Cathie Wood's Ark Invest Says Energy Bottlenecks Can't Stop AI Growth: Companies Could Go Partially Off-Grid

Cathie Wood's Ark Invest Says Energy Bottlenecks Can't Stop AI Growth: Companies Could Go Partially Off-Grid

In a blog post on Wednesday, Cathie Wood-led ARK Invest has projected that the growth and profitability of AI data centers will remain strong, despite increasing power demand and costs.

在星期三的博客发帖中,由凯西·伍德领导的ark预测,尽管电力需求和成本不断增加,人工智能数据中心的增长和盈利能力仍将保持强劲。

What Happened: The blog written by Sam Korus, director of Research Autonomous Technology & Robotics at ARK Invest, indicates that AI companies could partially operate off-grid through independent power generation.

事件回顾:由ark的研究自主技术与机器人部门董事Sam Korus撰写的博客指出,人工智能公司可以通过独立的电力生成部分地实现离网运行。

For example, Tesla and SpaceX CEO Elon Musk has used generators to power xAI's data center in Memphis, Tennessee, bypassing full grid interconnection.

例如,特斯拉和spacex(临时代码)首席执行官埃隆·马斯克曾使用发电机为位于田纳西州孟菲斯的xAI数据中心供电,绕过完全的电网连接。

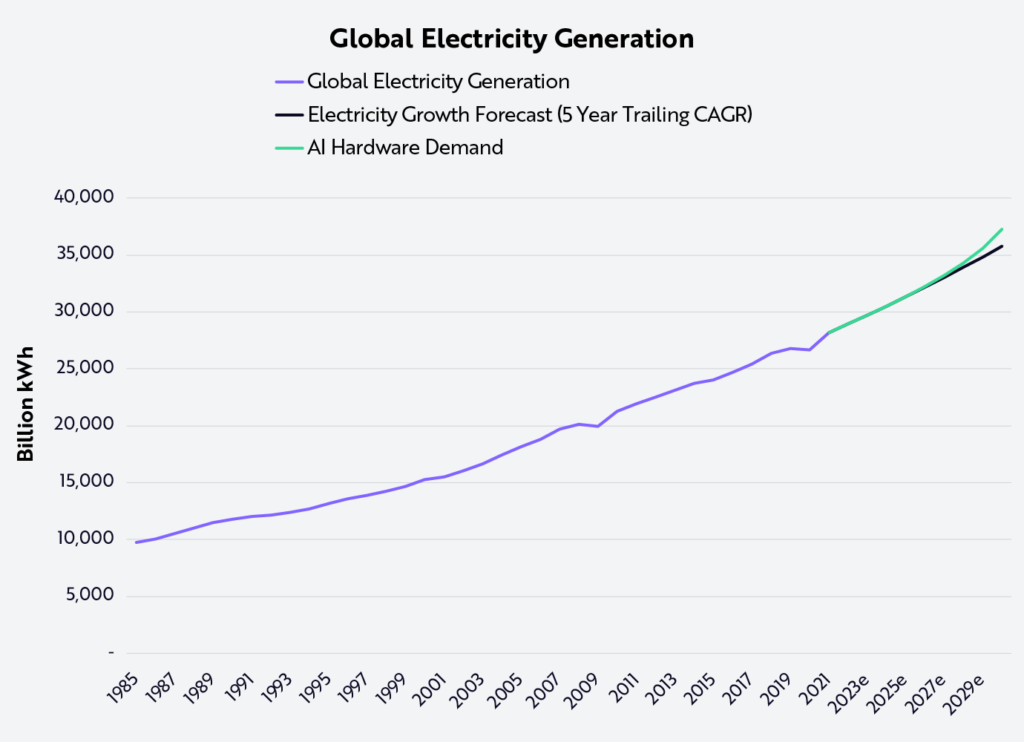

ARK estimates that the additional demand from AI data centers will drive the growth in global electricity demand to 3.2% at a compound annual rate through 2030.

ark估计,来自人工智能数据中心的额外需求将推动全球电力需求以3.2%的复合年增长率增长,直到2030年。

This is despite the average growth in electricity production globally being around 2.7% annually for the past five years.

尽管全球电力生产的平均增长率在过去五年中大约为2.7%。

Source: ARK Invest

资料来源:ark

ARK's research also suggested that the time required to build new generation and distribution capacity will not be a limiting factor.

ark的研究还表明,建设新的发电和配电能力所需的时间不会成为限制因素。

Electricity accounts for approximately 9% of total AI data center costs, leaving ample room for companies to invest in expedited, non-grid power solutions without disrupting data center economics.

电力占人工智能数据中心总成本的约9%,为公司投资加速的非电网电力解决方案留下了充足的空间,而不会破坏数据中心的经济性。

The research suggested that the incremental capital required to meet the incremental electricity demand would be around $235 billion in 2030, roughly 6% of what ARK expects to be spent on AI hardware that year.

研究表明,到2030年,满足额外电力需求所需的增量资本将约为2350亿美元,这大约是ark预计当年在人工智能硬件上支出的6%。

AI data center growth and profitability should remain strong despite rising power demand and costs. Independent power generation could allow AI companies to operate partially off-grid, expediting development. @skorusARK details more in a new research blog.

— ARK Invest (@ARKInvest) November 13, 2024

尽管电力需求和成本上升,人工智能数据中心的增长和盈利能力仍应保持强劲。独立发电可以让人工智能公司在一定程度上实现离网运营,加快发展。@skorusark在新的研究博客中详细介绍。

— ark投资(@ARKInvest)2024年11月13日

Why It Matters: The power demand for AI has been a topic of concern, with President-elect Donald Trump previously expressing shock at AI's substantial electricity demands in a conversation with Musk.

为什么这很重要:人工智能的电力需求一直以来都是一个令人担忧的话题,当选总统特朗普曾在与穆斯克的对话中对人工智能的巨大电力需求表示震惊。

Earlier, the CEO of Oklo Inc., Jacob DeWitte, also highlighted the "mind-blowing" demand for AI power, noting that Alphabet Inc.—Google's parent company—partnering with Kairos Power is just the beginning for nuclear power startups eager to collaborate with major tech firms.

早些时候,Oklo Inc.的首席执行官雅各布·德维特也强调了人工智能电力的"令人震惊"的需求,并指出alphabet inc.(谷歌母公司)与Kairos Power的合作仅仅是渴望与大型科技公司合作的核电初创公司的开始。

In April 2024, it was reported that if energy efficiency does not improve, AI data centers could account for up to a quarter of U.S. power demand by the decade's end.

2024年4月有报道称,如果能源效率没有改善,到本世纪末,人工智能数据中心可能占美国电力需求的四分之一。

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

免责声明:本内容部分由Benzinga Neuro帮助制作,并经Benzinga编辑审查和发布。

ARK estimates that the additional demand from AI data centers will drive the growth in global electricity demand to 3.2% at a compound annual rate through 2030.

ARK estimates that the additional demand from AI data centers will drive the growth in global electricity demand to 3.2% at a compound annual rate through 2030.