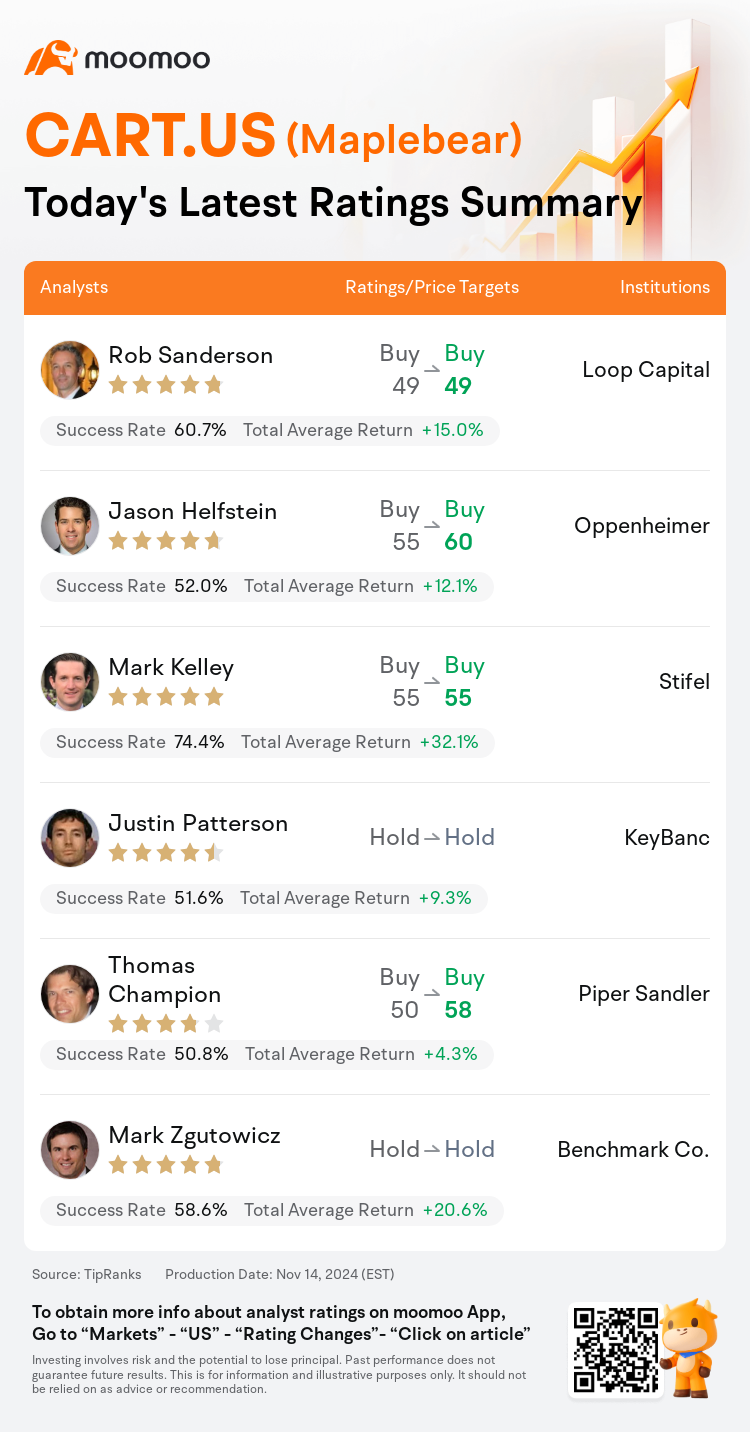

On Nov 14, major Wall Street analysts update their ratings for $Maplebear (CART.US)$, with price targets ranging from $49 to $60.

Loop Capital analyst Rob Sanderson maintains with a buy rating, and maintains the target price at $49.

Oppenheimer analyst Jason Helfstein maintains with a buy rating, and adjusts the target price from $55 to $60.

Stifel analyst Mark Kelley maintains with a buy rating, and maintains the target price at $55.

