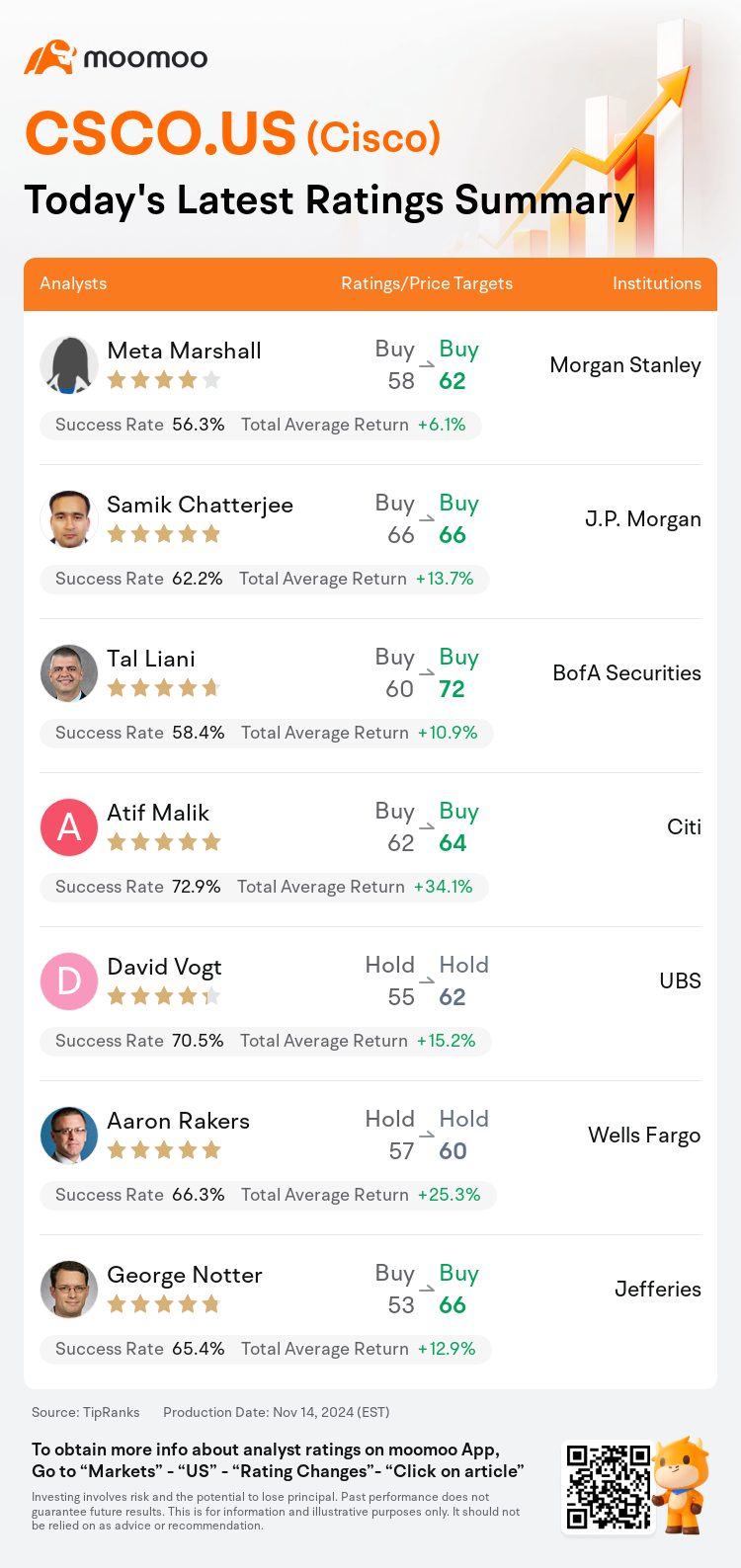

On Nov 14, major Wall Street analysts update their ratings for $Cisco (CSCO.US)$, with price targets ranging from $60 to $72.

Morgan Stanley analyst Meta Marshall maintains with a buy rating, and adjusts the target price from $58 to $62.

J.P. Morgan analyst Samik Chatterjee maintains with a buy rating, and maintains the target price at $66.

BofA Securities analyst Tal Liani maintains with a buy rating, and adjusts the target price from $60 to $72.

BofA Securities analyst Tal Liani maintains with a buy rating, and adjusts the target price from $60 to $72.

Citi analyst Atif Malik maintains with a buy rating, and adjusts the target price from $62 to $64.

UBS analyst David Vogt maintains with a hold rating, and adjusts the target price from $55 to $62.

Furthermore, according to the comprehensive report, the opinions of $Cisco (CSCO.US)$'s main analysts recently are as follows:

Cisco's Q1 performance surpassed expectations, primarily due to Splunk's better-than-anticipated results. The significance of the U.S. Federal sector was noted as a point of interest. Overall, the sentiment from the quarter's results reinforced a positive outlook on the company.

