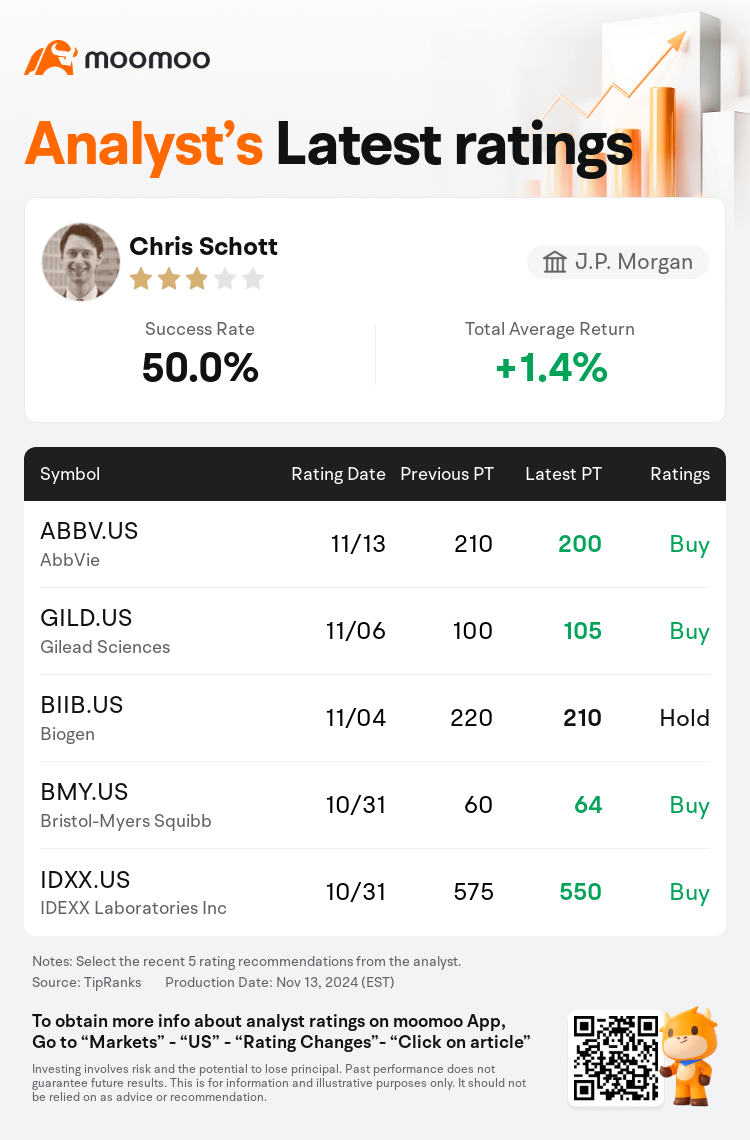

J.P. Morgan analyst Chris Schott maintains $AbbVie (ABBV.US)$ with a buy rating, and adjusts the target price from $210 to $200.

According to TipRanks data, the analyst has a success rate of 50.0% and a total average return of 1.4% over the past year.

Furthermore, according to the comprehensive report, the opinions of $AbbVie (ABBV.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $AbbVie (ABBV.US)$'s main analysts recently are as follows:

The unexpected negative update on emraclidine's Phase 2 outcomes has led to its removal from revenue models, subsequently increasing the projections for Cobenfy's performance. Despite the adjustments, the long-term growth trajectory in terms of revenue and earnings per share is not anticipated to be significantly altered for the involved companies.

Analysts noted that the key Phase 2 data for AbbVie's emraclidine did not meet expectations, failing to show a statistically significant alteration from the baseline in the primary scale used to measure efficacy in schizophrenia studies. This outcome was contrary to forecasts, especially considering the drug was a central component of AbbVie's multi-billion-dollar acquisition and was anticipated to generate substantial sales towards the decade's end, potentially rivaling competitive products.

The anticipated outcomes of the EMPOWER 1 and 2 Emraclidine Phase 2 studies in Schizophrenia did not meet expectations, with placebo results surpassing those of the active arms in both trials. This has led to the realization that the primary value proposition of the significant acquisition is no longer viable.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

摩根大通分析师Chris Schott维持$艾伯维公司 (ABBV.US)$买入评级,并将目标价从210美元下调至200美元。

根据TipRanks数据显示,该分析师近一年总胜率为50.0%,总平均回报率为1.4%。

此外,综合报道,$艾伯维公司 (ABBV.US)$近期主要分析师观点如下:

此外,综合报道,$艾伯维公司 (ABBV.US)$近期主要分析师观点如下:

对emraclidine的2期结果意外的负面更新已导致其从营业收入模型中移除,随后提高了Cobenfy绩效的预测。尽管做出了调整,但参与公司的营业收入和每股收益的长期增长轨迹预计不会发生显着变化。

分析师指出,AbbVie的emraclidine关键2期数据未达到预期,未能显示在用于评估精神分裂症研究疗效的主要指标上与基线存在统计学上显着的改变。这一结果与预测相反,尤其考虑到这种药物是AbbVie数十亿美元收购的核心组成部分,并预计将在未来十年末创造巨大销售额,有望与竞争产品媲美。

对于精神分裂症的EMPOWER 1和2期emraclidine研究的预期结果未达到预期,安慰剂组的结果在两项试验中均超过了有效干预组。这导致人们意识到重大收购的主要价值主张不再可行。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$艾伯维公司 (ABBV.US)$近期主要分析师观点如下:

此外,综合报道,$艾伯维公司 (ABBV.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of