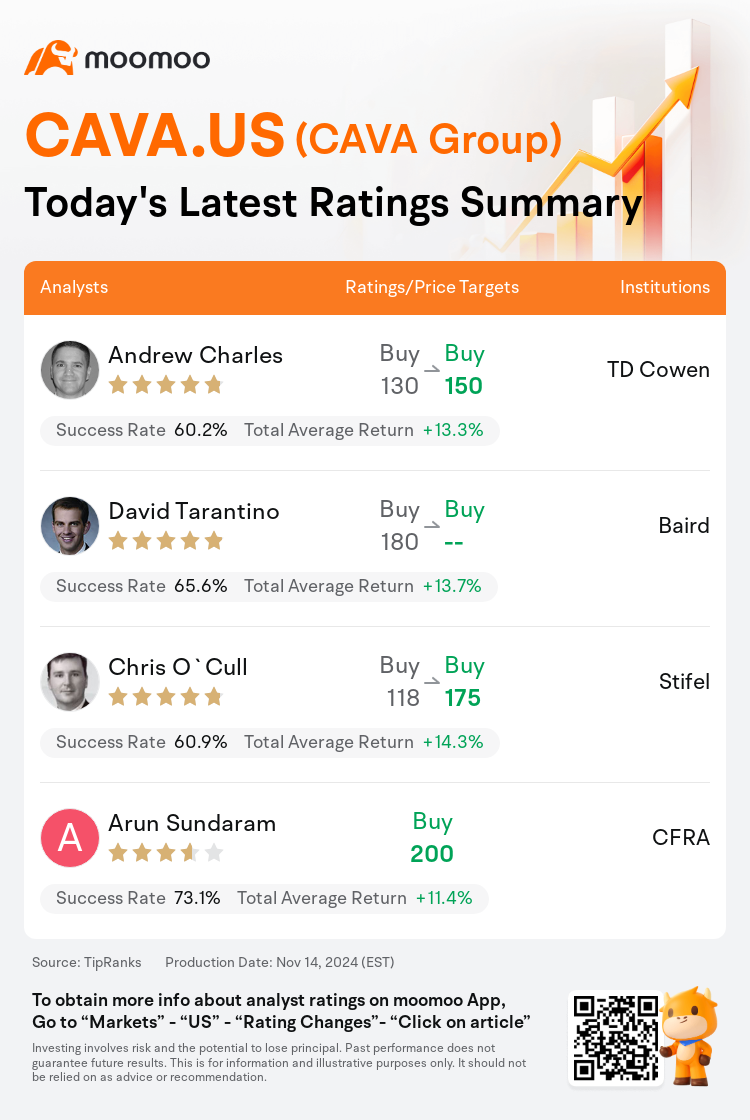

On Nov 14, major Wall Street analysts update their ratings for $CAVA Group (CAVA.US)$, with price targets ranging from $150 to $200.

TD Cowen analyst Andrew Charles maintains with a buy rating, and adjusts the target price from $130 to $150.

Baird analyst David Tarantino maintains with a buy rating.

Stifel analyst Chris O`Cull maintains with a buy rating, and adjusts the target price from $118 to $175.

Stifel analyst Chris O`Cull maintains with a buy rating, and adjusts the target price from $118 to $175.

CFRA analyst Arun Sundaram initiates coverage with a buy rating, and sets the target price at $200.

Furthermore, according to the comprehensive report, the opinions of $CAVA Group (CAVA.US)$'s main analysts recently are as follows:

Cava Group's multi-regional success is solidifying its path to eventually achieve national scale, as evidenced by its third-quarter headline same-store sales growth of 18.1%, which surpassed even the highest industry expectations. The company's stock performance has consistently exceeded initial predictions.

Cava Group's third quarter outperformance is evident in its comparable sales, margin, and EBITDA figures. The expectations for the company's 2024 outlook have been elevated, with indications of mid-to-high teens comparable sales growth in the fourth quarter and a robust two-year stack ranging between 25% to 30%.

Cava Group has once again exceeded expectations and increased future projections during the latest quarter. The company is set to quicken its new store openings by 2025. The unique position of Cava in a category that is challenging to replicate for home consumption, along with its increasing brand recognition, continues to drive its success.

After reporting a strong performance across the board in Q3, with comparable sales surpassing both the company's own forecasts and the average market predictions, the company has uplifted its projections for same-restaurant sales growth and yearly AEBITDA. Furthermore, initial goals for 2025 were set forth. It was also noted with approval that the company showcased enough confidence in its new unit pipeline and returns to aim for a net unit growth rate that surpasses its longstanding objective of 15%+. The company's decision to reinvest any enhanced leverage back into its team members and customers was also met with agreement.

The firm expressed satisfaction with the sales-driven third quarter outperformance and the increased guidance for 2024, which is underpinned by tangible sales drivers, alongside enhancements in brand recognition and consumer contentment.