Cisco's Q1 revenue contraction of 5.6% surpassed the predicted 6.1% decrease, while earnings per share surpassed the consensus. The company's FY25 revenue forecast saw an approximate $200M increase, largely reflecting this beat. Analysts note potential for growth acceleration in the latter half of the year, driven by robust order growth in Cloud/AI and Security, leading to adjustments in their financial models to account for these enhanced business trends.

Cisco's product orders have shown an increase of 9% excluding Splunk, a rise from the 6% observed in the previous quarter, indicating a positive turn in the company's business trajectory. Despite the timing of AI revenue recognition being somewhat uncertain, the expectation is that this revenue will begin being accounted for in the second half of 2025. Although the update on AI is encouraging, the notably high gross margins reported in the quarter, along with the forecasted 68%-69% for FY25, may require a cautious interpretation.

Post the fiscal Q1 report, the shares experienced a 3% decline in trading, as reactions were mixed to a modest earnings surpass and heightened expectations. This was in the context of better than anticipated artificial intelligence orders and encouraging signs in core networking orders, contrasted by a modestly enhanced fiscal 2025 growth forecast and a steady artificial intelligence guidance. The perceived 'mixed' results are seen to be eclipsed by the potential advantages to Cisco from a burgeoning artificial intelligence networking opportunity and more appealing valuation.

Cisco's recent fiscal Q1 sales results met expectations, and its earnings exceeded forecasts due to better-than-anticipated margins. Despite the expectation for greater order growth excluding certain acquisitions, it appears that the company's overall business has reached a stable state. Nonetheless, projections for growth by fiscal 2025 seem to be restrained, even when considering less challenging comparisons.

Here are the latest investment ratings and price targets for $Cisco (CSCO.US)$ from 7 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月14日,多家华尔街大行更新了$思科 (CSCO.US)$的评级,目标价介于60美元至72美元。

摩根士丹利分析师Meta Marshall维持买入评级,并将目标价从58美元上调至62美元。

摩根大通分析师Samik Chatterjee维持买入评级,维持目标价66美元。

美银证券分析师Tal Liani维持买入评级,并将目标价从60美元上调至72美元。

美银证券分析师Tal Liani维持买入评级,并将目标价从60美元上调至72美元。

花旗分析师Atif Malik维持买入评级,并将目标价从62美元上调至64美元。

瑞士银行分析师David Vogt维持持有评级,并将目标价从55美元上调至62美元。

此外,综合报道,$思科 (CSCO.US)$近期主要分析师观点如下:

思科的第一季表现超出了预期,主要是由于splunk的业绩好于预期。美国联邦部门的重要性被指出为一个值得关注的焦点。总体而言,本季度的结果强化了对公司的积极展望。

思科的第一季营业收入下降了5.6%,超出了预期的6.1%的降幅,而每股收益超出了共识。公司FY25年的营业收入预测约增加$20000万,这在很大程度上反映了这一超过预期的情况。分析师指出,后半年有增长加速的潜力,受益于云计算/人工智能和安防订单的强劲增长,导致他们调整财务模型以解释这些增强的业务态势。

思科的产品订单,不包括splunk,增长了9%,较上一季度的6%上升,显示公司业务轨迹出现积极转变。尽管人工智能营业收入确认的时机有些不确定,但预计这部分收入将在2025年下半年开始计入。虽然人工智能的更新令人鼓舞,但本季度报告的毛利率显著高,加上FY25年预测的68%-69%,可能需要谨慎解读。

提交财季Q1报告后,股票交易中股价出现3%的下跌,因为市场对适度超越的盈利和增加的预期反应参差不齐。这是在人工智能订单好于预期和核心网络订单出现令人鼓舞迹象的背景下,与适度提升的2025财季增长预测和稳定的人工智能指导形成对比。认为“参差不齐”的结果似乎被思科从蓬勃发展的人工智能网络机遇和更具吸引力的估值中获益的潜在优势所掩盖。

思科最近的财季Q1销售业绩符合预期,而由于利润率超出预测,其盈利也超出预期。尽管预计在排除某些收购后订单增长会更大,但公司的整体业务似乎已经达到稳定状态。然而,即使考虑到较少具挑战性的比较,到2025年财季的增长预测似乎是受到限制的。

以下为今日7位分析师对$思科 (CSCO.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

美银证券分析师Tal Liani维持买入评级,并将目标价从60美元上调至72美元。

美银证券分析师Tal Liani维持买入评级,并将目标价从60美元上调至72美元。

BofA Securities analyst Tal Liani maintains with a buy rating, and adjusts the target price from $60 to $72.

BofA Securities analyst Tal Liani maintains with a buy rating, and adjusts the target price from $60 to $72.