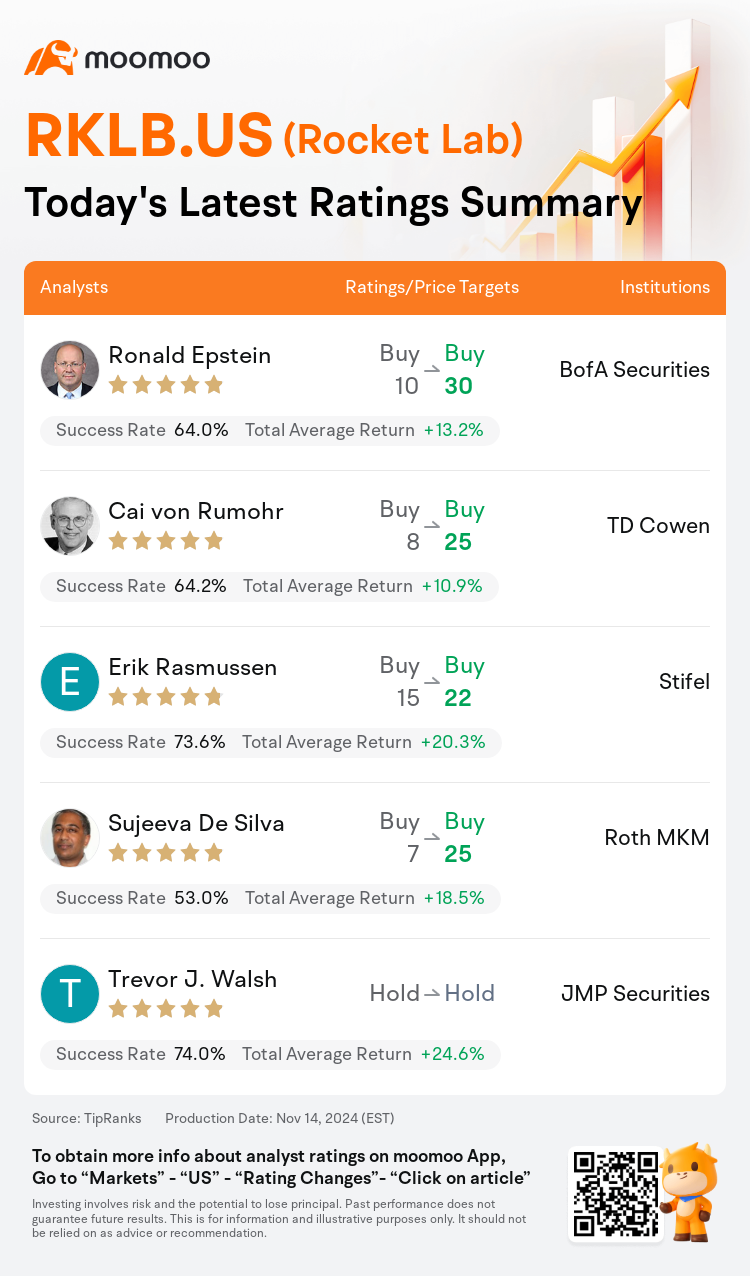

On Nov 14, major Wall Street analysts update their ratings for $Rocket Lab (RKLB.US)$, with price targets ranging from $22 to $30.

BofA Securities analyst Ronald Epstein maintains with a buy rating, and adjusts the target price from $10 to $30.

TD Cowen analyst Cai von Rumohr maintains with a buy rating, and adjusts the target price from $8 to $25.

Stifel analyst Erik Rasmussen maintains with a buy rating, and adjusts the target price from $15 to $22.

Stifel analyst Erik Rasmussen maintains with a buy rating, and adjusts the target price from $15 to $22.

Roth MKM analyst Sujeeva De Silva maintains with a buy rating, and adjusts the target price from $7 to $25.

JMP Securities analyst Trevor J. Walsh maintains with a hold rating.

Furthermore, according to the comprehensive report, the opinions of $Rocket Lab (RKLB.US)$'s main analysts recently are as follows:

Rocket Lab's progression in launch and spacecraft development is solidifying its position as a vital comprehensive space service provider. The company's advancement toward stronger free cash flow from Space Systems and Electron's profitability, coupled with reduced market risk and a more favorable beta as Neutron's risks diminish, supports the view of Rocket Lab becoming an important player in the space industry.

Rocket Lab reported revenue at the higher end of its guidance and a smaller than anticipated adjusted EBITDA loss. Significantly, the company secured their initial launch contract for its Neutron rocket, reinforcing confidence in their planned maiden test flight in mid-2025. This development indicates robust demand for a secondary launch provider in the market, following the industry leader.

Rocket Lab has received a multi-launch order for its Neutron vehicle, with the inaugural launch anticipated to take place in 2025.