Here are the latest investment ratings and price targets for $CAVA Group (CAVA.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

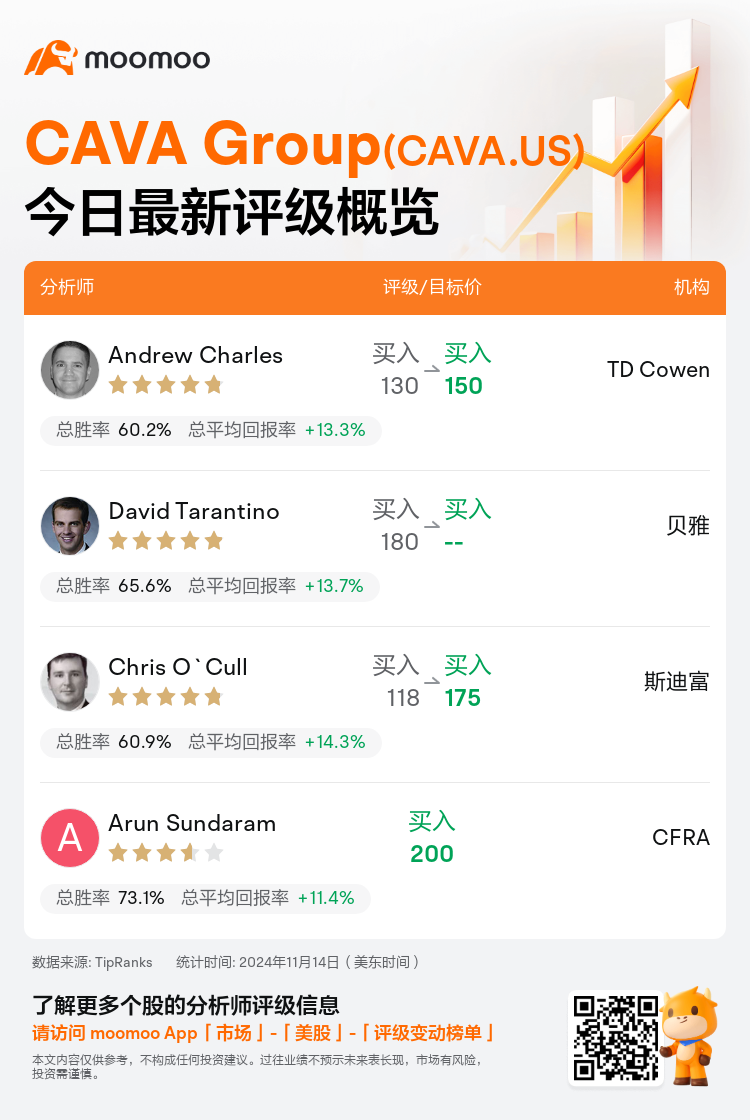

美东时间11月14日,多家华尔街大行更新了$CAVA Group (CAVA.US)$的评级,目标价介于150美元至200美元。

TD Cowen分析师Andrew Charles维持买入评级,并将目标价从130美元上调至150美元。

贝雅分析师David Tarantino维持买入评级。

斯迪富分析师Chris O`Cull维持买入评级,并将目标价从118美元上调至175美元。

斯迪富分析师Chris O`Cull维持买入评级,并将目标价从118美元上调至175美元。

CFRA分析师Arun Sundaram首予买入评级,目标价200美元。

此外,综合报道,$CAVA Group (CAVA.US)$近期主要分析师观点如下:

Cava Group的跨区域成功正巩固其最终实现国家规模的道路,其第三季度同店销售增长率为18.1%,超出了行业最高预期。该公司的股票表现始终超过最初的预测。

Cava Group的第三季度表现优异体现在其可比销售额、利润率和EBITDA数据中。公司2024年展望的期待值已经提升,表明第四季度可比销售额将增长15%至20%之间,并且前两年的累积增长幅度将在25%至30%之间。

Cava Group再次超越预期,并在最新季度增加了未来的预测。该公司计划加快到2025年的新店开业速度。Cava在不易复制的家庭消费类别中的独特地位,以及其日益增加的品牌知名度,继续推动其成功。

在第三季度各项业绩强劲的报告中,可比销售业绩超过了公司自身的预测和市场平均预测,公司提升了同店销售增长和年度AEBITDA的预测。此外,已制定了2025年的初始目标。还值得注意的是,公司对其新单位管道和回报展现出足够的信恳智能,以实现超过15%以上的净单位增长率的目标。该公司决定将任何增加的杠杆重新投入到其团队成员和客户中,这一决定也得到了赞同。

公司对以销售驱动的第三季度优异表现和2024年增加的指导意见表示满意,这一点得到了切实销售推动因素的支撑,以及品牌认知和消费者满意度的提升。

以下为今日4位分析师对$CAVA Group (CAVA.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

斯迪富分析师Chris O`Cull维持买入评级,并将目标价从118美元上调至175美元。

斯迪富分析师Chris O`Cull维持买入评级,并将目标价从118美元上调至175美元。

Stifel analyst Chris O`Cull maintains with a buy rating, and adjusts the target price from $118 to $175.

Stifel analyst Chris O`Cull maintains with a buy rating, and adjusts the target price from $118 to $175.