Decoding Energy Transfer's Options Activity: What's the Big Picture?

Decoding Energy Transfer's Options Activity: What's the Big Picture?

High-rolling investors have positioned themselves bullish on Energy Transfer (NYSE:ET), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in ET often signals that someone has privileged information.

高风险投资者已在energy transfer(纽交所:ET)上采取了看好的立场,零售交易者需要注意。这一活动今天通过Benzinga对公开可用期权数据的追踪引起了我们的注意。这些投资者的身份尚不确定,但在ET中如此显著的动作通常意味着有人掌握了内部信息。

Today, Benzinga's options scanner spotted 15 options trades for Energy Transfer. This is not a typical pattern.

今天,Benzinga的期权扫描仪发现了15笔energy transfer的期权交易。这并不是一个典型的模式。

The sentiment among these major traders is split, with 73% bullish and 26% bearish. Among all the options we identified, there was one put, amounting to $26,100, and 14 calls, totaling $793,981.

这些主要交易者的情绪各不相同,73%持看好态度,26%持看淡态度。在我们识别的所有期权中,有一笔看跌期权,金额为$26,100,还有14笔看涨期权,总计$793,981。

Predicted Price Range

预测价格区间

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $12.0 to $30.0 for Energy Transfer over the recent three months.

根据交易活动,显著投资者的目标价区间为energy transfer在最近三个月内的$12.0到$30.0。

Insights into Volume & Open Interest

成交量和持仓量分析

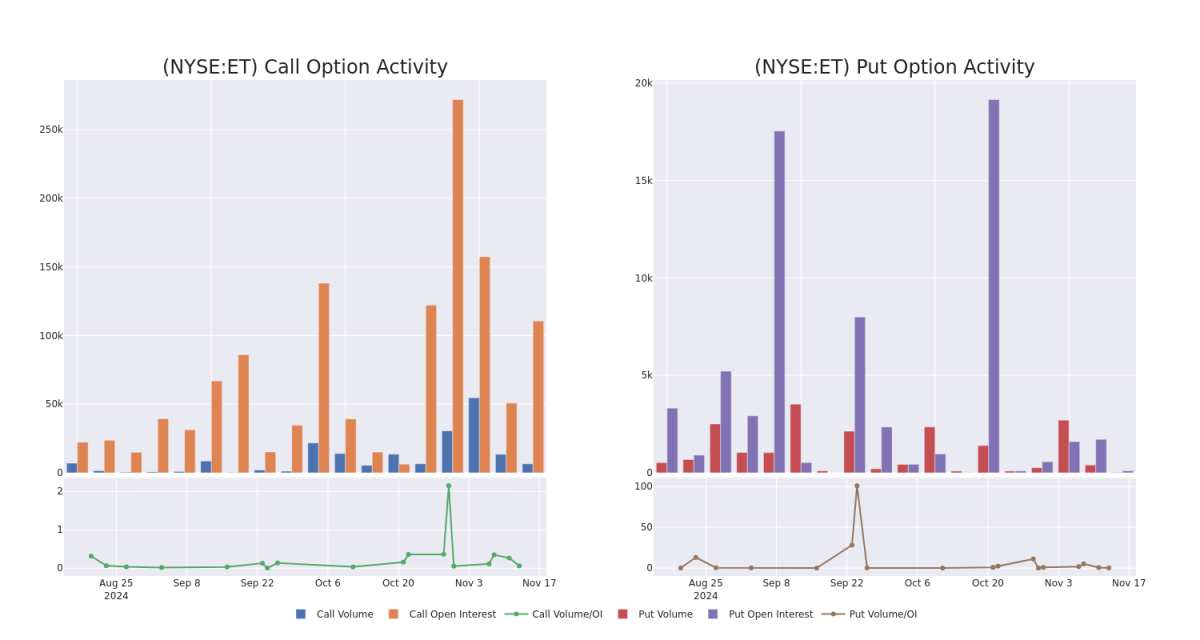

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Energy Transfer's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Energy Transfer's whale trades within a strike price range from $12.0 to $30.0 in the last 30 days.

