Check Out What Whales Are Doing With GME

Check Out What Whales Are Doing With GME

High-rolling investors have positioned themselves bullish on GameStop (NYSE:GME), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in GME often signals that someone has privileged information.

高风险投资者看好GameStop(纽交所:GME),对零售交易者来说至关重要。 通过Benzinga跟踪公开可获取的期权数据,我们今天关注到了这一活动。这些投资者的身份尚不明确,但GME出现如此重大变动往往意味着某人掌握着内幕消息。

Today, Benzinga's options scanner spotted 16 options trades for GameStop. This is not a typical pattern.

今天,Benzinga的期权扫描仪发现了16笔关于游戏驿站的期权交易。这不是一个典型的模式。

The sentiment among these major traders is split, with 50% bullish and 31% bearish. Among all the options we identified, there was one put, amounting to $41,334, and 15 calls, totaling $842,586.

这些主要交易者的情绪呈现分裂,50%看好,31%看淡。在我们识别的所有期权中,有一笔看跌期权,金额为$41,334,还有15笔看涨期权,总计$842,586。

What's The Price Target?

目标价是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $20.0 and $50.0 for GameStop, spanning the last three months.

评估交易量和未平仓合约后,很明显,主要市场操纵者正在关注游戏驿站在$20.0到$50.0的价格区间,这一切发生在过去三个月中。

Volume & Open Interest Trends

成交量和未平仓量趋势

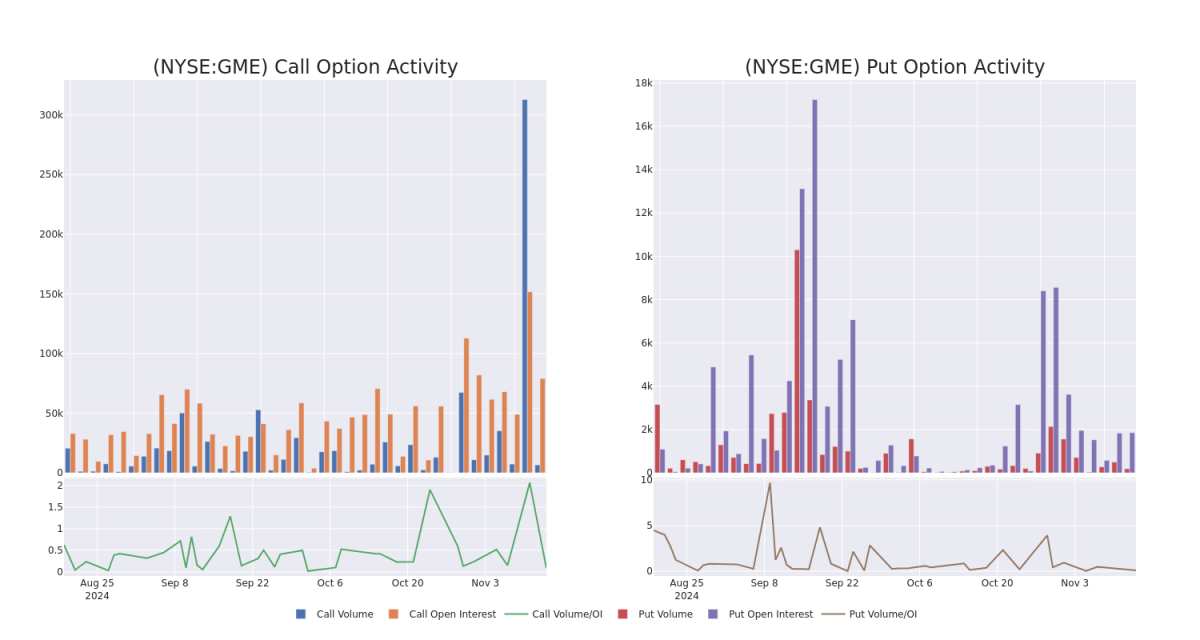

In terms of liquidity and interest, the mean open interest for GameStop options trades today is 6745.75 with a total volume of 6,843.00.

