Benzinga's options scanner just detected over 18 options trades for Alibaba Gr Hldgs (NYSE:BABA) summing a total amount of $949,572.

At the same time, our algo caught 6 for a total amount of 370,011.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $80.0 to $115.0 for Alibaba Gr Hldgs during the past quarter.

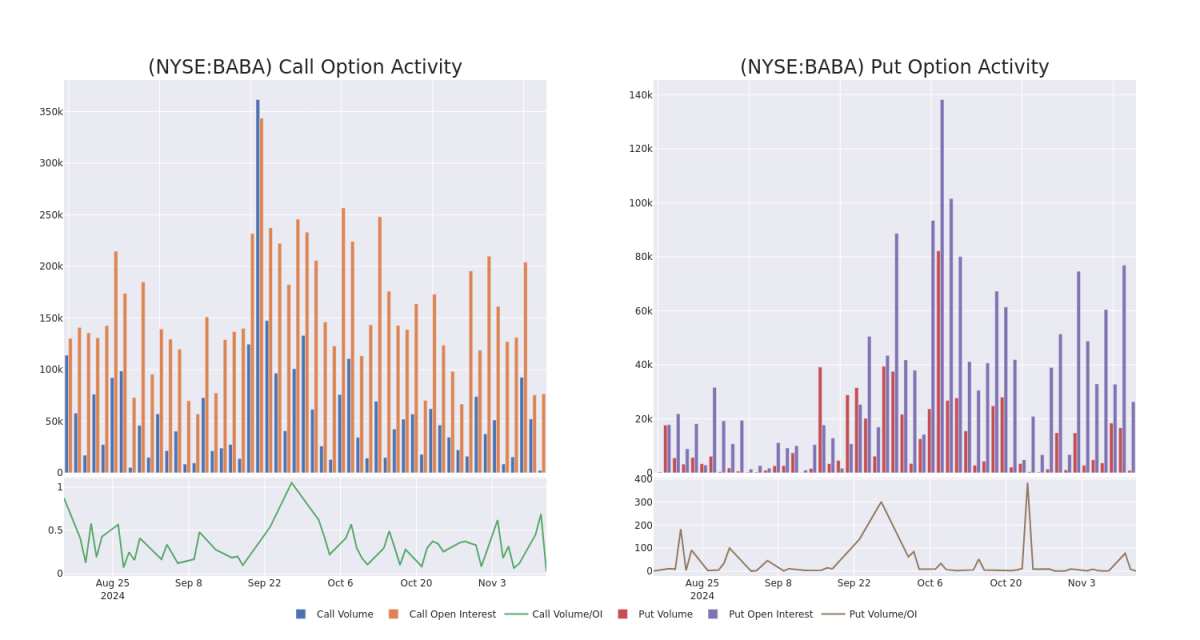

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Alibaba Gr Hldgs's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Alibaba Gr Hldgs's whale activity within a strike price range from $80.0 to $115.0 in the last 30 days.

Alibaba Gr Hldgs 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

| BABA | CALL | SWEEP | BULLISH | 01/17/25 | $4.95 | $4.8 | $4.92 | $95.00 | $217.9K | 8.3K | 467 |

| BABA | CALL | SWEEP | BULLISH | 02/21/25 | $9.7 | $9.55 | $9.69 | $87.50 | $96.9K | 94 | 100 |

| BABA | PUT | SWEEP | BULLISH | 01/17/25 | $7.2 | $7.1 | $7.08 | $95.00 | $80.7K | 7.6K | 226 |

| BABA | PUT | SWEEP | BULLISH | 12/20/24 | $3.45 | $3.35 | $3.35 | $90.00 | $67.0K | 6.5K | 227 |

| BABA | PUT | TRADE | BULLISH | 11/15/24 | $13.35 | $13.1 | $13.1 | $105.00 | $65.5K | 3.8K | 58 |

About Alibaba Gr Hldgs

Alibaba is the world's largest online and mobile commerce company as measured by gross merchandise volume. It operates China's online marketplaces, including Taobao (consumer-to-consumer) and Tmall (business-to-consumer). The China commerce retail division is the most valuable cash flow-generating business at Alibaba. Additional revenue sources include China commerce wholesale, international commerce retail/wholesale, local consumer services, cloud computing, digital media and entertainment platforms, Cainiao logistics services, and innovation initiatives/other.