Stifel analyst Mark Kelley maintains with a buy rating, and maintains the target price at $55.

KeyBanc analyst Justin Patterson maintains with a hold rating.

Piper Sandler analyst Thomas Champion maintains with a buy rating, and adjusts the target price from $50 to $58.

Furthermore, according to the comprehensive report, the opinions of $Maplebear (CART.US)$'s main analysts recently are as follows:

Instacart's Q3 results were robust, yet the Q4 adjusted EBITDA forecast did not meet investor expectations, according to an analyst. Nevertheless, it was noted that management emphasized a consistent dedication to achieving gradual annual margin enhancements as the company navigates the equilibrium between profitability and growth investments in areas such as affordability, technology, and marketing.

Following Instacart's Q3 report, there has been a modest decrease in the Gross Transaction Value (GTV) and revenue projections for Q4. Looking ahead to 2025, which serves as the valuation basis, there's a slight increase in GTV forecasts but a reduction in revenue and EBITDA expectations.

Instacart's shares are beginning to mirror its robust fundamental narrative. Despite improvement, its valuation based on EBITDA still significantly lags behind its peers by a considerable margin. The comprehensive scope and scale of the company's services demonstrate the considerable challenge competitors encounter, especially those who treat grocery services as a supplementary option.

The company's unit volume surpassed expectations in Q3, bolstered by its enhancing supply flexibility in partnership with Uber, affordability features stimulating additional demand, and technological advancements that are beneficial to grocer profit margins.

Product enhancements are contributing to increased Gross Transaction Value (GTV), and projections for 2025 appear to be on the conservative side. The company is putting a strong emphasis on expansion through marketing, with a notable increase in Sales & Marketing (S&M) expenses in the third quarter compared to the second. Although this strategy may dilute earnings in the short term, it is viewed as a strategic decision to secure continued double-digit growth.

Here are the latest investment ratings and price targets for $Maplebear (CART.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

