Market Mover | The Cryptocurrency Sector Shows Signs of Recovery Post-Market

Market Mover | The Cryptocurrency Sector Shows Signs of Recovery Post-Market

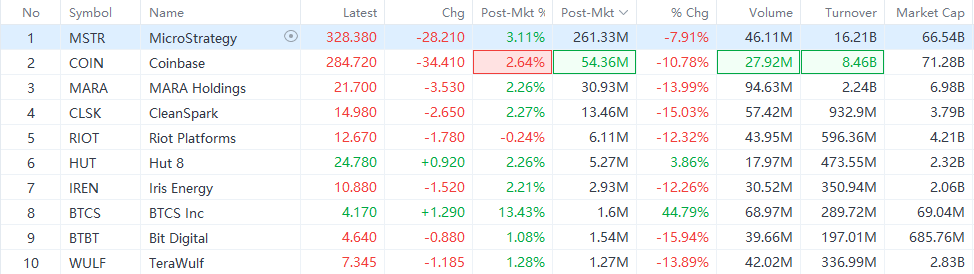

November 14, 2024 - Despite a dip in the cryptocurrency sector during the session, a rebound was observed post-market. $MicroStrategy (MSTR.US)$ shares rose 3.11% to $328.38, $Coinbase (COIN.US)$ shares rose 2.64% to $284.72, and $MARA Holdings (MARA.US)$ shares rose 2.26% to $21.70 in post-market trading on Wednesday. This swing comes amid heightened optimism and speculation regarding Bitcoin potentially reaching the $100,000 mark soon, a scenario bolstered by a series of events and market dynamics.

2024年11月14日 - 尽管在会议期间数字货币板块出现下滑,但在美股盘后观察到了反弹。 $MicroStrategy (MSTR.US)$ 股票上涨3.11%,至328.38美元, $Coinbase (COIN.US)$ 股票上涨2.64%,至284.72美元, $MARA Holdings (MARA.US)$ 股票在周三的美股盘后交易中上涨2.26%,至21.70美元。这一波动发生在对比特币可能很快达到100,000美元的高度乐观和投机之中,这种情况得到了系列事件和市场动态的支持。

Bitcoin experienced a remarkable surge in Wednesday's trading session, briefly breaking through the $93,000 threshold before retreating.

比特币在周三的交易中经历了显著的上涨,短暂突破了$93,000的关口后回落。

The resurgence in bullish sentiment followed a brief pause, gaining momentum when Donald Trump's victory in the U.S. presidential election was confirmed. The market responded positively, with Bitcoin not only surpassing the significant $90,000 barrier but climbing to an all-time high of $93,483.

看好情绪的复苏在短暂停顿后再次升温,特别是在特朗普概念在美国总统选举中获胜得到确认后。市场反应积极,比特币不仅突破了90,000美元的重大障碍,还攀升至93,483美元的历史新高。

Financial inflows into the sector have been robust. Earlier in the week, inflows into the U.S. spot Bitcoin ETF surpassed $1 billion, indicating strong and sustained interest from institutional investors. Wall Street's optimism, fueled by Trump's commitment to heavily back the cryptocurrency sector and his aim to transform the U.S. into a global crypto hub, has played a significant role. Speculators are betting on a more relaxed regulatory environment and anticipate the establishment of a cryptocurrency reserve fund to support ongoing demand.

流入行业板块的资金非常强劲。本周早些时候,流入美国现货比特币etf的资金超过了10亿,显示出机构投资者的强烈和持续的兴趣。华尔街的乐观情绪,由特朗普承诺大力支持数字货币行业及其将美国转变为全球数字货币中心的目标推动,起到了重要作用。投机者押注于监管环境会更加宽松,并预期将建立数字货币储备基金以支持持续需求。

High-profile financial experts have also weighed in on the potential of Bitcoin. Michael Novogratz, CEO of Galaxy Digital, proposing that Bitcoin could rival gold as a reserve asset within a decade. However, he also noted the low probability of Bitcoin becoming a reserve asset itself immediately, suggesting a more cautious long-term outlook.

一些高知名度的财务专家也对比特币的潜力进行了评估。Galaxy Digital的首席执行官迈克尔·诺沃格拉茨认为,比特币在十年内可能会与黄金相媲美,成为储备资产。然而,他也指出,比特币立即成为储备资产的可能性较低,建议采取更为谨慎的长期展望。

Despite the potential for further gains, some market skeptics caution that a lot of positive news may already be reflected in Bitcoin's current price. Additionally, rising U.S. bond yields and the strengthening dollar, which translate into higher borrowing costs, are unfavorable for risk assets like cryptocurrencies.

尽管可能会有进一步的上涨,但一些市场怀疑者警告说,许多积极消息可能已经反映在比特币当前的价格中。此外,美国债券收益率上升和美元走强,导致借贷成本上升,这对数字货币等风险资产是不利的。

From October 12, Bitcoin has been on a strong uptrend, marking a year-to-date increase of over 110%. Unlike in instances when Bitcoin reached all-time highs, traders and investors are not inclined to cash in their gains, indicating a strong belief in the cryptocurrency's value appreciation in the coming days and months. According to Glassnode, there is room for further price increases before potential demand exhaustion sets in.

从10月12日起,比特币经历了强劲的上升趋势,年初至今涨幅超过110%。与比特币曾达到历史高点时不同,交易者和投资者并不倾向于兑现他们的收益,这表明对数字货币在未来几天和几个月内价值上涨的强烈信心。根据Glassnode的数据,在潜在需求枯竭之前,价格还有进一步上涨的空间。

Financial inflows into the sector have been robust. Earlier in the week, inflows into the U.S. spot Bitcoin ETF surpassed $1 billion, indicating strong and sustained interest from institutional investors. Wall Street's optimism, fueled by Trump's commitment to heavily back the cryptocurrency sector and his aim to transform the U.S. into a global crypto hub, has played a significant role.

Financial inflows into the sector have been robust. Earlier in the week, inflows into the U.S. spot Bitcoin ETF surpassed $1 billion, indicating strong and sustained interest from institutional investors. Wall Street's optimism, fueled by Trump's commitment to heavily back the cryptocurrency sector and his aim to transform the U.S. into a global crypto hub, has played a significant role.