Markets Breath Sigh Of Relief After In-Line Inflation Data: Stocks Rebound As Small Caps, Bonds Soar

Markets Breath Sigh Of Relief After In-Line Inflation Data: Stocks Rebound As Small Caps, Bonds Soar

Investors can breathe a sigh of relief as October inflation data met economists' expectations, though the annual headline rate showed a slight uptick from the previous month.

投资者可以松一口气,因为十月份的通胀数据符合经济学家的预期,尽管年度核心指数略有上升,比上个月稍微增加。

As anticipated, the Consumer Price Index (CPI) rose 2.6% year-over-year in October, marking an increase from September's 2.4% but snapping six straight months of declines.

正如预期的那样,十月份消费者价格指数(CPI)同比上涨2.6%,高于9月份的2.4%,打破了连续六个月的下降趋势。

Excluding food and energy, core inflation held steady at 3.3% for the third consecutive month, highlighting some stickiness in underlying price pressures that remain above the Fed's 2% target.

除食品和能源外,核心通胀率连续第三个月保持在3.3%,凸显出一些基础价格压力的坚挺,仍高于联邦储备的2%目标。

In response to the data, speculators raised their expectations for an interest-rate cut, with increased bets on a 25-basis-point reduction in December. Market-implied probabilities now indicate a 79% likelihood of a December rate cut, up from 58% before the CPI report, as per the CME FedWatch tool.

对于这些数据的反应,投机者提高了对降息的预期,增加了对12月份降息25个基点的押注。市场隐含的概率现在表明,12月份降息的可能性为79%,而在CPI报告发布之前为58%,根据CME的FedWatch工具显示。

Following the release, Minneapolis Fed President Neel Kashkari expressed optimism about inflation's trajectory, stating on Bloomberg TV, "I have confidence inflation is headed in the right direction."

在数据发布后,明尼阿波利斯联储主席尼尔·卡什卡里对通胀走势表示乐观,在彭博电视台表示:“我相信通胀正在朝着正确的方向发展。”

On Tuesday, Kashkari had flagged the risk of a rate pause in December if inflation data surprises to the upside.

卡什卡里周二提到,如果通胀数据出人意料地上升,可能会导致12月的利率暂停。

"I am not yet seeing a lot of upside inflation risks; the bigger risk is getting stuck," he added on Wednesday.

他在周三补充道:“我还没有看到很大的上行通胀风险;更大的风险是陷入僵局。”

Markets reacted positively, with U.S. equity futures slightly rising, while Treasury yields and the dollar eased amid increased rate-cut expectations.

市场积极反应,美国股指期货略有上涨,而国债收益率和美元因加剧的降息预期而下跌。

Market Reactions

市场反应

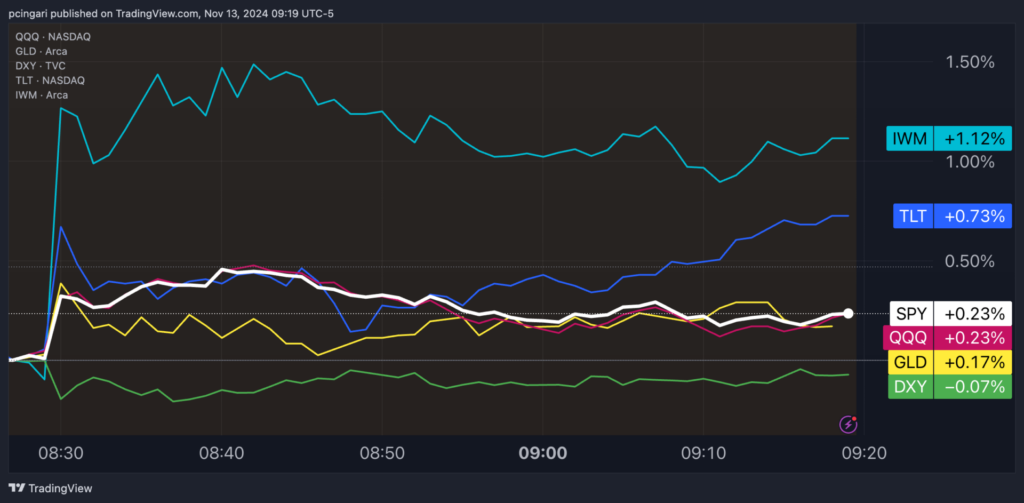

- The S&P 500, as tracked by the SPDR S&P 500 ETF Trust (NYSE:SPY), was 0.2% higher.

- The Nasdaq 100, followed by the Invesco QQQ Trust, Series 1 (NASDAQ:QQQ), inched 0.15% higher.

- Small caps outperformed large-cap counterparts, as the iShares Russell 2000 (NYSE:IWM), rallied 1.1% minutes ahead the New York open.

- Top-performing S&P 500 stocks during the premarket trading were Charter Communications Inc. (NASDAQ:CHTR), GE Vernova Inc. (NYSE:GEV) and Albemarle Corp. (NYSE:ALB) up 5.7%, 4% and 3.7%, respectively.

- Skyworks Solutions Inc. (NASDAQ:SWKS), Fair Isaac Corp. (NYSE:FICO) and Bio-Techne Corp. (NASDAQ:TECH) were the laggards, down 6.7%, 4.1% and 2.8%, respectively.

- Gold prices rose 0.3%, following three straight sessions of declines.

- The U.S. dollar index (DXY) slightly eased 0.1%.

- Treasury-linked ETFs rose, with the iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) up by 0.7%.

- 标普500指数,由SPDR标普500etf信托基金(纽交所:SPY)跟踪,上涨0.2%。

- 纳斯达克100指数,由Invesco QQQ信托系列1(纳斯达克:QQQ)跟踪,微涨0.15%。

- 小市值股表现优于大市值对手,iShares Russell 2000(纽交所:IWM)在纽约开盘前一分钟上涨了1.1%。

- 盘前交易中表现最佳的标普500股有特许通讯公司(纳斯达克:CHTR),GE Vernova公司(纽交所:GEV)和阿尔伯马尔公司(纽交所:ALB),分别上涨了5.7%,4%和3.7%。

- Skyworks Solutions公司(纳斯达克:SWKS),Fair Isaac公司(纽交所:FICO)和Bio-Techne公司(纳斯达克:TECH)是表现不佳的股票,分别下跌了6.7%,4.1%和2.8%。

- 黄金价格上涨了0.3%,在连续三个交易日下跌之后。

- 美元指数(DXY)略微下降了0.1%。

- 国债etf上涨,iShares 20+年期国债etf(纳斯达克:TLT)上涨0.7%。

- Wall Street Veteran Predicts S&P 500 To Hit 10,000 By 2029: 'Roaring 2020s'

- 华尔街老手预测标准普尔500指数到2029年达到1万点:'繁荣的20年代'

In response to the data,

In response to the data,