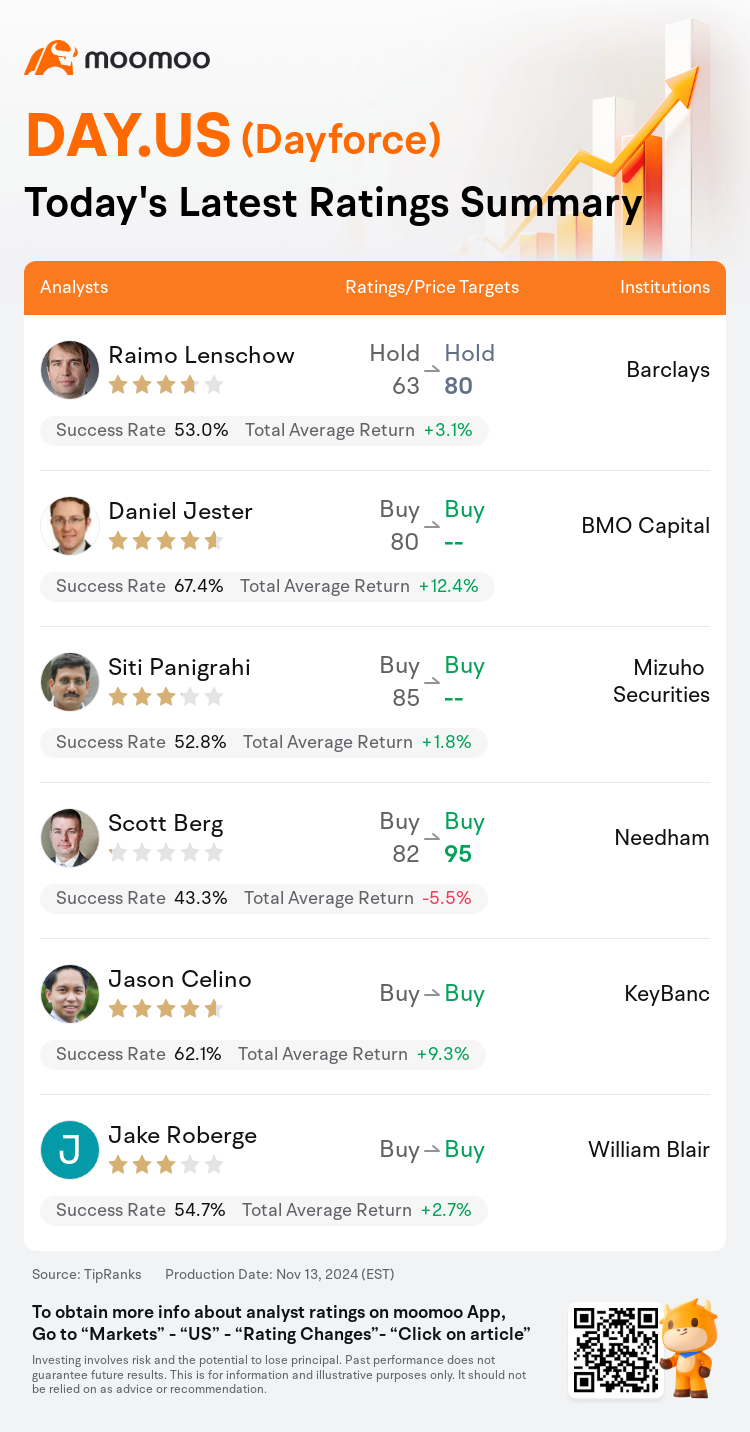

On Nov 13, major Wall Street analysts update their ratings for $Dayforce (DAY.US)$, with price targets ranging from $80 to $95.

Barclays analyst Raimo Lenschow maintains with a hold rating, and adjusts the target price from $63 to $80.

BMO Capital analyst Daniel Jester maintains with a buy rating.

Mizuho Securities analyst Siti Panigrahi maintains with a buy rating.

Mizuho Securities analyst Siti Panigrahi maintains with a buy rating.

Needham analyst Scott Berg maintains with a buy rating, and adjusts the target price from $82 to $95.

KeyBanc analyst Jason Celino maintains with a buy rating.

Furthermore, according to the comprehensive report, the opinions of $Dayforce (DAY.US)$'s main analysts recently are as follows:

Investor confidence in Dayforce's long-term potential is expected to rise following recent discussions. The company's trajectory for revenue expansion is well-defined, and achieving the anticipated 13%-15% growth target appears feasible according to an analyst.

The firm's optimism regarding Dayforce is supported by the product's robustness, the development of its partner ecosystem, moderate investments in sales, and a heightened emphasis on cost efficiency and cash flow generation.

During its investor day, Dayforce set forth ambitious revenue and free cash flow objectives for fiscal 2031. The growth is being propelled by acquiring new customers, leveraging cross-selling opportunities within the Dayforce platform, including managed services, targeting larger-scale clients, and pursuing international expansion. The outlook provided has reinforced the belief in the company's sustainable growth trajectory and its potential to enhance free cash flow production.

After attending Dayforce's investor day in Las Vegas, which concentrated on financial details as expected, the outlook for Dayforce's recurring revenue growth is now anticipated to be in the upper-to-mid teens range, a minor deceleration from the previously projected high teens. This update is balanced by the company's sustained dedication to enhancing margins while progressing towards its long-term free cash flow objective of $1B. The increased emphasis on profitability left a positive impression.

