We Take A Look At Why ReposiTrak, Inc.'s (NYSE:TRAK) CEO Has Earned Their Pay Packet

We Take A Look At Why ReposiTrak, Inc.'s (NYSE:TRAK) CEO Has Earned Their Pay Packet

Key Insights

主要见解

- ReposiTrak to hold its Annual General Meeting on 20th of November

- Salary of US$1.06m is part of CEO Randy Fields's total remuneration

- Total compensation is similar to the industry average

- ReposiTrak's total shareholder return over the past three years was 278% while its EPS grew by 18% over the past three years

- ReposiTrak将于11月20日举行年度股东大会

- 美元106万的薪资是CEO Randy Fields总报酬的一部分

- 总补偿与行业平均水平相似

- ReposiTrak过去三年的总股东回报率为278%,而其每股收益在过去三年中增长了18%

We have been pretty impressed with the performance at ReposiTrak, Inc. (NYSE:TRAK) recently and CEO Randy Fields deserves a mention for their role in it. Shareholders will have this at the front of their minds in the upcoming AGM on 20th of November. It is likely that the focus will be on company strategy going forward as shareholders hear from the board and cast their votes on resolutions such as executive remuneration and other matters. Here is our take on why we think CEO compensation is not extravagant.

我们对ReposiTrak公司(纽交所:TRAK)最近的业绩印象深刻,首席执行官Randy Fields也应该因其在其中的角色而受到关注。股东们将在11月20日即将召开的股东大会上牢记这一点。很可能焦点将集中在未来公司战略上,股东们将听取董事会的发言,并对执行薪酬等问题进行投票表决。以下是我们对为何认为首席执行官薪酬不过高的看法。

Comparing ReposiTrak, Inc.'s CEO Compensation With The Industry

将ReposiTrak公司首席执行官的薪酬与行业板块进行比较

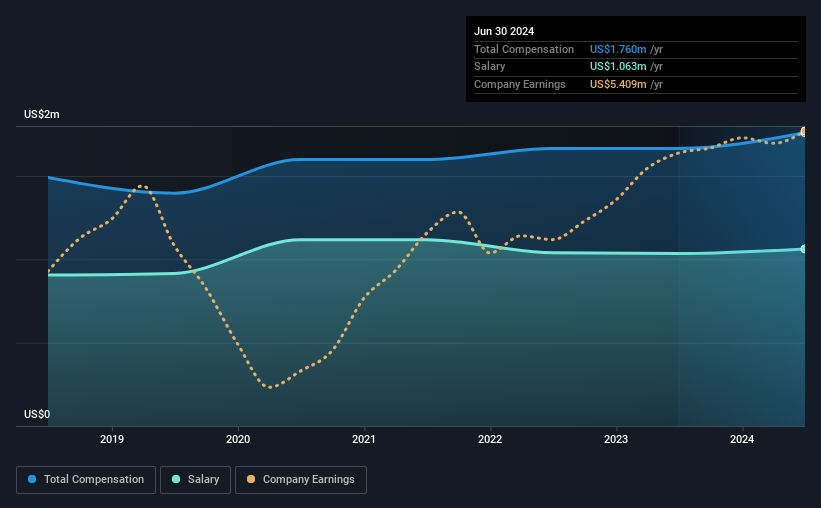

According to our data, ReposiTrak, Inc. has a market capitalization of US$385m, and paid its CEO total annual compensation worth US$1.8m over the year to June 2024. That's just a smallish increase of 5.7% on last year. In particular, the salary of US$1.06m, makes up a huge portion of the total compensation being paid to the CEO.

根据我们的数据,ReposiTrak公司的市值为38500万美元,CEO在截至2024年6月的一年内获得了总计180万美元的年度薪酬。这与去年相比仅增长了5.7%。特别是,其中106万美元的薪水占到了CEO总薪酬的大部分。

In comparison with other companies in the American Software industry with market capitalizations ranging from US$200m to US$800m, the reported median CEO total compensation was US$1.8m. This suggests that ReposiTrak remunerates its CEO largely in line with the industry average. What's more, Randy Fields holds US$95m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

与美国软件行业市值介于20000万到80000万美元的其他公司相比,报告的首席执行官总薪酬中位数为180万美元。这表明ReposiTrak公司向首席执行官的薪酬在很大程度上符合行业平均水平。此外,Randy Fields以个人名义持有公司9500万美元的股份,表明他们在这场游戏中投入了大量资金。

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | US$1.1m | US$1.0m | 60% |

| Other | US$697k | US$631k | 40% |

| Total Compensation | US$1.8m | US$1.7m | 100% |

| 组成部分 | 2024 | 2023 | 比例(2024年) |

| 薪资 | 110万美元 | 100万美元 | 60% |

| 其他 | 697,000美元 | 631,000美元 | 40% |

| 总补偿 | 180万美元 | 1.7百万美元 | 100% |

Speaking on an industry level, nearly 15% of total compensation represents salary, while the remainder of 85% is other remuneration. ReposiTrak is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

就行业板块而言,近15%的总报酬代表薪水,而其余85%是其他报酬。 ReposiTrak通过薪水支付更高比例的报酬,与整个行业相比。 如果薪水是总报酬中的主要组成部分,这意味着CEO无论业绩如何,都会获得更高固定比例的总报酬。

ReposiTrak, Inc.'s Growth

ReposiTrak, Inc.的增长

Over the past three years, ReposiTrak, Inc. has seen its earnings per share (EPS) grow by 18% per year. In the last year, its revenue is up 7.1%.

在过去三年中,ReposiTrak,Inc.的每股收益(EPS)年均增长18%。在过去一年中,其营业收入增长了7.1%。

This demonstrates that the company has been improving recently and is good news for the shareholders. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

这表明公司最近一直在改善,对股东来说是个好消息。看到营收持续增长是好事,因为这符合良好的业务状况。展望未来,您可能希望查看分析师对公司未来收益的免费可视化报告。

Has ReposiTrak, Inc. Been A Good Investment?

ReposiTrak, Inc. 是一个好投资吗?

Boasting a total shareholder return of 278% over three years, ReposiTrak, Inc. has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

在过去三年中,ReposiTrak, Inc.的股东总回报率达到278%,对股东来说表现不错。因此,有人可能认为该公司的CEO应该获得比同等规模公司更多的报酬。

In Summary...

总之……

The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. However, investors will get the chance to engage on key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

公司的稳健表现可能让大多数股东感到满意,可能会使CEO的薪酬成为股东大会讨论的最次要问题。但是,投资者将有机会讨论公司的关键战略举措和未来增长机会,并设定他们的长期期望。

If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at ReposiTrak.

如果你认为CEO的薪酬水平很有趣,那么你可能真的会喜欢这个ReposiTrak内部交易的免费可视化工具。

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

当然,你可能会通过观察其他股票的不同涨跌幅来找到一笔不错的投资。所以,可以看一下这个有趣的公司的免费列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧吗?请直接与我们联系。或者,发送电子邮件至editorial-team @ simplywallst.com。

Simply Wall St的这篇文章是一般性质的。我们仅基于历史数据和分析师预测提供评论,使用公正的方法,我们的文章并非意在提供财务建议。这并不构成买入或卖出任何股票的建议,并且不考虑您的目标或财务状况。我们旨在为您带来基于基础数据驱动的长期聚焦分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St对提及的任何股票都没有持仓。

Speaking on an industry level, nearly 15% of total compensation represents salary, while the remainder of 85% is other remuneration. ReposiTrak is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Speaking on an industry level, nearly 15% of total compensation represents salary, while the remainder of 85% is other remuneration. ReposiTrak is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.