查看成交量和未平仓合约是进行期权交易的强有力手段。这些数据可以帮助您跟踪energy transfer在特定执行价格下的流动性和兴趣。下面,我们可以观察到过去30天内energy transfer的鲸鱼交易在$12.0到$30.0的期权的成交量和未平仓合约的变化。

Energy Transfer Option Volume And Open Interest Over Last 30 Days

energy transfer过去30天的期权成交量和未平仓合约

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ET | CALL | SWEEP | BULLISH | 01/15/27 | $4.35 | $4.1 | $4.35 | $13.00 | $86.9K | 838 | 1.2K |

| ET | CALL | SWEEP | BULLISH | 01/15/27 | $4.35 | $4.1 | $4.35 | $13.00 | $86.9K | 838 | 801 |

| ET | CALL | SWEEP | BULLISH | 01/15/27 | $4.35 | $4.1 | $4.35 | $13.00 | $86.9K | 838 | 601 |

| ET | CALL | SWEEP | BULLISH | 01/15/27 | $4.35 | $4.25 | $4.35 | $13.00 | $86.9K | 838 | 401 |

| ET | CALL | SWEEP | BULLISH | 01/15/27 | $4.35 | $4.1 | $4.35 | $13.00 | $86.9K | 838 | 815 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| energy transfer | 看涨 | 扫单 | 看好 | 01/15/27 | $4.35 | $4.1 | $4.35 | $13.00 | $86.9K | 838 | 1.2K |

| energy transfer | 看涨 | 扫单 | 看好 | 01/15/27 | $4.35 | $4.1 | $4.35 | $13.00 | $86.9K | 838 | 801 |

| energy transfer | 看涨 | 扫单 | 看好 | 01/15/27 | $4.35 | $4.1 | $4.35 | $13.00 | 86.9K美元 | 838 | 601 |

| 能源传输 | 看涨 | 扫单 | 看好 | 01/15/27 | $4.35 | $4.25 | $4.35 | $13.00 | $86.9K | 838 | 401 |

| energy transfer | 看涨 | 扫盘 | 看好 | 01/15/27 | $4.35 | $4.1 | $4.35 | $13.00 | 86.9K美元 | 838 | 815 |

About Energy Transfer

有关能源转移的信息

Energy Transfer owns one of the largest portfolios of crude oil, natural gas, and natural gas liquid assets in the US, primarily in Texas and the US midcontinent region. Its pipeline network totals 130,000 miles. It also owns gathering and processing facilities, one of the largest fractionation facilities in the US, fuel distribution assets, and the Lake Charles gas liquefaction facility. It combined its publicly traded limited and general partnerships in October 2018.

Energy Transfer拥有美国最大的原油、天然气和天然气液体资产组合之一,主要位于得克萨斯州和美国中部地区。其管道网络总长13万英里。它还拥有采集和加工设施、美国最大的分馏设施之一、燃料分销资产以及莱克查尔斯天然气液化设施。该公司在2018年10月合并了其公开交易的有限合伙和普通合伙。

Current Position of Energy Transfer

energy transfer当前的位置

- Trading volume stands at 5,151,619, with ET's price up by 0.44%, positioned at $17.12.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 91 days.

- 交易量为5,151,619,ET的价格上涨了0.44%,定位在$17.12。

- RSI指标显示该股票可能接近超买。

- 预计将在91天内公布收益声明。

What The Experts Say On Energy Transfer

能源转移方面专家的观点是什么

2 market experts have recently issued ratings for this stock, with a consensus target price of $20.0.

两位市场专家最近对这只股票发布了评级,达成的共识目标价为20.0美元。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from B of A Securities has revised its rating downward to Buy, adjusting the price target to $20. * Maintaining their stance, an analyst from RBC Capital continues to hold a Outperform rating for Energy Transfer, targeting a price of $20.

一位拥有20年经验的期权交易专家揭示了他的一行图表技巧,显示何时买入和卖出。复制他的交易,每20天平均获得27%的利润。点击此处获取访问权限。* 一位来自美国银行证券的分析师已下调其评级至买入,将目标价调整为20美元。* 根据保持的立场,来自RBC Capital的分析师继续对Energy Transfer维持跑赢大盘评级,目标价格为20美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Energy Transfer options trades with real-time alerts from Benzinga Pro.

期权交易涉及更高的风险和潜在回报。精明的交易员通过不断学习、调整策略、监控多个因子并密切关注市场变化来管理这些风险。通过Benzinga Pro的实时提醒了解最新的Energy Transfer期权交易情况。

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $12.0 to $30.0 for Energy Transfer over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $12.0 to $30.0 for Energy Transfer over the recent three months.