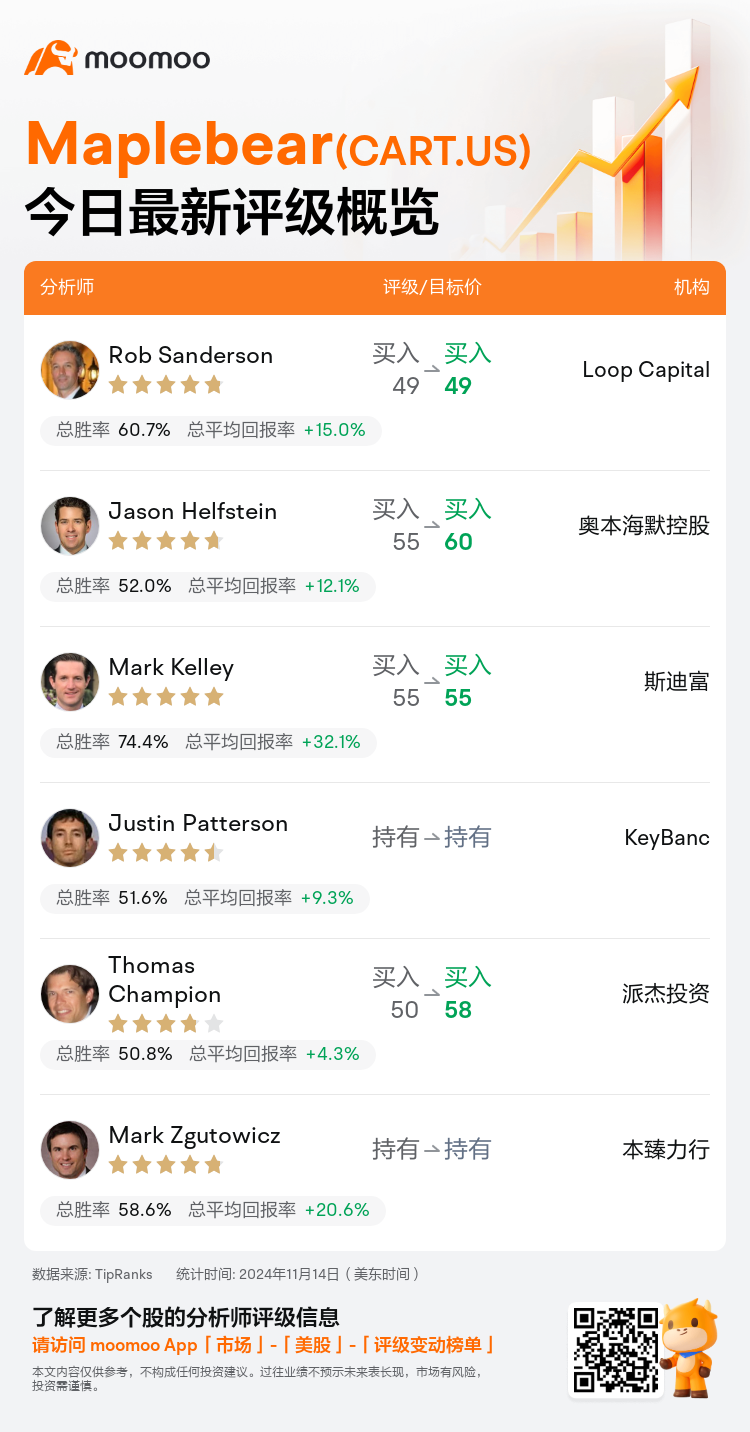

美东时间11月14日,多家华尔街大行更新了$Maplebear (CART.US)$的评级,目标价介于49美元至60美元。

Loop Capital分析师Rob Sanderson维持买入评级,维持目标价49美元。

奥本海默控股分析师Jason Helfstein维持买入评级,并将目标价从55美元上调至60美元。

斯迪富分析师Mark Kelley维持买入评级,维持目标价55美元。

斯迪富分析师Mark Kelley维持买入评级,维持目标价55美元。

KeyBanc分析师Justin Patterson维持持有评级。

派杰投资分析师Thomas Champion维持买入评级,并将目标价从50美元上调至58美元。

此外,综合报道,$Maplebear (CART.US)$近期主要分析师观点如下:

Instacart的第三季度业绩强劲,然而第四季度调整后的EBITDA预测未达到投资者预期,根据一位分析师的说法。尽管如此,管理层强调了公司在盈利能力和增长投资方面实现逐渐年度边缘增加的坚定承诺,同时在可负担性、科技和营销等领域寻求平衡。

在Instacart的第三季度报告之后,第四季度的毛交易价值(GTV)和营业收入预测出现了小幅下降。展望到2025年,作为估值基础,GTV预测略有增加,但营业收入和EBITDA预期有所降低。

Instacart的股价开始反映其强劲的基本故事。尽管有改善,但基于EBITDA的估值仍然远远落后于同行相当大的幅度。公司服务的广泛范围和规模展示了公司的竞争对手所面临的巨大挑战,尤其是那些将杂货服务视为辅助选择的竞争对手。

公司的出货量在第三季度超出预期,得到Uber合作伙伴关系的灵活供应能力,促进额外需求的价格实惠功能,以及有利于杂货店利润率的技术进步的支撑。

产品的改进正在促使毛交易价值(GTV)增加,2025年的预测似乎偏保守。该公司正在大力推动通过市场营销进行扩张,第三季度与第二季度相比销售和市场营销(S&M)支出显著增加。尽管这一策略可能会在短期内稀释收益,但被视为保持持续两位数增长的战略决定。

以下为今日6位分析师对$Maplebear (CART.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

斯迪富分析师Mark Kelley维持买入评级,维持目标价55美元。

斯迪富分析师Mark Kelley维持买入评级,维持目标价55美元。

Stifel analyst Mark Kelley maintains with a buy rating, and maintains the target price at $55.

Stifel analyst Mark Kelley maintains with a buy rating, and maintains the target price at $55.