Smart Money Is Betting Big In CSCO Options

Smart Money Is Betting Big In CSCO Options

Financial giants have made a conspicuous bearish move on Cisco Systems. Our analysis of options history for Cisco Systems (NASDAQ:CSCO) revealed 21 unusual trades.

金融巨头对思科系统采取了明显的看跌举动。我们对思科系统(纳斯达克股票代码:CSCO)期权历史的分析显示了21笔不寻常的交易。

Delving into the details, we found 47% of traders were bullish, while 52% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $185,284, and 16 were calls, valued at $797,928.

深入研究细节,我们发现47%的交易者看涨,而52%的交易者表现出看跌趋势。在我们发现的所有交易中,有5笔是看跌期权,价值为185,284美元,16笔是看涨期权,价值797,928美元。

What's The Price Target?

目标价格是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $50.0 and $70.0 for Cisco Systems, spanning the last three months.

在评估了交易量和未平仓合约之后,很明显,主要市场走势者正在关注思科系统在过去三个月中介于50.0美元至70.0美元之间的价格区间。

Volume & Open Interest Trends

交易量和未平仓合约趋势

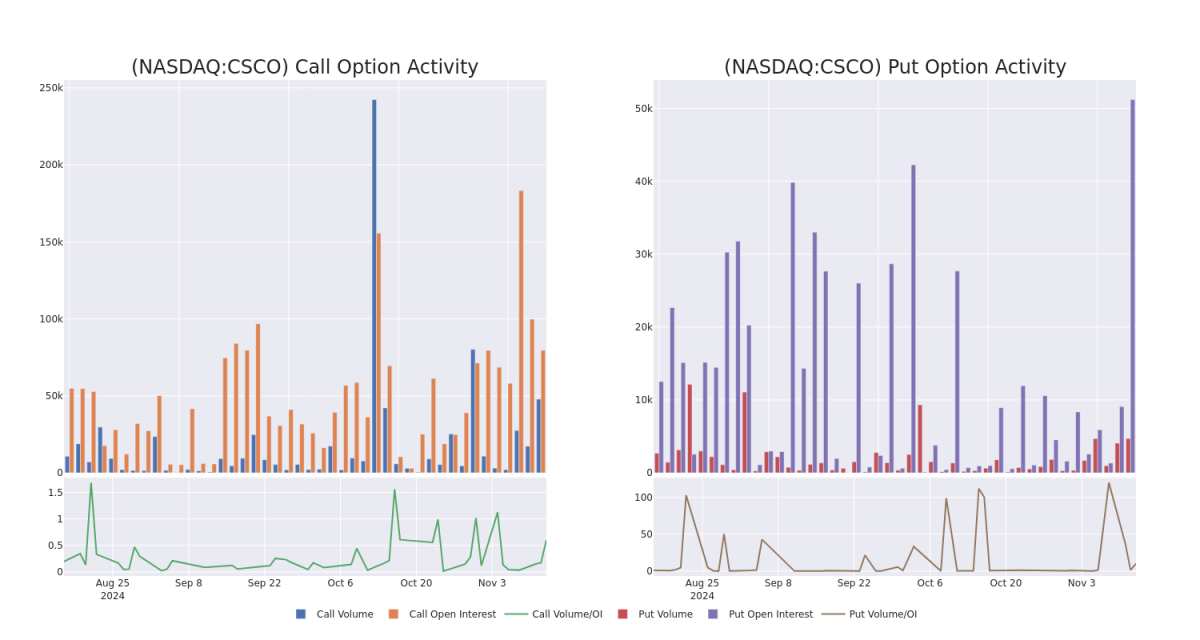

In today's trading context, the average open interest for options of Cisco Systems stands at 7690.71, with a total volume reaching 52,519.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Cisco Systems, situated within the strike price corridor from $50.0 to $70.0, throughout the last 30 days.

在当今的交易背景下,思科系统公司期权的平均未平仓合约为7690.71,总交易量达到52,519.00。随附的图表描绘了过去30天思科系统高价值交易的看涨期权和看跌期权交易量以及未平仓合约的变化,行使价走势从50.0美元到70.0美元不等。

Cisco Systems 30-Day Option Volume & Interest Snapshot

思科系统 30 天期权交易量和利息快照

Significant Options Trades Detected:

检测到的重要期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CSCO | CALL | SWEEP | BEARISH | 11/22/24 | $1.31 | $1.29 | $1.29 | $60.00 | $129.0K | 3.7K | 2.0K |

| CSCO | CALL | SWEEP | BEARISH | 01/17/25 | $0.19 | $0.17 | $0.17 | $70.00 | $76.8K | 7.9K | 7.5K |

| CSCO | CALL | SWEEP | BULLISH | 12/20/24 | $0.36 | $0.34 | $0.36 | $65.00 | $74.8K | 1.2K | 2.2K |

| CSCO | PUT | SWEEP | BEARISH | 11/15/24 | $0.48 | $0.46 | $0.48 | $55.00 | $72.0K | 11.9K | 1.8K |

| CSCO | CALL | SWEEP | BEARISH | 12/13/24 | $3.2 | $3.1 | $3.1 | $57.00 | $62.0K | 554 | 271 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CSCO | 打电话 | 扫 | 粗鲁的 | 11/22/24 | 1.31 美元 | 1.29 美元 | 1.29 美元 | 60.00 美元 | 129.0K | 3.7K | 2.0K |

| CSCO | 打电话 | 扫 | 粗鲁的 | 01/17/25 | 0.19 美元 | 0.17 美元 | 0.17 美元 | 70.00 美元 | 76.8 万美元 | 7.9K | 7.5K |

| CSCO | 打电话 | 扫 | 看涨 | 12/20/24 | 0.36 美元 | 0.34 美元 | 0.36 美元 | 65.00 美元 | 74.8 万美元 | 1.2K | 2.2K |

| CSCO | 放 | 扫 | 粗鲁的 | 11/15/24 | 0.48 美元 | 0.46 美元 | 0.48 美元 | 55.00 美元 | 72.0 万美元 | 11.9K | 1.8K |

| CSCO | 打电话 | 扫 | 粗鲁的 | 12/13/24 | 3.2 美元 | 3.1 美元 | 3.1 美元 | 57.00 美元 | 62.0 万美元 | 554 | 271 |

About Cisco Systems

关于思科系统

Cisco Systems is the largest provider of networking equipment in the world and one of the largest software companies in the world. Its largest businesses are selling networking hardware and software (where it has leading market shares) and cybersecurity software such as firewalls. It also has collaboration products, like its Webex suite, and observability tools. It primarily outsources its manufacturing to third parties and has a large sales and marketing staff-25,000 strong across 90 countries. Overall, Cisco employs 80,000 people and sells its products globally.

思科系统公司是世界上最大的网络设备提供商,也是世界上最大的软件公司之一。其最大的业务是销售网络硬件和软件(在其中占有领先的市场份额)以及防火墙等网络安全软件。它还拥有协作产品,例如其Webex套件和可观察性工具。它主要将其制造外包给第三方,拥有庞大的销售和营销人员,在90个国家拥有25,000名员工。总体而言,思科拥有8万名员工,并在全球销售其产品。

Following our analysis of the options activities associated with Cisco Systems, we pivot to a closer look at the company's own performance.

在分析了与思科系统相关的期权活动之后,我们转而仔细研究公司自身的表现。

Present Market Standing of Cisco Systems

思科系统目前的市场地位

- Trading volume stands at 8,619,036, with CSCO's price down by -0.14%, positioned at $58.63.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 0 days.

- 交易量为8,619,036美元,CSCO的价格下跌了-0.14%,至58.63美元。

- RSI指标显示该股可能接近超买。

- 预计将在0天内公布财报。

What Analysts Are Saying About Cisco Systems

分析师对思科系统的看法

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $64.0.

在过去的30天中,共有2位专业分析师对该股发表了看法,将平均目标股价定为64.0美元。

Turn $1000 into $1270 in just 20 days?

在短短 20 天内将 1000 美元变成 1270 美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Citigroup has elevated its stance to Buy, setting a new price target at $62. * An analyst from JP Morgan upgraded its action to Overweight with a price target of $66.

20年专业期权交易员透露了他的单线图技术,该技术显示何时买入和卖出。复制他的交易,平均每20天获利27%。点击此处查看。* 花旗集团的一位分析师已将其立场上调至买入,将新的目标股价定为62美元。*摩根大通的一位分析师将其行动上调至增持,目标股价为66美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Cisco Systems options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。借助 Benzinga Pro 的实时警报,随时了解最新的思科系统期权交易。

In today's trading context, the average open interest for options of Cisco Systems stands at 7690.71, with a total volume reaching 52,519.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Cisco Systems, situated within the strike price corridor from $50.0 to $70.0, throughout the last 30 days.

In today's trading context, the average open interest for options of Cisco Systems stands at 7690.71, with a total volume reaching 52,519.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Cisco Systems, situated within the strike price corridor from $50.0 to $70.0, throughout the last 30 days.