Here are the latest investment ratings and price targets for $Dayforce (DAY.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

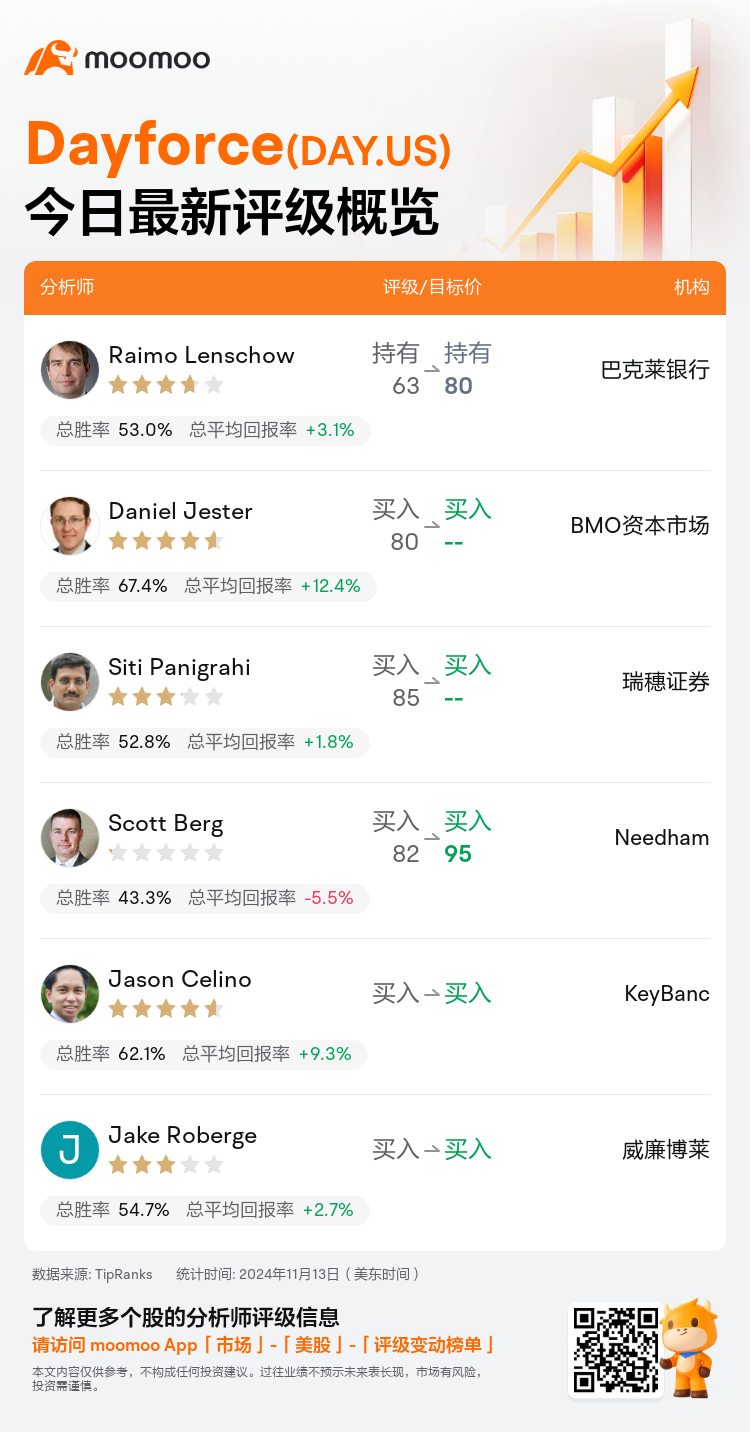

美东时间11月13日,多家华尔街大行更新了$Dayforce (DAY.US)$的评级,目标价介于80美元至95美元。

巴克莱银行分析师Raimo Lenschow维持持有评级,并将目标价从63美元上调至80美元。

BMO资本市场分析师Daniel Jester维持买入评级。

瑞穗证券分析师Siti Panigrahi维持买入评级。

瑞穗证券分析师Siti Panigrahi维持买入评级。

Needham分析师Scott Berg维持买入评级,并将目标价从82美元上调至95美元。

KeyBanc分析师Jason Celino维持买入评级。

此外,综合报道,$Dayforce (DAY.US)$近期主要分析师观点如下:

投资者对Dayforce的长期潜力的信恳智能有望在最近的讨论之后上升。该公司的营业收入扩张轨迹明确,分析师认为实现预期的13%-15%增长目标是可行的。

公司对Dayforce的乐观态度得到了支持,主要是由产品的稳健性、合作伙伴生态系统的发展、对销售的适度投资以及对成本效率和现金流产生的高度重视。

在其投资者日活动中,Dayforce提出了2031财年雄心勃勃的营业收入和自由现金流目标。增长受新客户的获取推动,利用Dayforce平台内的交叉销售机会,包括托管服务,定位更大规模的客户,并推动国际扩张。提供的展望巩固了对公司可持续增长轨迹和提高自由现金流产生潜力的信心。

在参加了Dayforce在拉斯维加斯举行的投资者日活动后,该活动侧重于财务细节,这符合预期,现预计Dayforce的营业收入增长将在上到中等十几个百分点的区间内,略有放缓,不过比之前预期的高十几个百分点。这一更新由公司持续致力于提高利润率以及朝着其10亿美元的长期自由现金流目标迈进相互平衡。对盈利能力的加大强调留下了积极印象。

以下为今日6位分析师对$Dayforce (DAY.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

瑞穗证券分析师Siti Panigrahi维持买入评级。

瑞穗证券分析师Siti Panigrahi维持买入评级。

Mizuho Securities analyst Siti Panigrahi maintains with a buy rating.

Mizuho Securities analyst Siti Panigrahi maintains with a buy rating.