Having examined the options trading patterns of Alibaba Gr Hldgs, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Alibaba Gr Hldgs Standing Right Now?

- Trading volume stands at 1,542,776, with BABA's price up by 0.1%, positioned at $91.88.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 2 days.

What The Experts Say On Alibaba Gr Hldgs

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $120.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Barclays persists with their Overweight rating on Alibaba Gr Hldgs, maintaining a target price of $137. * An analyst from Baird has decided to maintain their Outperform rating on Alibaba Gr Hldgs, which currently sits at a price target of $110. * An analyst from Mizuho has decided to maintain their Outperform rating on Alibaba Gr Hldgs, which currently sits at a price target of $113.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Alibaba Gr Hldgs options trades with real-time alerts from Benzinga Pro.

Benzinga的期权扫描仪刚刚检测到阿里巴巴集团(纽交所:BABA)的18笔期权交易,总金额为949,572美元。

与此同时,我们的量化系统捕捉到6笔,总金额为370,011美元。

预测价格区间

分析这些合同的成交量和未平仓合约,似乎大型投资者在过去一个季度内一直关注阿里巴巴集团的80.0美元到115.0美元的价格区间。

成交量和持仓量分析

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

这些数据可以帮助你追踪到阿里巴巴集团在给定行使价的期权流动性和市场兴趣。

下面,我们可以观察到阿里巴巴集团的期权在过去30天内,在80.0美元到115.0美元的行使价区间内的买入和卖出的成交量和未平仓合约的演变。

阿里巴巴集团(Alibaba Gr Hldgs)30天期权成交量和持仓量截图

值得注意的期权活动:

Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

BABA | CALL | SWEEP | BULLISH | 01/17/25 | $4.95 | $4.8 | $4.92 | $95.00 | $217.9K | 8.3K | 467 |

BABA | CALL | SWEEP | BULLISH | 02/21/25 | $9.7 | $9.55 | $9.69 | $87.50 | $96.9K | 94 | 100 |

BABA | PUT | SWEEP | BULLISH | 01/17/25 | $7.2 | $7.1 | $7.08 | $95.00 | $80.7K | 7.6K | 226 |

BABA | PUT | SWEEP | BULLISH | 12/20/24 | $3.45 | $3.35 | $3.35 | $90.00 | $67.0K | 6.5K | 227 |

BABA | PUT | TRADE | BULLISH | 11/15/24 | $13.35 | $13.1 | $13.1 | $105.00 | $65.5K | 3.8K | 58 |

关于阿里巴巴集团控股

阿里巴巴是全球最大的在线和移动商务公司,根据总商品交易量进行计量。它运营着中国的在线市场,包括淘宝(消费者对消费者)和天猫(商家对消费者)。中国零售业务部门是阿里巴巴最有价值的现金流业务。其它收入来源包括中国商业批发、国际商业零售/批发、地方消费者服务、云计算服务商、数字媒体和娱乐平台、菜鸟物流服务以及创新举措和其它业务。

经过对阿里巴巴集团控股有限公司期权交易模式的研究,我们现在的注意力直接转向了这家公司。这种转变使我们能够深入了解其当前的市场定位和表现

阿里巴巴集团目前的情况如何?

专家对阿里巴巴集团的看法

在过去的一个月里,3名行业分析师分享了他们对该股票的见解,提出了120.0美元的平均目标价。

在短短20天内,将1000美元变成1270美元?

一位拥有20年经验的期权交易员透露了他的单行图表技术,展示了何时买入和卖出。复制他的交易,平均每20天获利27%。点击这里获取访问权限。* 巴克莱银行的分析师对阿里巴巴集团维持超配评级,目标价为137美元。* 来自Baird的分析师决定对阿里巴巴集团维持跑赢大盘评级,目前的目标价为110美元。* 来自瑞穗的分析师决定对阿里巴巴集团维持跑赢大盘评级,目前的目标价为113美元。

期权交易具有更高的风险和潜在回报。精明的交易者通过不断地学习、调整策略、监控多个因子并密切关注市场动态来管理这些风险。通过Benzinga Pro的实时警报,了解最新的阿里巴巴Gr Hldgs期权交易。

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.