Market Mover | Catapult shares surge 8% following strong earnings performance

Market Mover | Catapult shares surge 8% following strong earnings performance

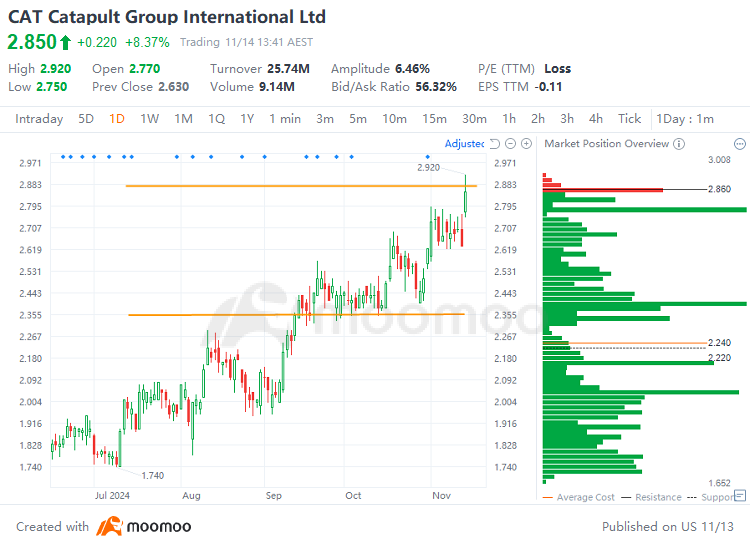

$Catapult Group International Ltd (CAT.AU)$ shares rose 8.37% on Thursday, with trading volume expanding to A$25.74 million. Catapult has rose 7.05% over the past week, with a cumulative gain of 108.70% year-to-date.

$Catapult Group International Ltd (CAT.AU)$ 周四,Catapult的股票上涨了8.37%,成交量扩大至2574万澳元。过去一周,Catapult上涨了7.05%,年初至今累计涨幅为108.70%。

Catapult's technical analysis chart:

Catapult的技术面分析图:

Technical Analysis:

技术面分析:

Support: A$2.35

Resistance: A$2.86

Price range A$2.35 to A$2.86: The trading range indicates a heavy concentration of buy orders, with the stock price on an upward trend. The stock repeatedly touched the level near A$2.35, where it found significant support and subsequently rebounded. There is a strong presence of buy orders around A$2.35, suggesting a robust foundation for the price. There is considerable upward pressure near the resistance level of A$2.86, with a lot of profit-taking positions, which suggests strong selling pressure. Going forward, it will be crucial to monitor whether the stock can effectively break through the resistance level at A$2.86.

压力位:A$2.35

支撑位:A$2.86

价格区间A$2.35至A$2.86:该交易区间表明买入订单高度集中,股价呈上升趋势。股价多次触及A$2.35附近的水平,此处找到了显著的支撑并随后反弹。在A$2.35附近买入订单强劲,表明该价格有坚实的基础。在支撑位A$2.86附近存在相当大的上行压力,很多获利了结的仓位,这表明强烈的卖出压力。未来,需要密切关注该股票能否有效突破A$2.86的支撑位。

Market News :

市场资讯:

Catapult announced its financial results for the first half of the fiscal year 2025 ended September 30, 2024.

Catapult公布了截至2024年9月30日的2025财年上半年的财务结果。

The Annualized Contract Value (ACV), which is Catapult's key indicator of future revenue, saw a 20% increase YoY on a constant currency basis, reaching $96.8 million US dollars (or A$143 million). Revenues grew to $57.8 million US dollars (or A$85 million), marking a 19% increase YoY on a constant currency basis. The profit margin from additional revenue generated was 75% YoY, resulting in a Free Cash Flow (FCF) of $4.8 million US dollars (or A$7 million). ACV retention remained robust at 96.2%. The Customer Lifetime Duration increased by 7% YoY to 7.6 years. The number of Pro Team Customers grew by 7.9% YoY, reaching 3,470 teams.

年化合同价值(ACV)是Catapult未来营业收入的关键指标,按固定货币计算同比增长20%,达9680万美金(或14300万澳元)。营业收入增长至5780万美金(或8500万澳元),在固定货币基础上同比增长19%。额外营业收入的利润率同比为75%,自然而然产生了480万美金(或700万澳元)的自由现金流(FCF)。ACV保留率保持强劲,为96.2%。客户生命周期持续增长,同比增加7%,达7.6年。专业团队客户数量同比增长7.9%,达到3470个团队。

Commenting on the outlook for the Company, Mr Lopes said:

在谈到公司的前景时,Lopes先生说:

Our objective remains to deliver on our strategic priorities, emphasizing profitable growth. For the entirety of FY25, we continue to expect ACV growth to remain strong with low churn, continued improvement in cost margins towards long-term targets, and higher free cash flow.

我们的目标依然是实现我们在策略上的优先事项,强调盈利增长。在2025财年的整个期间,我们仍然预期ACV增长将保持强劲,客户流失率低,成本利润不断改善,朝着长期目标迈进,以及更高的自由现金流。

Overall Analysis:

总体分析:

Fundamentally, focus on the company's performance and operational status. Technically, it is necessary to monitor whether the stock price continues to stay within the upward channel, whether the support at the bottom of the channel remains valid, and whether the resistance level can be effectively broken through.

基本上,专注于公司的表现和运营状况。从技术上讲,有必要监测股价是否继续保持在上升通道内,渠道底部的支撑是否保持有效,以及阻力位是否能够有效突破。

In this scenario, investors should adopt a cautious strategy, setting stop-loss points to manage risk and maintaining ongoing vigilance regarding company developments and market conditions.

在这种情况下,投资者应采取谨慎的策略,设置止损点来管理风险,并对公司发展和市场情况保持持续警惕。

Resistance: A$2.86

Resistance: A$2.86