该股的评级,平均目标价为63.3333333333336美元。

Unusual Options Activity Detected: Smart Money on the Move

检测到不寻常的期权活动:智能货币在移动

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Reflecting concerns, an analyst from B of A Securities lowers its rating to Neutral with a new price target of $57.* An analyst from JP Morgan downgraded its action to Neutral with a price target of $56. * An analyst from Susquehanna persists with their Positive rating on Occidental Petroleum, maintaining a target price of $77.

Benzinga Edge的不寻常期权委员会在潜在的市场推动者发生之前就发现了它们。看看大笔资金对你最喜欢的股票持有哪些头寸。点击此处查看。* 出于担忧,Bof A Securities的一位分析师将其评级下调至中性,新的目标股价为57美元。*摩根大通的一位分析师将其评级下调至中性,目标股价为56美元。*萨斯奎哈纳的一位分析师坚持对西方石油的正面评级,维持77美元的目标价。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.