Here are the latest investment ratings and price targets for $Rocket Lab (RKLB.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

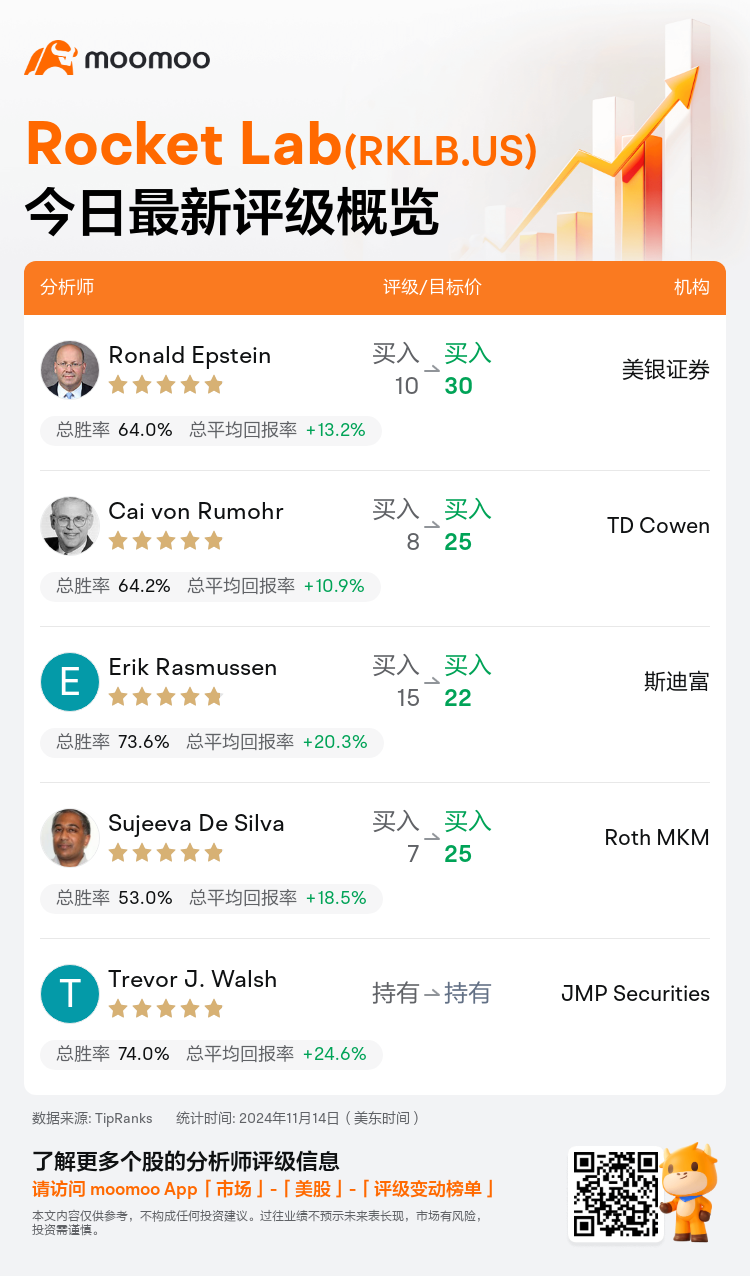

美东时间11月14日,多家华尔街大行更新了$Rocket Lab (RKLB.US)$的评级,目标价介于22美元至30美元。

美银证券分析师Ronald Epstein维持买入评级,并将目标价从10美元上调至30美元。

TD Cowen分析师Cai von Rumohr维持买入评级,并将目标价从8美元上调至25美元。

斯迪富分析师Erik Rasmussen维持买入评级,并将目标价从15美元上调至22美元。

斯迪富分析师Erik Rasmussen维持买入评级,并将目标价从15美元上调至22美元。

Roth MKM分析师Sujeeva De Silva维持买入评级,并将目标价从7美元上调至25美元。

JMP Securities分析师Trevor J. Walsh维持持有评级。

此外,综合报道,$Rocket Lab (RKLB.US)$近期主要分析师观点如下:

火箭实验室在发射和航天器开发方面的进展巩固了其作为重要综合空间服务提供商的地位。公司在太空系统的自由现金流日益强劲,以及电子火箭的盈利能力,加上市场风险的降低和随着中子火箭风险的减少而变得更加有利的贝塔系数,支持了火箭实验室成为太空行业重要参与者的观点。

火箭实验室报告其营业收入处于指导范围的高端,调整后的EBITDA损失小于预期。值得注意的是,该公司获得了其中子火箭的首个发射合同,进一步增强了对其计划在2025年中期进行首次测试飞行的信恳智能。这一发展表明市场对第二个发射服务提供商有着强劲的需求,跟随行业领导者之后。

火箭实验室已获得其中子火箭的多次发射订单,预计首次发射将在2025年进行。

以下为今日5位分析师对$Rocket Lab (RKLB.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

斯迪富分析师Erik Rasmussen维持买入评级,并将目标价从15美元上调至22美元。

斯迪富分析师Erik Rasmussen维持买入评级,并将目标价从15美元上调至22美元。

Stifel analyst Erik Rasmussen maintains with a buy rating, and adjusts the target price from $15 to $22.

Stifel analyst Erik Rasmussen maintains with a buy rating, and adjusts the target price from $15 to $22.