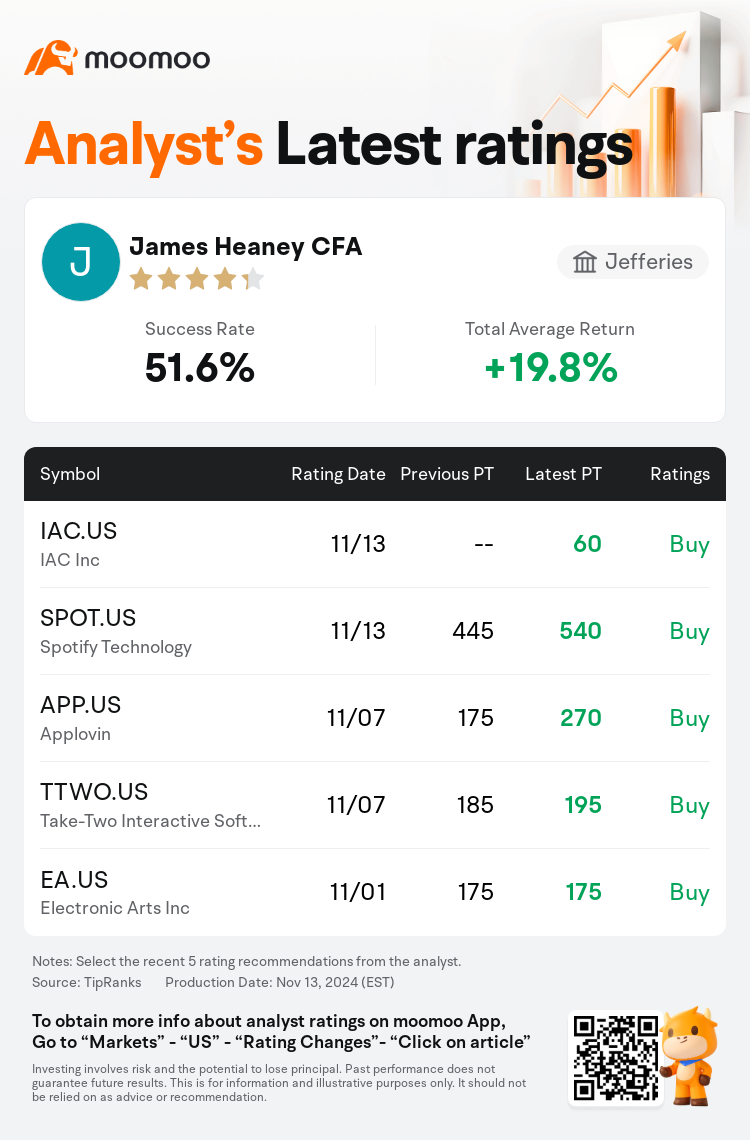

Jefferies analyst James Heaney CFA initiates coverage on $IAC Inc (IAC.US)$ with a buy rating, and sets the target price at $60.

According to TipRanks data, the analyst has a success rate of 51.6% and a total average return of 19.8% over the past year.

Furthermore, according to the comprehensive report, the opinions of $IAC Inc (IAC.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $IAC Inc (IAC.US)$'s main analysts recently are as follows:

Following the Q3 report, there are indications that Angi may encounter additional challenges in early 2025. Nevertheless, management has conveyed a sense of confidence for the period following these challenges. Additionally, a potential spin could mitigate the longstanding impact on IAC's equity, which has been in place for seven years.

IAC is contemplating a distribution of its 85% ownership interest in Angi to its shareholders. Concurrently, Angi is in the midst of an operational overhaul, as it saw its revenue decline by more than 15% year-over-year in the third quarter.

The third-quarter outcomes were largely overlooked due to IAC's announcement to spin off Angi Inc., which comprises approximately 28% of IAC's market valuation. This move is seen as an attempt by IAC to release capital for additional value generation. Considering the current negligible valuation of IAC's remaining assets excluding Angi and MGM, the spinoff is perceived as a chance to surface shareholder value from increasingly profitable components such as Dotdash-Meredith.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

富瑞集团分析师James Heaney CFA首予$IAC Inc (IAC.US)$买入评级,目标价60美元。

根据TipRanks数据显示,该分析师近一年总胜率为51.6%,总平均回报率为19.8%。

此外,综合报道,$IAC Inc (IAC.US)$近期主要分析师观点如下:

此外,综合报道,$IAC Inc (IAC.US)$近期主要分析师观点如下:

继第三季度报告之后,有迹象表明Angi可能在2025年初遇到更多挑战。尽管如此,管理层对这些挑战之后的这段时期表现出了信心。此外,潜在的分拆可以减轻对IAC股票的长期影响,IAC股票已经存在了七年。

IAC正在考虑将其在Angi的85%所有权分配给其股东。同时,Angi正在进行运营改革,其收入在第三季度同比下降了15%以上。

由于IAC宣布分拆Angi Inc.,该公司约占IAC市场估值的28%,第三季度的业绩在很大程度上被忽视了。此举被视为IAC试图释放资金以创造更多价值。考虑到IAC目前不包括Angi和MgM在内的剩余资产的估值微不足道,分拆被视为从Dotdash-Meredith等利润不断提高的组成部分中暴露股东价值的机会。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$IAC Inc (IAC.US)$近期主要分析师观点如下:

此外,综合报道,$IAC Inc (IAC.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of