SICC Co., Ltd.'s (SHSE:688234) Price Is Out Of Tune With Revenues

SICC Co., Ltd.'s (SHSE:688234) Price Is Out Of Tune With Revenues

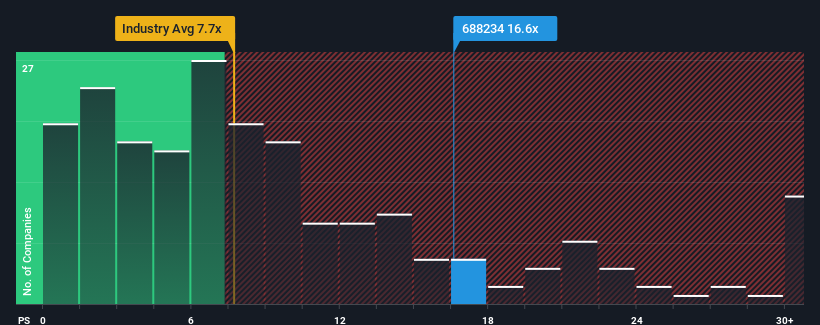

With a price-to-sales (or "P/S") ratio of 16.6x SICC Co., Ltd. (SHSE:688234) may be sending very bearish signals at the moment, given that almost half of all the Semiconductor companies in China have P/S ratios under 7.7x and even P/S lower than 3x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

How SICC Has Been Performing

With revenue growth that's superior to most other companies of late, SICC has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on SICC will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For SICC?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like SICC's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 76% last year. The latest three year period has also seen an excellent 246% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Taking a look back first, we see that the company grew revenue by an impressive 76% last year. The latest three year period has also seen an excellent 246% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 38% per year during the coming three years according to the eleven analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 46% each year, which is noticeably more attractive.

With this information, we find it concerning that SICC is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From SICC's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite analysts forecasting some poorer-than-industry revenue growth figures for SICC, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for SICC that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.