在流动性和兴趣方面,今天游戏驿站期权交易的平均未平仓合约为6745.75,成交量为6,843.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for GameStop's big money trades within a strike price range of $20.0 to $50.0 over the last 30 days.

在下图中,我们可以跟踪过去30天中游戏驿站的大额交易的看涨和看跌期权的成交量和未平仓合约的发展,行使价格区间为$20.0到$50.0。

GameStop 30-Day Option Volume & Interest Snapshot

游戏驿站30天期权成交量和持仓量快照

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GME | CALL | SWEEP | NEUTRAL | 11/29/24 | $1.05 | $0.72 | $0.88 | $47.00 | $178.0K | 35 | 2.0K |

| GME | CALL | SWEEP | BEARISH | 01/17/25 | $4.65 | $4.55 | $4.55 | $40.00 | $91.1K | 27.9K | 766 |

| GME | CALL | SWEEP | BULLISH | 11/15/24 | $5.65 | $5.6 | $5.6 | $22.00 | $86.2K | 9.0K | 283 |

| GME | CALL | SWEEP | BULLISH | 11/15/24 | $6.75 | $6.3 | $6.64 | $21.00 | $66.4K | 6.8K | 289 |

| GME | CALL | SWEEP | BULLISH | 11/15/24 | $6.75 | $6.45 | $6.64 | $21.00 | $49.8K | 6.8K | 185 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 游戏驿站 | 看涨 | 扫单 | 中立 | 11/29/24 | $1.05 | 0.72美元 | $0.88 | $47.00 | $178.0K | 35 | 2.0K |

| 游戏驿站 | 看涨 | 扫单 | 看淡 | 01/17/25 | $4.65 | $4.55 | $4.55 | $40.00 | $91.1K | 27.9千 | 766 |

| 游戏驿站 | 看涨 | 扫单 | 看好 | 11/15/24 | $5.65 | $5.6 | $5.6 | $22.00 | $86.2K | 9.0K | 283 |

| 游戏驿站 | 看涨 | 扫盘 | 看好 | 11/15/24 | $6.75 | $6.3 | $6.64 | $21.00 | $66.4K | 6.8K | 289 |

| 游戏驿站 | 看涨 | 扫单 | 看好 | 11/15/24 | $6.75 | $6.45 | $6.64 | $21.00 | $49.8K | 6.8K | 185 |

About GameStop

关于游戏驿站

GameStop Corp is a U.S. multichannel video game, consumer electronics, and services retailer. The company operates across Europe, Canada, Australia, and the United States. GameStop sells new and second-hand video game hardware, physical and digital video game software, and video game accessories, mainly through GameStop, EB Games, and Micromania stores and international e-commerce sites. The majority of sales are from the United States.

GameStop Corp是美国的一家多渠道视频游戏、消费电子和服务零售商。该公司在欧洲、加拿大、澳洲和美国等地区运营。GameStop主要通过GameStop、Eb Games和Micromania商店以及国际电子商务网站销售新和二手视频游戏硬件、实体和数字视频游戏软件和视频游戏配件。销售收入的大部分来自美国。

In light of the recent options history for GameStop, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鉴于游戏驿站最近的期权历史,现在应该专注于公司本身。我们的目标是探索其当前的表现。

GameStop's Current Market Status

GameStop的当前市场状态

- Currently trading with a volume of 7,460,340, the GME's price is up by 3.51%, now at $27.39.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 20 days.

- 目前交易量为7,460,340,游戏驿站的价格上涨了3.51%,现在为27.39美元。

- RSI读数表明股票目前可能超买。

- 预期的盈利发布将在20天内进行。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期权异动模块可以提前发现潜在的市场热点。了解大笔的资金在您喜欢的股票上的仓位变动。点击这里获取访问权限。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $20.0 and $50.0 for GameStop, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $20.0 and $50.0 for GameStop, spanning the last three months.