Should Shareholders Reconsider Lumentum Holdings Inc.'s (NASDAQ:LITE) CEO Compensation Package?

Should Shareholders Reconsider Lumentum Holdings Inc.'s (NASDAQ:LITE) CEO Compensation Package?

Key Insights

主要见解

- Lumentum Holdings will host its Annual General Meeting on 20th of November

- CEO Alan Lowe's total compensation includes salary of US$903.8k

- The total compensation is 2,626% higher than the average for the industry

- Lumentum Holdings' three-year loss to shareholders was 3.7% while its EPS was down 124% over the past three years

- Lumentum控股将于11月20日举行其年度股东大会

- 首席执行官Alan Lowe的总补偿包括90.38万美元的薪水

- 总补偿比行业平均水平高出2626%

- Lumentum控股的股东持有亏损了3.7%,而其每股收益在过去三年下降了124%

The results at Lumentum Holdings Inc. (NASDAQ:LITE) have been quite disappointing recently and CEO Alan Lowe bears some responsibility for this. Shareholders can take the chance to hold the board and management accountable for the unsatisfactory performance at the next AGM on 20th of November. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. The data we present below explains why we think CEO compensation is not consistent with recent performance.

Lumentum Holdings Inc. (NASDAQ:LITE)的业绩最近相当令人失望,首席执行官Alan Lowe对此负有一定责任。股东们有机会在11月20日的下一届股东大会上把董事会和管理层的不尽职行为置于台面,这也是股东们影响管理层的机会,例如通过对公司决议的投票来影响高管报酬,这可能对公司产生重大影响。我们接下来提供的数据解释了为什么我们认为首席执行官的薪酬与最近的表现不一致。

Comparing Lumentum Holdings Inc.'s CEO Compensation With The Industry

将Lumentum Holdings Inc.的首席执行官薪酬与行业进行比较

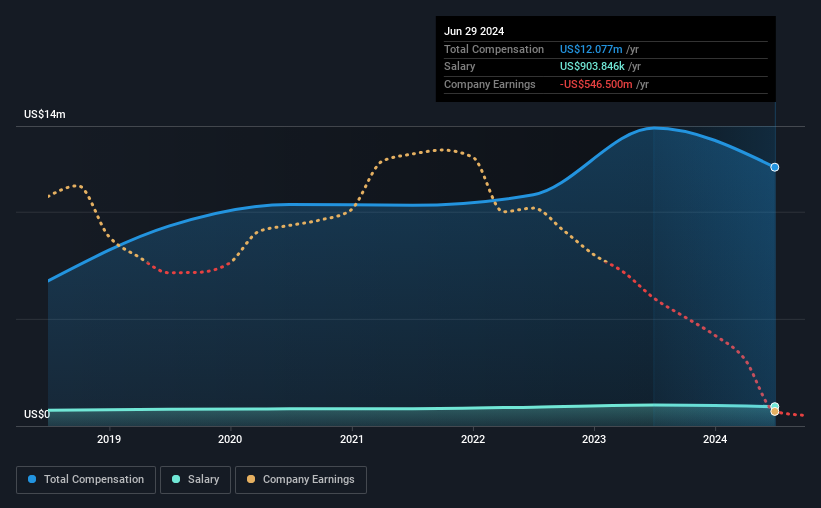

At the time of writing, our data shows that Lumentum Holdings Inc. has a market capitalization of US$6.0b, and reported total annual CEO compensation of US$12m for the year to June 2024. That's a notable decrease of 13% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$904k.

在撰写本文时,我们的数据显示Lumentum Holdings Inc.的市值为60亿美元,截至2024年6月全年首席执行官总薪酬为1200万美元。与去年相比显著下降13%。我们认为总体薪酬更重要,但我们的数据显示首席执行官薪水更低,为90.4万美元。

On comparing similar companies from the American Communications industry with market caps ranging from US$4.0b to US$12b, we found that the median CEO total compensation was US$443k. Hence, we can conclude that Alan Lowe is remunerated higher than the industry median. Moreover, Alan Lowe also holds US$11m worth of Lumentum Holdings stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

与美国通信-半导体行业市值在40亿至120亿美元范围内的类似公司进行比较,我们发现首席执行官总薪酬中位数为44.3万美元。因此,我们可以得出结论,Alan Lowe的薪酬高于行业中位数。此外,Alan Lowe还直接持有价值1100万美元的Lumentum Holdings股票,这向我们揭示了他在该公司中拥有重大个人利益。

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | US$904k | US$981k | 7% |

| Other | US$11m | US$13m | 93% |

| Total Compensation | US$12m | US$14m | 100% |

| 组成部分 | 2024 | 2023 | 比例(2024年) |

| 薪资 | 美国$904k | 美国$981k | 7% |

| 其他 | 1100万美元 | 13百万美元 | 93% |

| 总补偿 | 1200万美元 | 14美元 | 100% |

Talking in terms of the industry, salary represented approximately 20% of total compensation out of all the companies we analyzed, while other remuneration made up 80% of the pie. In Lumentum Holdings' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

从行业角度来看,在我们分析的所有公司中,薪水大约占总报酬的20%,而其他薪酬占据了80%的份额。在Lumentum Holdings的情况下,非薪酬报酬占据了总报酬的较大比例,与整个行业相比。如果总报酬倾向于非薪酬福利,这表明CEO的薪酬与公司表现相关联。

Lumentum Holdings Inc.'s Growth

lumentum控股公司的增长

Over the last three years, Lumentum Holdings Inc. has shrunk its earnings per share by 124% per year. In the last year, its revenue is down 13%.

在过去的三年里,lumentum控股公司的每股收益每年下降124%。在过去一年中,其营业收入下降了13%。

The decline in EPS is a bit concerning. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

每股收益的下降有点引人担忧。事实上,营业收入年同比下降可能描绘了一个丑陋的画面。这些因素表明业务表现可能不足以为CEO提供高薪。展望未来,您可能希望查看分析师对公司未来收益的免费视觉报告。

Has Lumentum Holdings Inc. Been A Good Investment?

lumentum控股公司是一个好的投资吗?

Given the total shareholder loss of 3.7% over three years, many shareholders in Lumentum Holdings Inc. are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

在过去三年中,lumentum控股公司的股东总损失达到了3.7%,许多股东可能相当不满。因此,如果CEO得到丰厚报酬,股东可能感到不安。

To Conclude...

总之...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

随着公司业绩的疲软,股东们在其投资上的股价回报也很差,这表明他们极不可能赞成提高首席执行官的薪酬。在即将到来的股东大会上,管理层将有机会解释他们计划如何使业务恢复正常并应对投资者的关切。

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We did our research and identified 2 warning signs (and 1 which makes us a bit uncomfortable) in Lumentum Holdings we think you should know about.

分析CEO薪酬始终是明智的选择,与对公司关键业绩领域进行彻底分析一样。我们做了调查,在lumentum控股中确定了2个警告迹象(还有一个让我们有点不舒服的迹象),我们认为您应该知道。

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

可以说,业务质量比CEO薪酬水平更为重要。因此,请查看这个免费的有趣公司列表,这些公司具有高的净资产收益率和较低的债务。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧吗?请直接与我们联系。或者,发送电子邮件至editorial-team @ simplywallst.com。

Simply Wall St的这篇文章是一般性质的。我们仅基于历史数据和分析师预测提供评论,使用公正的方法,我们的文章并非意在提供财务建议。这并不构成买入或卖出任何股票的建议,并且不考虑您的目标或财务状况。我们旨在为您带来基于基础数据驱动的长期聚焦分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St对提及的任何股票都没有持仓。

Talking in terms of the industry, salary represented approximately 20% of total compensation out of all the companies we analyzed, while other remuneration made up 80% of the pie. In Lumentum Holdings' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Talking in terms of the industry, salary represented approximately 20% of total compensation out of all the companies we analyzed, while other remuneration made up 80% of the pie. In Lumentum Holdings' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.